Kingfisher plunges to fresh three-year low

17th August 2017 11:37

by Graeme Evans from interactive investor

Share on

While the five-year rebuilding job at continues to progress, the same can't be said about current trading or the company's share price.

Summer sales figures highlighted continued weaker trading in France, with the like-for-like performance at B&Q showing a 4.7% decline following the impact of poor weather on demand for seasonal products. One bright spot came from Screwfix, where sales have continued to surge - up 10.8%.

Broker Investec Securities described second-quarter trading as underwhelming and said it continues to see better investment opportunities elsewhere in the retail sector.

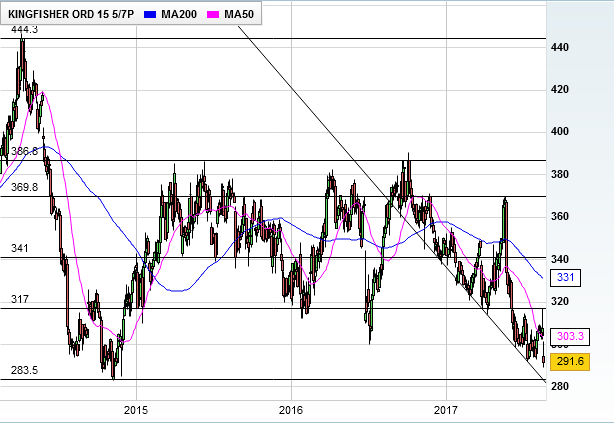

Investec analyst Kate Calvert nudged down her 2018 and 2019 pre-tax profit forecasts by 1% and retained the broker's sell rating. She has a share price target of 268p, which is below the 300p to 400p range that has largely been home to Kingfisher for the past three years.

Calvert added: "While valuation is not demanding, short-term risk of further downgrades remains high given the scale and complexity of the transformation plan."

Shares slipped below the 300p mark Thursday, weakening 6% to 289p, testing lows not seen since late 2014.

The five-year, ONE Kingfisher plan aims to deliver £500 million of sustainable annual profit uplift by year five, over and above 'business as usual'.

The project will unify the products on offer across Europe, as well as improve infrastructure and processes in order to become a simpler, more agile operation.

Kingfisher said it was on track to achieve the plan's second year milestones but admitted it has experienced disruption due to the transformation work.

Chief executive Véronique Laury said: "Availability of this year's unified and unique product is now approaching normal levels.

"We continue to adapt new processes as our transformation progresses, which will support the significant amount of change planned for H2."

But the plan has also been impacted by weaker macroeconomic conditions, house price uncertainty and rising DIY capacity. In France, market share is under pressure and the sector has yet to react to stronger housing stats or the improving trend in unemployment figures.

Despite these testing trading conditions, Kingfisher said it remains comfortable with consensus underlying earnings per share (EPS) expectations of 26p in the 2017/18 year. This is stated before the short-term costs associated with the turnaround plan.

It said it had also returned a further £168 million to shareholders in the year to date via buybacks in a previously announced £600 million capital return.

Kingfisher operates nearly 1,200 stores and has multi-channel operations across 10 countries in Europe, Russia and Turkey. It recorded sales of £11.2 billion in the year ended to January 2017, with adjusted pre-tax profits of £787 million.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.