Sectors to buy and where to take profits

6th July 2017 12:26

by David Brenchley from interactive investor

Share on

It's a while since we debated the value stocks versus quality growth stocks argument. At the end of 2016 and moving into this year, it was a big talking point - after an incredible rally over a number of years, value was about to come back into vogue.

However, it has not quite come to pass yet, with a tech rally driving the recent winning run across global stockmarkets. So, growth had the upper hand compared to value, but some now predict the tide is about to turn and have adjusted their portfolio accordingly.

Analysts at Barclays still think value is the place to be, and it's placing big bets on its European Equity Strategy portfolio.

"We reiterate our view for another significant rotation out of quality/low volatility stocks into value stocks," they said Thursday.

Barclays expects robust global growth in the region - around 2% real GDP growth in both 2017 and 2018 - and, combined with rising oil prices, modest US fiscal easing, higher inflation and higher bond yields, should revive the reflation trade.

A return of reflation is not currently priced in by investors, though. "On valuation, low volatility/bond proxy stocks in Europe are currently trading at near a 1.2 standard deviation high relative to history," they note. "In 2010 and 2014, when investors were pricing reflation in, these stocks were trading in line with longer-term averages.

"A similar de-rating in valuations would imply a further c.10% underperformance from these stocks."

For this reason, the analysts prefer value stocks. They see earnings per share (EPS) growth of 20% in the euro area, with materials, financials, industrials, consumer discretionary and energy plays tipped to deliver strongest profit growth.

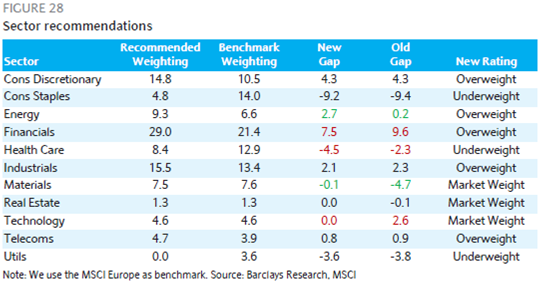

A change in weightings to their European portfolio, sees upgrades for energy stocks to 'overweight' and materials to 'market weight'. Conversely, healthcare has been reduced to 'underweight', while the portfolio is taking profits from technology due to valuations that looked cheap a year ago now being very high.

Energy

The change in weighting toward energy stocks has been brought about not only Barclays' bullishness around the direction of travel for oil prices, but because valuations imply a recovery to $60 a barrel is now not being priced in.

That wasn't the case at the beginning of the year, with price/earnings (PE) multiples in the sector appearing high. They seem to have moderated in recent weeks, though, and currently trade in line with historic norms, suggesting optimism is waning.

Oil prices will hit $55 in the third quarter of 2017, the broker's commodities analysts forecast. Moreover, they say, the dividend yield spread between the energy sector and the market is now approaching 3%. Large-cap firms should be able to cover their dividends in a $50 per barrel world.

Materials

Here, Barclays favours mining over chemicals, with confidence flowing from positive data out of China.

"Property market activity in China remains supportive of iron ore prices at these levels and Chinese rail freight growth, another measure of economic growth in China, remains robust.

"Valuations in the sector currently imply that iron ore prices further collapse to the 2016 lows and remain at those levels to perpetuity. Indeed, free cash flow yields for the sector on spot commodity prices are well above 10%."

As well as adding to the portfolio, keeps its place.

Banks

The case for being 'overweight' European banks has not changed, according to Barclays. In fact, their analysts point out Euro banks are now near the cheapest they have been relative to US banks in several decades.

Earnings revisions ratios continue to be positive relative to the market with the sector seeing upgrades to EPS estimates. Further, the broker's economists foresee two deposit rate hikes in 2018, rather than one. "The start of a hiking cycle should be supportive of bank returns on equity."

is the preferred London-listed bank.

Technology

Barclays said in August last year that the tech sector was almost as cheap as it had been for several decades relative to the market, despite improving growth prospects.

Our funds analyst Dzmitry Lipski has written elsewhere today about The 'old' tech shares still worth buying, but Barclays has had to cut exposure to pay for its increased weighting in mining and energy.

After a spectacular rally – the Nasdaq Composite is up 26% in the past 12 months – the relative valuation perspective has changed, the broker says, with PE multiples back near highs seen in recent years.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.