This extraordinary stock is a 'buy', here's why

24th July 2017 11:04

by Richard Beddard from interactive investor

Share on

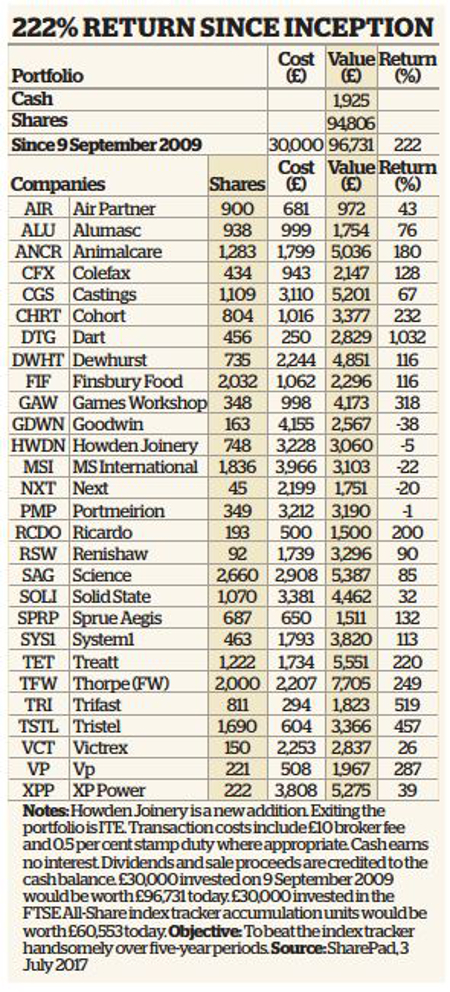

In recent weeks I have added (parent company of Howdens) to the Share Sleuth Portfolio. It is the second new addition to the portfolio this year, following in May. To fund the purchase, I reduced the portfolio's holdings in and and ejected .

Howdens supplies fitted kitchens. The units are good quality and middle of the range but not special enough for the average Josephine or Joe to insist on a Howdens kitchen. Generally, I don't believe the kitchens themselves are the reason Howdens earns extraordinary returns on capital.

Howdens is special because of the service it provides to local tradesmen. Small builders sell its kitchens to homeowners and landlords and, in the process, sidestep the costs of showrooms and delivery. Tradesmen can't store kitchen units until they need to install them, so Howdens ensures it keeps everything they need in stock, and it gives them enough credit to finish a job before they have to pay for a kitchen.

Since Howdens doesn't retail, the tradesman can add their own mark-up without fear of being beaten down by customers who discover they could pay less by going direct. Howdens' depot managers earn a share of their depot's profits, which gives them a powerful incentive to treat customers well.

Most impressively, Howdens spells out its strategy in its annual reports. I think this is a sign of strength. Companies unafraid to say how they make money probably don't fear rivals will copy them.

Howdens' rivals - companies such as Magnet that have retail and trade businesses - would have to close down or separate their retail arms and extend their trade networks, while building availability to Howdens' near 100% levels. New rivals would be going up against a very efficient incumbent.

Howdens faces two risks. The first is the febrile UK economy and a house price crash. Since kitchens are expensive and people often change them when they move house, people will defer modernising them when the economy slumps. I'm sanguine about that, not because I don't think it will happen, but because I don't know when it will happen.

Let's say I hold Howdens shares in the portfolio for at least 10 years. I think it's likely that Howdens' share price will fall substantially, but temporarily, at some point during that period. It doesn't make any difference to my returns when that happens, as long as Howdens stays true to its business model and I stay true to Howdens. It's financially strong, so I am confident.

The other risk is what happens when Howdens has filled the UK with depots, which could happen within 10 years. It's due to meet its current depot target in five or six. Then, if possible, it will need to raise the target or find a new engine for growth. It seems likely, because Howdens has been experimenting with stores in Europe for more than a decade, that the company will embark on a more serious rollout abroad.

This could easily go wrong, but because of Howdens' long apprenticeship in Europe and its entrepreneurial culture, I think it will find a way to adapt its business model to new circumstances.

The share price (428p) was within my comfort zone. It valued the enterprise at about £3 billion or about 16 times adjusted profit in the year to December 2016. The earnings yield was 6%.

The Share Sleuth portfolio was fully invested, so to raise cash I reduced two holdings and liquidated another. We say goodbye to ITE. It organises trade shows in Russia, Central Asia and other emerging markets, and it has lost the portfolio money.

I have also taken profits in Renishaw, which makes automated machine tools and robots, and Air Partner, an air charter broker seeking to become a diversified airline services company. Next month I will explain why, of the 28 shares in the portfolio, these three got the chop.

Full Share Sleuth Portfolio

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.