Why this serious investor is seduced by Churchill China

7th June 2017 17:03

by Richard Beddard from interactive investor

Share on

Grand tour - stage 2

Stage two of my Grand Tour across the middle of England took me from AGM in an anonymous hotel just off the M1 in Leicester to site spread out on a hill in the northern fringes of Stoke-on-Trent.

First impressions were of unexpected modernity. It reminded me more of the science parks I'm familiar with in Cambridge, than what I imagined the location of one our surviving potters would be like.

Churchill proudly traces its origins back to 1795, the date is even in its internet address (churchill1795.com), but I saw nothing of 1795 and not much to remind me of 1995 there.

Pricing conundrum

In my little universe, Churchill is an anomaly. I've never added it to the Share Sleuth Portfolio, the model portfolio I run, even though I've personally owned shares in the company for the best part of eight years.

Every time I've considered the shares, they've seemed too pricey. Typically, in last month's edition of Money Observer magazine's Share Watch column I concluded:

"Churchill China has a focused strategy that is likely to reinforce itself over time. As it continues to invest in production and distribution it should become an even more formidable competitor. But it's difficult to recommend the share at the current price of £10.90. This values the enterprise at about £120 million, or 23 times adjusted profit. The earnings yield is just 4%."

I've said similar things many times, yet since I started the Share Sleuth portfolio, Churchill China shares have more than quadrupled in price. My judgements about the business have been good, but my judgements about its value have not.

Churchill hasn't just made more profit year after year, Churchill's been more profitable. That's a distinction we often overlook. Increasing profit means a company made more money. Increasing profitability means it made proportionally more money compared to the money it has invested. The longer that goes on, the more confident we can be it's become better at making more money, which augers well for the future. Here's all of that, in a chart:

Focus on hospitality

I arrived in Stoke knowing Churchill China pulled off this success story by focusing on the hospitality industry, restaurants in other words. Over the last decade its steadily reduced sales of tableware to retailers, while actually making a little more profit from it.

The directors say retail is "Darwinian", and supplying supermarkets and department stores would have locked them in a race to the bottom against cheap Chinese imports. They're admirers of nearby - its distinctive brands have thrived in the retail market - but Churchill favours commercial customers. Eighty per-cent of hospitality business is repeat business, and restaurants buy the highly durable pottery which is Churchill's specialism.

Known unknowns

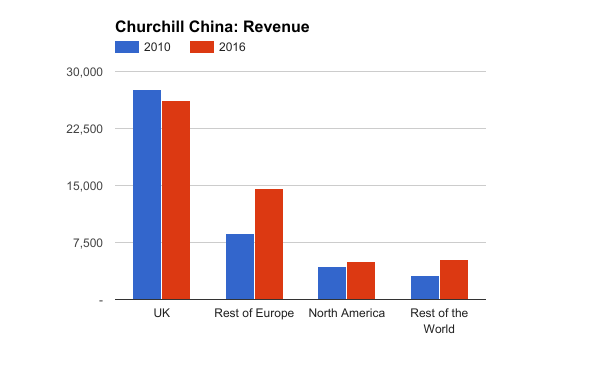

I've gone to find out more about the known unknowns. My biggest concern is that most of Churchill's growth in recent years has come from Europe. Between 2010 and 2016 revenue in the UK, Churchill's biggest market contracted 5%. In North America it increased 14%, and in Europe it increased 69%, a rate only matched by the rest of the world, which grew from a smaller base.

The company focused its expansion in Europe, I believe, because of its proximity and the favourable trading conditions bestowed by the EU. Within the EU, Churchill China benefits from free trade and anti-dumping regulations that slap a 15 to 22% duty on Chinese imports, depending on their quality.

Worst case, WTO rules would mean a 7% tariff on Churchill's exports to Europe, should we leave the EU without coming to a new trade agreement.

Built to last

Could Britain's exit from the EU shatter the growth story? Churchill's directors are sanguine. As you might expect James Roper, who along with other family members owns a controlling interest in the firm dating back to 1922, talks of its 'generational' mission. The company has focused on developing products that should be as resistant to competition as they are to breaking in a dishwasher.

It's added value by adding colour and texture to its plates. Until recently almost all the plates Churchill sold were white and round. Unlike in our homes, where plates can be highly decorated because they are mostly on show, the aim in restaurants these days is to frame the food with simple bold patterns. The fewer processes, the lower the cost.

Raku, a recently introduced range that combines a traditional print and modern translucent glaze in a single process, has the distinction of being not only Churchill's highest value product, but also the cheapest to produce. The company says Raku is its fastest growing range and "added value" products like it now account for 29% of revenue compared to 9% in 2011.

Superior products, Churchill believes, put it in a position to grow exports irrespective of the outcome of the UK's negotiations with the EU, from 50% to 60 or 70% of total revenue, although it won't say by when. Export growth though, is essential, as Churchill's already the market leader in the UK and doesn't expect market share to grow.

Outside the EU it thinks it can grow 10% a year in the US. The main constraint is salaries - sales people there are paid twice as much as their European counterparts.

Conundrum solved (kind of)

I was seduced by many things at Churchill China, the robots in the factory, the plates in the showroom, and the board. Unlike some of my fellow Arsenal fans, I think long service is a virtue, particularly when it's allied to success.

David O'Connor, a former painter and decorator, became chief executive in 2014. He's been with the company more than 20 years though, and served on the board since 1999. Now that Brett Phillips has retired at Portmeirion, David Taylor must be a contender for longest-serving finance director at a listed company. He joined the board in 1993.

James Roper has only been sales and marketing director since 2015, but he's served his apprenticeship, having worked at the family firm since 2001. Andrew Roper, the former chief executive, remains as a non-executive director. He must be very pleased with the way things are working out.

O'Connor is a fan of Gervais Williams, a respected fund manager and director at Miton. He gives me his copy of Williams' latest book, "The retreat of Globalisation". The CEO, who has a self-made aura, comments on the importance of reading and learning. There seems to be an informal book club operating among the board. It turns out Taylor and James Roper are reading Williams themselves, although they prefer his earlier books. Miton, owns a notifiable interest in Churchill China and that notion brings me back to the pricing conundrum.

The board respects its investors, those that have turned up at its AGM and institutional investors like Miton, and that respect is probably reciprocated. Williams is an advocate of buying and holding shares in small niche businesses. Perhaps Churchill commands a premium because it is attractive to a certain kind of investor.

Taylor agrees that relations with investors are good and also points out that under current regulations an investment in Churchill China is exempt from inheritance tax if you hold it for more than two years.

While many AIM stocks qualify, the Venn diagram of good companies and AIM listed companies is somewhat restricted. While I would not buy the shares for the tax break, many probably do.

Observations about Churchill go some way to explaining the high valuations of AIM listed and , two more companies I admire. I'm pleased to say the former is a mainstay of my personal and public portfolios. I'm sorry to say the latter seems to have been permanently priced out of both.

*See ‘What our man learned about Next from Lord Wolfson’: http://www.iii.co.uk/articles/416651/what-our-man-learned-about-next-lord-wolfson

**See Money Observer’s Share Sleuth page:

Contact Richard Beddard by email or on Twitter.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.