Five alternative investments for 5% plus yields

17th August 2017 08:43

by Jennifer Hill from interactive investor

Share on

Investors are on the hunt for alternative sources of income, given the high valuations of many equity markets and poor value in bonds.

"We've been looking at other investments for income - to break the correlation with equity-based assets and avoid bonds, which offer such atrocious value," says Philip Milton, founder of Devon-based wealth manager Philip J Milton.

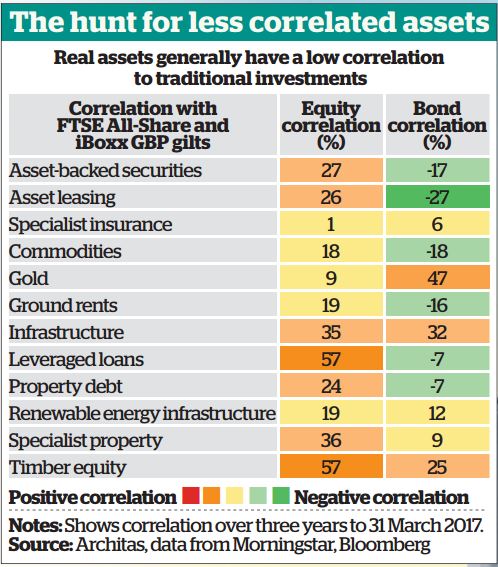

Specialist sources of income have little correlation with traditional investments (see table below), meaning they don't tend to travel in same direction as the mainstream.

They also offer an enhanced level of income in a world of low interest rates and superior protection against inflation, according to multi-manager Architas.

They hold meaningful growth potential, too. Asset-leasing, infrastructure and renewable energy have outperformed the since 2006, with significantly less volatility, as the chart below shows.

"It's vital to compare the overall attractions of alternative income to the more vanilla equity and bond funds," says Rob Burdett, co-head of multi manager at F&C.

"Right now, equity income funds yield 3% to 4% depending on where you are in the world, but geopolitics and the like could cause big fluctuations in equity capital values, even if dividends are unaffected. Government bonds are almost all yielding less than inflation, and so the closed-ended innovative income world is worth looking at."

Many alternative sources of income are relatively illiquid, so are best accessed through closed-ended investment trusts rather than open-ended funds, which can be vulnerable to investor redemptions.

The opportunity set for specialist income investments has grown significantly in recent years, as new trusts have launched and existing ones have raised capital, led by investor demand for the high level of income on offer.

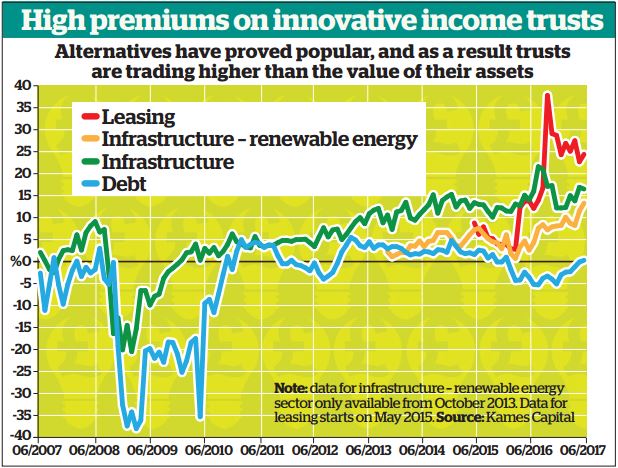

The trend has continued apace this year, pushing trusts onto high premiums (see chart below). In the first five months of 2017, investment trusts raised a total of £4.5 billion, of which £3.6 billion was in alternatives; 82% of issuance was by funds with a yield of 3% or more, data from Numis Securities shows. Half of the investment trust universe now comprises alternatives trusts.

"London has proved to be a centre of excellence for the raising of capital for these alternatives," says Nick Edwardson, a senior multi-asset specialist at Kames Capital, which makes significant use of them in its and funds.

