Chart of the week: Favourite trade keeps on giving

19th June 2017 12:18

by John Burford from interactive investor

Share on

Randgold follows my script beautifully

This has been one of my favourite trading markets since I started writing COTW. Long-term readers will know that I have managed to anticipate many of the major waves both up and down - and the most recent one is no exception.

Last time I covered was on May 8 when the market was in a down phase and I was tracking the minor waves down. I suggested that there was more downside to come before an A-B-C pattern that I had anticipated was finished. I suggested that after the C wave was in place, the market would start another rally phase.

This was the chart I was working with in early May:

The market had declined off my B wave high and had broken below T3 and had met the Fibonacci 50% support area at £66. I was looking for the C wave to finish below the A wave low, so the £66 level could be my C wave low. That was one of my two options.

The other possibility was for one more dip to the Fibonacci 62% level at £63. Those were my two clear options. Either one would imply a resumption of the rally after the C wave was done.

Now, when faced with this dilemma - shall I buy now or wait for a possible further decline to a lower target? - I have a simple plan. I like to buy one half of my intended position here and if the shares drop to the lower target, I would buy the other half there.

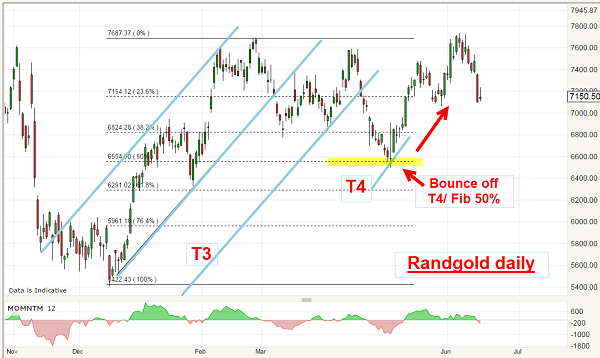

So let’s see how this panned out. Here is the updated chart

In fact, the market did start turning back up from that level. And one further clue that it might turn there was the fact that I had drawn in the T4 support line and that was added support to add to the Fibonacci 50% level. Remember, I draw these extra tramlines equidistant from the original pair.

So, the market staged a very sharp rally to the £77 level to match the old high back in March. Short-term traders would have captured a very tidy £11 (+15%) gain.

But what about the longer-term picture? Traders on this time scale would be holding as the main trend remains up.

So, with my half position I am not fully invested, but at least I have captured a profit and what is wrong about that?

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.