Re-assessing Games Workshop: Is it a buy?

18th August 2017 16:58

by Richard Beddard from interactive investor

Share on

Egg on your face Richard?

Egg?

Yes, egg. A couple of years ago you laid into Games Workshop. You said either you were mad or Games Workshop was delusional. Yet in the year to May 2017 the company has increased revenue 21% at constant exchange rates and nearly doubled profit. Care to explain who was delusional?

Ah. I see what you're getting at. Let me explain. I made that comment in January 2016 when published its half-year results. The company had failed to lift revenue convincingly for well over a decade and had recently promised a sales drive, yet sales had fallen.

I actually said: "But when I read Games Workshop's results, I wonder about what the company says, and what it doesn't say, and whether I'm mad or it's delusional."

Either condition could have been true. I was simply unable to reconcile the company's rhetoric with its results. Pundits too often project certainty, when actually their confident assertions belie deep misgivings.

It makes the stock market more perilous for naïve investors because the pundit transmits his overconfidence to them. If you don't know, I think it's better to be honest about it.

Very high minded. Did you think of that yourself?

Actually no, I'm following the example of a hero of mine, the late, great film critic Roger Ebert, who told the interviewer Charlie Rose:

I'm reluctant to tell you that I cry because it makes me look like a sap. You know, because critics are always crying and I want to be the critic that's too tough to cry. But if I did cry during that movie, then I have to tell you that happened… If I was aroused during an erotic scene, I have to tell you that happened. If I laughed, I have to tell you it's funny. I went to see Jackass, a shameful movie, and I laughed all the way through it. I have to tell you that. I'm the guy. I was in the theatre and I have to be honest.

Well I'm the guy reading the annual report, visiting the AGM, and deciding whether to invest in the company.

Brave man. Have you ever been aroused reading an annual report?

Next question.

Take me back then. What was it that you didn't like?

Swayed by comments on my articles from hundreds of angry gamers, I thought Games Workshop might be killing the goose that laid the golden egg.

The company only seemed to be interested in big-spending older customers. By and large these customers have stopped playing Warhammer, the war game that got them into the hobby as teenagers.

They often pay modellers to assemble and paint elaborate models costing up to a thousand pounds.

No doubt these are highly profitable customers, but the company's inability to lift revenue despite rising prices suggested the number of customers was slowly diminishing.

To maintain profitability Games Workshop threw its efforts into manufacturing and retail efficiency, churning out millions of models as cheaply as possible and selling them through its new one-man store format.

There was very little talk of the game in annual reports and, since gamers were complaining about cost and rule changes that required them to buy new models, I though the company may be throttling the next generation of hobbyist.

Frankly, I didn't know whether to believe the hypothesis or not. It seemed incredible to me that the company would be so short-sighted, especially considering its oft-repeated ambition to remain in business forever.

But the results suggested something was wrong.

So you sold the shares then?

No. I didn't.

Why not? You didn't like the rhetoric, and you didn't like the results.

It's not that simple. In some ways Games Workshop is admirable.

Admirable?

Yes. It's invented a hobby, collecting fantasy toy soldiers, which it has the exclusive right to exploit (Games Workshop says it defends this right vigorously).

While other brands exist, none of them are anything like as popular as Warhammer.

Since collecting and gaming are social activities that can only flourish if lots of other people are trading and playing, it's one of those business where the spoils tend to go to the biggest.

Games Workshop controls almost every aspect of the business. It manufactures the miniatures, it retails them, and it promotes them through the games and publications.

It licenses its characters and stories to software developers who create Warhammer apps and PC games. It runs its own web stores and, while it also sells through independent gaming and modelling shops, it's famously particular about how it does it.

While high handedness sometimes brings it into conflict with its own customers, one could argue the passionate disputes that flare up, such as a wildly popular online petition urging Games Workshop to refocus on the game and a multi-million dollar lawsuit filed by a distributor alleging multiple shenanigans, are a sign of how strongly people feel about Warhammer.

So you didn't sell. Did you buy?