With soaring demand pushing up the premiums to asset value on which alternative income trusts trade, is it a price worth paying?

Nathan Sweeney, a senior investment manager at Architas, says: "The general premium on the sector is only likely to decrease once we see a significant and concerted increase to interest rates - something that's unlikely to happen in the short to medium term. The question is whether you think the price reflects the benefits these assets can provide to a portfolio."

In many cases asset managers believe so; moreover, despite headline figures, some innovative income trusts can be bought close to net asset value (NAV) or even at a discount.

"There's a wide spectrum of discounts and premiums and it's incorrect to universally assume the sector is overpriced or running at a premium," adds Sweeney.

So below we take a closer look at five innovative asset classes that offer the prospect of a relatively high and often predictable income stream.

Infrastructure

Infrastructure has been the growth story of the decade in the closed-ended space. Since the first infrastructure trust launched in 2006, it has become the fourth largest sector with assets of £9 billion.

Seven Investment Management (7IM) first invested in in 2007, and after a five-year absence re-entered the sector this spring, using recent fundraisings as an 'attractive entry point' for its cautious portfolios to build positions in HICL, and .

"We like the long-term, predictable cash flows, with a high degree of inflation-linking and low economic market sensitivity, backed by public sector entities," says Alex Scott, 7IM's deputy chief investment officer.

The sector yields 4.8%, but tends to trade on a relatively high premium to asset value - and has done almost throughout its decade-long history. At present, the average premium is 13.5%.

However, Scott points to the likely conservative nature of NAV calculations: the discount rates used to value infrastructure assets have fallen much less than yields on other assets, and remain close to levels seen a decade ago.

"The apparent premium to NAV may simply be the market effectively indicating that discount rates are higher than they need to be," he says.

Regardless, Seneca fund manager Richard Parfect believes premiums can be justified to a degree by growing income streams. IPP, for example, has grown its dividend by 2.5% since launch and offers a good hedge against rising inflation, with 89% of revenues being inflation-linked.

Renewable energy

The renewable energy infrastructure sector focuses on projects that are good for the planet, and is an area favoured by Architas. "Assets driven by wind and solar patterns offer truly uncorrelated returns," says Sweeney.

"If the wind is blowing or the sun is shining, these assets can deliver returns regardless of what's happening in equity or bond markets."

Almost 7% of its fund is in renewable energy infrastructure, which it accesses through funds like .

This pays inflation-protected income from a portfolio of wind farms, solar farms and biomass plants, mainly in the UK, though it also owns two wind farms in France.

On average, funds in this sector yield 5.6% and trade on a premium of 11.9%. However, 7IM, whose exposure to alternative strategies has just hit its highest ever levels, still regards them as attractive on the understanding that assets will grow in value.

"The sector has seen some volatility on the back of the falling oil price and removal of government subsidies, but as the costs of solar and wind installation and operation fall - and they have come down very substantially - this sensitivity to oil price and government policy risk is reduced," says Camilla Ritchie, manager of the , which owns , and .

Ben Yearsley, a director of Shore Financial Planning, a Plymouth-based adviser, owns Foresight Solar in his ISA. It is trading on the smallest premium in the sector at 8%.

Debt

From asset-backed to direct lending, the debt sector encompasses a range of funds, some of which are quite complex.

"Loans to high-quality borrowers don't come with attractive interest rates for investors, so the sector focuses on lower-quality borrowers and structures designed to leverage income to boost yields," says James Carthew, research director at research company QuotedData.

F&C likes asset-backed lending funds that marry the return levels of high-yield bonds with greater security, albeit less liquidity. "We are choosy," says Burdett, who holds and in the .

Recent issuance points to the sector's attractions, but not every fund is in demand. Some direct lending or 'peer-to-peer' funds are trading on wide discounts after struggling to meet targeted returns or suffering impairments to underlying assets.

Milton believes fears over the sector are overblown and has bought , which is trading on a 25% discount following recent wobbles and yields 10.8 %. "It's not as bad as the pessimists fear, hence an opportunity," he says.

