Housebuilders bounce back, but should you invest?

5th July 2017 14:05

by David Brenchley from interactive investor

Share on

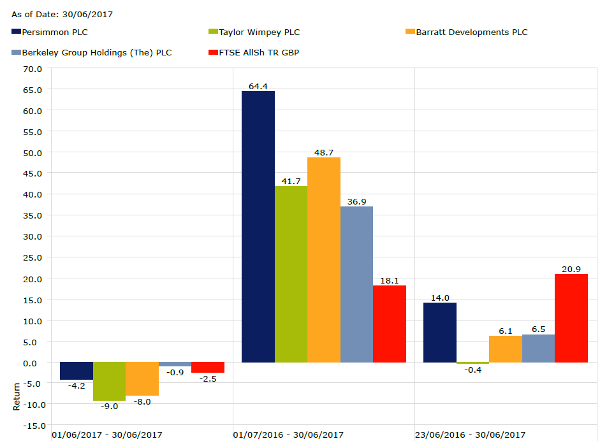

House prices remain a favourite dinner party talking-point, but sentiment toward housebuilders has ebbed and flowed in recent times, with the sector hardest hit in the immediate aftermath of the Brexit vote last June.

However, those firms recovered strongly, clawing back all the lost ground, easily outperforming the wider market. And 10 of the 12 companies that make up the Home Construction sub-sector saw double-digit share price returns in the first half of 2017.

They gave up some of those gains last month, though, through a combination of political uncertainty in the wake of a hung parliament and deteriorating economic data.

However, on the back of positive updates from both and , all 12 housebuilders are higher Wednesday, led by the reporting pair. Persimmon rose 5% to a high of 2,405p, while MJ Gleeson led the FTSE All-Share, surging 7.5% to 673p. Both are now within sight of record highs.

The housing market has taken the general election in its stride, said Persimmon today, noting that consumer confidence remains resilient.

Record-low interest rates, which appear unlikely to budge much, despite a more hawkish Bank of England Monetary Policy Committee, mean mortgage rates remain "compelling", supporting new home purchases.

A half-year update from the £7 billion behemoth was "excellent", with legal completion volumes up 8% to 7,794 in the first six months of 2017. Its average selling price increased by 3.5% to around £213,000 and revenue rose 12% to £1.66 billion.

Operating margin is expected to "comfortably exceed" the second half of 2016's 25.7%. A strong balance sheet, with £1.12 billion of cash as at 30 June, before dividends of £339 million were paid two days ago, and a strong land bank position the firm nicely.

In its financial year to 30 June, urban regenerator Gleeson hit its initial target of building 1,000 new homes per year, selling 1,013 homes, up 12% year-on-year, through its Gleeson Homes division, focused on challenging communities in the North of England. It now wants to double that within five years. It's an ambitious but deliverable target, according to Charlie Campbell, analyst at broker Liberum.

The firm's second division, Gleeson Strategic Land, a land promotion business focused on the South of England, sold eight land interests of 126 acres in the year and has planning permission for 11 new sites, four of which are currently in a legal process for sale.

Chief executive Jolyon Harrison says Gleeson Homes is in its "strongest ever position", with £34 million of cash on its balance sheet. Meanwhile, Strategic Land "continues to experience strong demand from both large and mid-sized housebuilding customers for consented land".

Liberum's price target moves up 6% to 742p on the back of earnings per share (EPS) forecast upgrades of 4-5% because of the new home building target. This would see the stock trade on a "not excessively ambitious" June 2018 price/earnings (PE) ratio of 14.

Strip out cash, that PE drops to 11 times, which Campbell says looks "undemanding" should it deliver its housebuilding target.

If it's thumbs up for Gleeson, analysts worry about Persimmon.

"We remain cautious as we still believe that there are much tougher times ahead with a tougher mortgage lending climate likely to arise, weakening house prices that threaten to gnaw away at the margins," writes Shore Capital's Robin Hardy, who's also concerned that evolving housing policy will put pressure on demand and build costs.

"We would still be inclined to take profits across the sector and still look to make intra-sector switching of large cap into midcap espeically into any material pick-up in the sector today."

Bank of America Merrill Lynch's (BAML) Andy Murphy also points out that Persimmon trades on the highest PE of the mainstream housebuilders (10 times FY 2017).

Gleeson boss Jeff Fairburn has been in the news for all the wrong reasons this year. His controversial bonus - £112 million in shares - is one of the largest packages in UK corporate history.

Mark Martin, manager of the , does not believe the remuneration level was warranted, arguing at a recent event that Fairburn is "essentially freeriding on UK government stimulus packages".

Housebuilders are prized by investors for their high yields and both Persimmon (4.8% for 2018 on BAML forecasts) and Gleeson (3.7% on Liberum's estimates) are decent payers, though Murphy questions the durability of Persimmon's dividend plan should an expected Brexit-induced slowdown materialise.

Those yields have always looked attractive, especially in today's climate as investors are made to work harder for their income, and sentiment towards these high payers has improved in recent months.

But Martin thinks UK equity income funds' love for housebuilders is "dangerous".

"They're paying back all this money to shareholders in special dividends, which is great for fat-cat capitalists, but isn't great for UK plc which desperately needs that money ploughed back into building new houses."

He also takes a different view to valuing housebuilders as the sell-side analysts do, referencing assertions from investment sages such as Anthony Bolton and Warren Buffett that "price/book, rather than price/earnings, is the best way of valuing housebuilders over the long term".

On this metric, he explains, housebuilders are running at high valuations. The average price/book ratio in 2017 is around 2 times, just below peak levels of around 2.25 times back in 2007.

Woodford's a fan

Others do love them, though. Star fund manager Neil Woodford, with his bullish view on the outlook for the UK economy, has piled into the sector recently. and both take their places in his new Income Focus fund's top 10 holdings and he's backed others.

Woodford steered well clear of housebuilders for a significant period as they "have not represented an attractive enough investment proposition" in the first 15 or so years of this century, against a backdrop of low confidence in the UK economic outlook.

However, his view on the economy have now changed - largely against consensus. This has "created a contrarian opportunity to revisit the sector", he says.

"UK housebuilders and the construction industry more broadly now look poised to benefit from structurally positive fundamental dynamics", underpinned by cross-party agreement on the need for new homes to be build.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.