10 of the best-quality companies on AIM

26th July 2017 13:25

by Ben Hobson from Stockopedia

Share on

Stockmarket valuations often drift in the traditionally quiet summer months, and this year is no exception. But after taking a breather in recent weeks, smaller-cap indices are beginning to pick up again - and this bullish move is being led by the Alternative Investment Market (AIM).

AIM is the UK's market for smaller, growth companies. The All-Share index, which comprises 963 companies, has risen by an impressive 39% over the past year. Indeed, AIM has helped deliver some of the market's biggest winners in recent years.

But it's not all good news. New research shows that the number of companies leaving AIM because of the resignation of their Nominated Advisers (Nomads) has risen sharply over the past five years.

Analysis by accountancy group UHY shows that 14 out of 82 companies that left AIM in the last year did so because their Nomad resigned. That compares to only three out of 101 companies that delisted in 2011/12.

AIM's Nomad system is part of a "light touch" regulatory regime that was designed to make it easier for smaller companies to maintain a public listing. Nomads tend to be corporate brokers and investment banks, and it's their job to advise companies on their responsibilities to the market.

One of the quirks of the Nomad system is that these advisers occasionally resign from their positions. Often the reasons are genuine and companies can quickly find a replacement. However, under AIM rules, failure to find a replacement in time will result in them being booted off the market.

A cancelled market listing that's forced by a Nomad resignation can be hugely frustrating for investors. It leaves them with few options but to go along with the company's terms, and it's damaging to the reputation of the market as a whole.

According to UHY, the financial risks of failing to make sure client companies are compliant, together with limited fees available, has reduced the number of firms prepared to take on the role of Nomad.

Apparently, this is being felt hardest among smaller or more complex companies, as well as those based in emerging economies (AIM has 161 international companies).

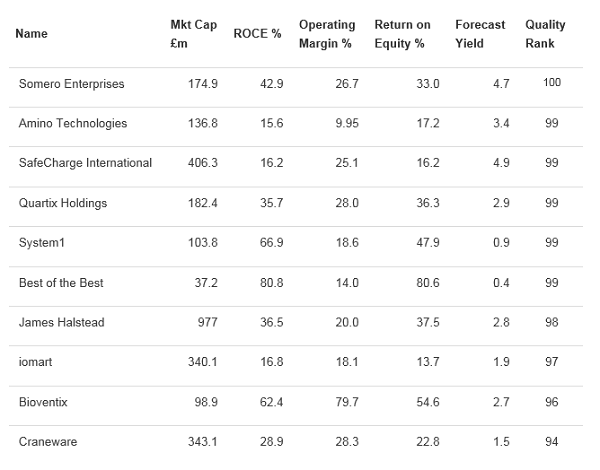

One of the encouraging features about what's become a regular look at higher quality, small-cap AIM stocks, is that the list of names doesn't change all that much.

is an American company specialising in technology that levels concrete floors. It works in a cyclical market, but in upbeat conditions its profitability and financial strength are eye-catching.

Others include the internet TV company , payment services group and the vehicle tracking specialist .

The best return on capital, at 80.8%, is found in the smallest company on the list -, the car competitions business. The highest margins, at 54.6%, are to be found at the biotech business, .

Keeping an eye on company quality

For investors, this "crunch" in the Nomad system is a reminder of the risks of investing in AIM shares and why a focus on quality is essential. We regularly press the case in this column for embracing high quality standards in small-cap investing.

One place to start is to focus on the moat-like qualities of firms that can establish and defend highly profitable operations that can produce impressive, long-run returns for their shareholders.

Moats have earned themselves a place in the investing lexicon that's synonymous with a robust competitive advantage and strong, resilient profitability. It's a term employed by the successful American investor, Warren Buffett, and looks for characteristics in a business that make it very difficult for competitors to fight against.

Companies with the strongest competitive moats tend to be large and well established. But these features can also be found in much smaller businesses in highly profitable niches.

Typically, you can find the signs in some key quality measures and metrics. They include strong, stable returns from invested capital can be seen in return on capital employed (ROCE) and return on equity. These firms often have great pricing power, which often shows up in high margins and high levels of free cashflow.

To get an idea of the sorts of companies on AIM that have the hallmarks of strong economic moats, we screened the market for Interactive Investor using some of these key measures.

We sorted the list based on Stockopedia's QualityRank, which takes into account long-term quality factors, balance sheet strength and any potential accounting or insolvency risk red flags - from zero (poor) to 100 (excellent).

Evidence of growing numbers of AIM de-listings as a result of Nomad resignations will be a concern for some market watchers. However, higher-quality companies rarely encounter this problem.

Given the inherent risks of investing in smaller companies - which can be more prone to financial pressure - de-listings are part and parcel of the challenges faced by investors.

Focusing on profitable, financially resilient business with the capability of delivering strong returns to shareholders, is likely to be a preferable place to begin assessing AIM stocks.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

Interactive Investor readers can enjoy a completely FREE 14-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.