Brexit one year on: The top 20 performing funds

23rd June 2017 12:15

by Faith Glasgow from interactive investor

Share on

A year ago today, the UK went to the polls to determine whether the country would stay as part of the European Union or leave.

The unexpected Leave vote sent UK markets into mayhem. By the close of 27 June, the FTSE 100 index had lost 4.5%, while the mid and small-cap indices were down around 14%, as investors sold up indiscriminately on the back of the uncertain domestic economic outlook.

But the markets rapidly shrugged off their panic. By mid-July the FTSE 100 was 5% ahead of pre-vote levels as the internationally facing blue chips, which receive 70% of earnings from overseas, benefited from the pound's fall (it dropped to a 31-year low in the immediate aftermath of the vote). In particular, the bank, mining and oil sectors dominated stock market returns.

UK smaller companies saw indiscriminate selling immediately following the EU referendum, but the UK economy has grown steadily and more domestically focused smaller companies had overtaken the blue chip index by April.

Across the board, the UK indices have continued on a roll: from 24 June 2016 to close of 21 June 2017, the FTSE 100 index is up 26%, and if you measure from the depths of the drop at close of 27 June it has gained 29.4%. The FTSE 250 index has done even better, up almost 26% and 35% respectively, according to FE Analytics, while the FTSE AIM All-Share has gained a massive 40 and 45% over those periods.

The fund winners

So how have the funds focusing on UK stocks performed in comparison? After all, a low-cost blue-chip or FTSE All-Share tracker could have delivered respectable gains of around 26% since 24 June. Have active managers been able to add value?

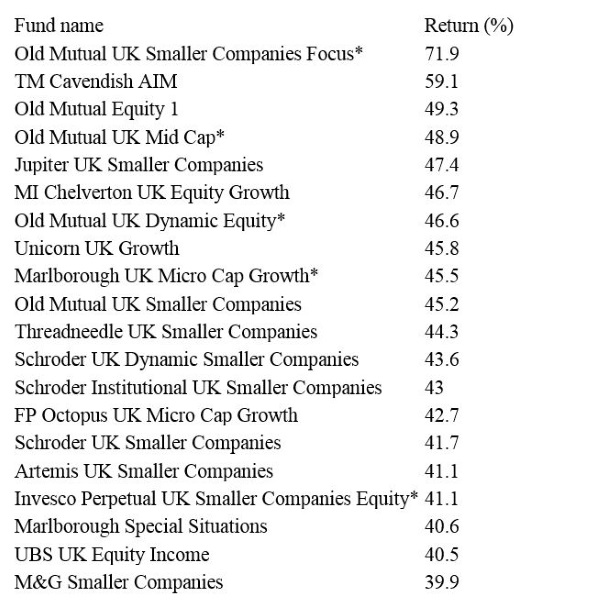

The table below shows total returns since 24 June 2016 from the top 20 funds with one-year track records housed in the Investment Association UK all companies, smaller companies and equity income sectors, of which there are almost 400 in total. The data comes from FE Analytics.

*Donates a Money Observer Rated Fund.

- Table shows total returns over period 24/6/16 to 21/6/17 of all funds in UK sectors.

Smaller company funds have bounced back

As the table makes clear, the answer to our question is yes; and it's smaller companies funds that have dominated that index outperformance, with 13 out of the top 20 focused on the smaller end of the market. All 20 returned at least 40% over the year.

Old Mutual UK Smaller Companies Focus leads the pack with a massive 72% return, followed at a distance by another of TM Cavendish's AIM-focused fund on 59%.

"It was hard for active managers to keep pace with the post Brexit rally in the FTSE 100 which was dominated by a rally in a small number of mega caps across a narrow range of sectors (banks, miners and oil)," comments Gavin Haynes, managing director of Whitechurch Securities.

"In contrast, the smaller end of the market provides scope for stock-pickers to find domestically focused companies and niche global businesses across a wide variety of sectors (the Numis Smaller Companies index contains over 700 companies to choose from)."

Haynes believes that there are some "exciting opportunities and valuation anomalies" for canny stock-pickers at the bottom end of the market – and that will be helped by a softer Brexit, which will be interpreted as a more business-friendly outcome by investors.

The other remarkable aspect of the table is the concentration of Old Mutual funds, with five of the top 10 coming from the OM stable. Three – OM UK Dynamic Equity, OM UK Mid Cap and OM UK Smaller Companies Focus – are Money Observer Rated Funds.

Haynes comments: "The performance of a number of Old Mutual funds has been impressive, with some shrewd stock-picking to exploit recovery. But I would certainly be careful of using this period of past performance as a guide as to which are good and bad funds.

"For example, near are the bottom of the table include some highly rated funds that take a very cautious approach (eg JOHCM UK Opportunities and Troy Income, both Rated Funds). With the UK stock market trading close to record high levels, these are both funds that I would consider as good core defensive holdings."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.