As an alternative, Yearsley suggests crowdfunding bonds, which can be bought direct or through an adviser. He has bought several of these, which offer yields of up to 15%.

"I haven't necessarily invested in those offering the highest rate, but looked for a mix of return and safety from some level of asset backing - a pub bond that owns the freehold and yields 7%, for example."

Specialist property

Commercial property funds suffered in the wake of the EU referendum, and those concerned about the outlook could consider specialist property as another way into the asset class.

Burdett, for example, is wary of property valuations in general, so prefers "recession beneficiaries" like student accommodation trust GCP Student Living. Specialist property sub-sectors have their own fundamentals. Student accommodation taps into rising demand for higher education, while GP surgeries are a play on a rising and ageing population that requires more healthcare.

"Given the potential income returns on offer, typically 4 to 6%, sometimes with annual inflation uplifts, appetite for these assets has been high from retail and institutional investors alike," says Rathbones research analyst Alex Moore. However, he warns, investing in these assets introduces new risks to a portfolio: "Government policy can be hugely influential here."

Healthcare real estate investment trusts are trading on an average premium of 23%, but shares in trusts investing in student digs can be bought for single-digit premiums. has one of the lowest premiums in the sector at 2.2%.

Reinsurance

derives around half of the dividends paid to shareholders from alternative asset classes, including catastrophe bonds.

The market for catastrophe bond and insurance-linked securities has grown from under $1 billion (£770 million) in value outstanding in 1997 to more than $25 billion today, according to data provider Artemis Deal Directory.

"Typically for these instruments, the risk of non-payment is based on issues occurring in the natural world rather than in financial markets; they are certainly not 'risk-free', but clearly are exposed to a very different set of risks," says Mike Brooks, manager of the Aberdeen fund.

He accesses the asset class through the only two funds in the sector, and .

"These funds insure the insurers by agreeing to take on worst-case scenario risks such as major earthquakes, hurricanes and plane crashes," says Carthew at QuotedData.

"They cannot lose more than a fixed amount and diversify their risk exposure so that, even if one of these disasters does happen, the fund's NAV shouldn't take too big a hit."

Monica Tepes, investment companies research director at Cantor Fitzgerald, points to the 8.4% discount on Blue Capital, despite its 'good track record'. It yields 6.5%, while Catco trades on a 4.4% premium and yields 5.4%.

Blue Capital has traded on a discount as wide as 16.8% in the last 12 months and Milton added it as a defensive element to client portfolios when it was close to this level.

Do your homework

Due diligence is vital. "Some infrastructure managers may be lightly regulated and weak operational practices could quickly escalate," says Prudential's head of alternative investing, Michael Howard. "This may be extremely problematic when liquidity is much lower and most deals have multi-year lock-ins."

Pouring over investment trust prospectuses may be beyond the expertise of retail investors and their advisers, hence many are turning to multi-managers.

Falkirk based Tom Munro Financial Solutions uses the , which has increased alternatives exposure from 2.5% last year to 8% today [May]. "It's delivered exactly what I require for clients looking to generate around 6% a year," says Munro.

Buy into secondary issues

When funds trade on significant premiums, there can often be opportunities to buy at more attractive prices through secondary issuance (typically at a discount to the prevailing share price, but a premium to NAV), says Michael Harvey, an investment manager at Hargreave Hale in Nottingham. Last month [12 June], proposed a new share issue to raise £100 million.

However, Ewan Lovett-Turner, a director of investment companies research at Numis, says: "Recent issues in the infrastructure sector have been heavily oversubscribed, which means that investors may not get all the shares applied for in an issue."

Don't overallocate

It is important to remain diversified and have a broad mix of traditional asset classes as well as alternatives. Yearsley says alternatives should make up no more than 10% of an income portfolio.

Brooks likes shares that screen well in quality and value terms, and emerging market bonds offering yields of 6% or more, as well as alternatives. "By allocating across a broader mix of asset classes and combining them, investors can reduce risk," he says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.