Expert picks these winning shares for the Brexit era

11th August 2017 09:19

by Lindsay Vincent from interactive investor

Share on

Jonathan Brown has heard mixed verdicts on Brexit from corporate bosses. However, he tells Lindsay Vincent, he remains confident he can find winners and avoid losers in the smaller companies sector.

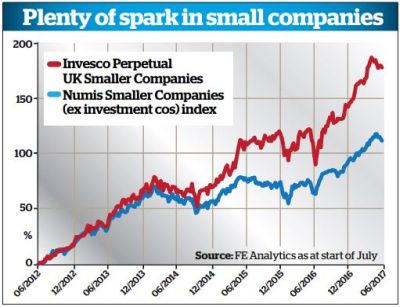

One of the chronic vexations for those who hold sway in the smaller companies sector is the perception that firms in the minor league are more risky and volatile than those higher up the corporate ladder. What makes this opinion even more annoying for these specialists is the undisputed fact that smaller companies have consistently outperformed larger companies.

"It is very frustrating," says Jonathan Brown, lead manager of . "The long-term record of smaller companies is fantastic." Citing figures for the past 30 years, he adds: "They have substantially outperformed - by 3.5% a year - the . It is frustrating that people don't take these facts on-board."

Brown also takes issue with the widely held view that smaller companies are more volatile than larger firms. "The evidence doesn't really back that up," he says. "Over the past five years, smaller companies haven't been as volatile as the large caps. The large cap sector, with its banks and mining stocks, has been extremely volatile."

The next five years will, however, throw down testing challenges for smaller companies. These range from realities in the US - principally that a property man whom many now regard as deranged and shallow is US president - to the Brexit mess here in the UK. Here the consensus is that large companies, with their substantial operations abroad, will cope with Brexit better than smaller companies.

Brown can only speak for himself and the companies he has invested in, but he says: "We've spoken to all our companies - we have about 300 meetings a year (half with firms being considered for investment) - and the responses vary." Because manufacturers export, they are much more relaxed than firms with a domestic bias and financial services companies.

He adds: "WTO tariffs, if it comes to that, have been more than offset by the downward move in sterling. Trade will be a bit more complex - there may be delays at ports because of red tape and so on. But the companies we've spoken to don't think it will be too bad for their businesses. However, the financial sector will be significantly affected."

Competitive Edge

Brown owns some financial services companies, such as , the UK private client and investment management business, and , the wealth management outfit. Another is , an intriguing enterprise and one of his top 10 holdings, which provides "offshore structures" in the Channel Islands for the likes of real estate and private equity operators.

Brown's criteria for company ownership - most are held for four years - is the stuff of investment management textbooks. He seeks companies with a clear competitive advantage that can take market share off their competitors, and niche businesses that are highly cash generative.

Inevitably, there will be setbacks in a portfolio of around 80 stocks. Last year's heavy losers included and . What did he learn? About his Carpetright holding, he says: "Even if it was an interesting recovery story [when we bought it], maybe I should have reacted earlier to new competition." That came in the shape of Tapi, the ambitious French outfit.

Moreover, both Carpetright and Topps Tiles operate businesses in markets where hordes of small, nifty privately owned carpet and tile shops will always provide strong competition for the multiples. Both Topps Tiles and Carpetright are affected by the economic cycle and, as a rule, Brown avoids such firms. "We prefer companies that are less affected by the business cycle: businesses that people will continue to use even in times of recession and diversified firms with overseas exposure," he says.

Sound strategy

Indications that interest rates may rise do not cause him angst. He infers that companies with pricing power will be able to sidestep inflation, while the cash-generative businesses he focuses on won"t be affected as badly as those with operational gearing.

Brown believes wages will now have to rise more quickly than they have over the past few years, when they were mostly static. Many incomes have fallen behind official inflation. Against this background, he says, the firms to avoid are those that offer services similar to those provided by other firms and don't have an edge.

He cites "weak retailer" as an example. "It has no unique trading advantages," he says. Furthermore, it is one of many firms that will be affected by falling discretionary incomes in a time of rising mortgage rates. Real estate companies, which traditionally have heavy debt loadings, will also be casualties of higher interest rates.

Brown has run the £255 million trust for 15 years and his strategy of broad diversification has served him well. The trust has been a top-quartile performer over the past one- and three-year periods. He says this may explain why the trust "always finds it easy to get companies to talk to it".

The trust's board recently introduced a policy to pay a materially higher dividend, paid quarterly and funded from capital when necessary, which has helped reduce the discount on the trust's shares to some 4%, compared with a 12-month high of 11%. Performance figures for the past one -, three - and five-year periods are gains of 42, 67, and 180% respectively, helping steer the trust to a Money Observer investment trust award and Rated Fund status this year.

Finding value

Whereas Brown regards Debenhams as a retailer without clear trading advantages, he sees two retailers he owns, and , as firms that do. Boohoo, an online retailer, sells low-cost fashion and - unlike , the well-established retailer of what some call "toot" - it doesn"t have shops.

"It is growing quickly and taking market share from shops. Revenues last year rose by 50%." E-commerce retailers, he believes, will continue to eat into the trade of traditional outlets. He's relaxed about recent falls in the share price of JD Sports. Its high street competitor, , is a different animal: a purveyor of low-cost sporting apparel in less than salubrious settings. JD Sports' edge, he says, is its strong connections with such leading firms as and .

Brown might not be owning JD Sports for much longer, however, as it is knocking on the door of the index. His upper limit for small and medium-sized companiesis a capitalisation of £1.4 billion, although he will run his winners if he thinks there is still mileage to be had in the share price.

While many competing trusts are now avoiding the pub sector, Brown remains keen on and . He says: "Wetherspoon has a good estate and is a well-run business. If we do get a recession, it will still trade well." Marston's, whose share price has been noticeably weak recently, made the right decision to sell off old pubs and invest in new ones, he adds. The firm also has the advantage of brewing its own products, and it is benefiting from a revival in demand for craft beer and real ale.

These firms are not among the trust's top 10 holdings, unlike , which produces veterinary products. Brown also owns , the AIM-quoted veterinary group with a substantial chain of surgeries: as he points out, people will always spend money on the welfare of their pets.

His third pharmaceutical holding is , also a top 10 holding. The company, capitalised at around £800 million, has a little-known niche global market: the distribution of products not yet approved by the various regulatory authorities that could offer the desperately ill a lifeline.

Like many investors, Brown is pondering what a Labour government might mean for business. Healthcare firms, banks and defence companies are likely to be among the worst hit, he thinks. However, he believes , with its export-focused business, will be an exception. Its speciality is electronic warfare: encryption products that go into sonar buoys and nuclear submarines. Brown says: "There are a lot of new Chinese submarines out there, and the US navy is always very keen to know where they are."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.