No. I was stuck between a rock and a hard place. I couldn't bring myself to dispose of such a unique business, but I felt I didn't sufficiently understand what was going on. I sat on my hands.

Sat on your hands. Do they teach you that in investing school?

I haven't been to investing school so I wouldn't know. But you'll find it's quite an effective strategy.

And now. Are you any closer to reconciling the rhetoric and the results?

Good question.

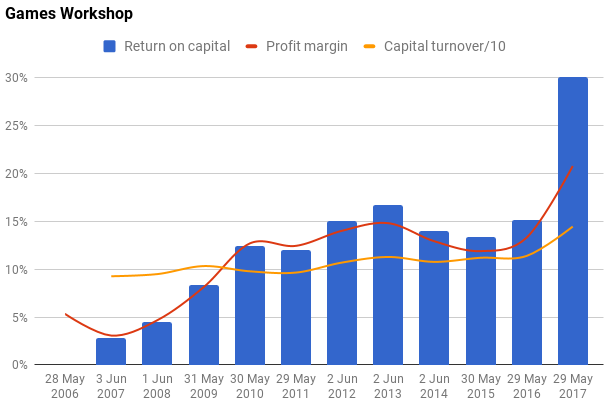

First off the results have finally, and quite dramatically, lurched in the right direction. Take a look at return on capital:

The first years of that chart are anomalous. Games Workshop suffered a dramatic contraction in profitability due to a wild expansion on the back of a game based on the Lord of the Rings.

The game was a fad that lasted little longer than the film trilogy's run in cinemas, but Games Workshop had expanded as though its appeal, like Warhammer's, was permanent.

Even so, in its most recent financial year, Games Workshop was almost twice as profitable as any previous year.

Some of this supercharged performance was due to good luck. 75% of Games Workshop's revenue comes from abroad, so it benefited from the devaluation of the pound.

Most of it was due to a plethora of Games Workshop initiatives, though, including the one-man stores, rebranding them Warhammer, relaunching the classic Warhammer game in a simpler guise as Warhammer Age of Sigmar, providing a wider range of miniatures at different price points and a drive to recruit better managers.

So the results have changed, what about the rhetoric?

Maybe it's wishful thinking, but I detect subtle changes of emphasis in the annual report. One paragraph, admittedly buried in the middle of chief executive Kevin Rountree's spiel, particularly excited me.

It referred to improvements in the range addressing "all aspects of the hobby: collect, build, paint and play". It's the last word that heartened me so.

Rountree and chairman Tom Kirby still strike a somewhat maniacal tone, though. They brook no criticism from outside the company, or within.

The biggest risk they say, is ego. Not their own egos, but those of their managers and they will not allow private agendas to rule. They give the impression of a cult.

Reading the testimony of employees on Glassdoor, a site that invites reviews of employers, reinforces that impression. If you don't fit in - you won't last long.

I don't think I'd like to work there, I'd be the square peg, but plenty of people rate it as a great place to work.

Having exercised pay restraint in previous years, the company did the right thing this year and rewarded staff handsomely. It paid every employee a bonus of £1,750 on top of the £250 maximum profit share.

Only the executive directors received no bonus. Read that again, because I don't think you'll read it about many other companies.

Oh and Tom Kirby, the contrary, self-flagellating, proselytizing, defender of "the Hobby", who has at times been chairman, at times been chief executive, and at times been both, is standing down from the board.

Kirby's going?

Well, I wouldn't go that far. He'll still be paid £250,000 a year as a consultant.

Bearing in mind Kirby himself says Rountree is better at the detail than he is, and Rountree is well versed in the business, I wonder why the company needs him to the extent such a big pay packet implies.

Rountree joined the company in 1998 and was chief financial officer and then chief operating officer before he became chief executive officer in January 2015.

OK, the Kirby conundrum aside, it's a buy then?

Not so fast, hot shot. First of all, one swallow doesn't make a summer. This was a year in which a lot of things went right. It won't always be so.

My expectation is the Games Workshop of the next 10 years will probably be more profitable than the Games Workshop of the last 10 years.

I doubt it will always reach the amazing heights it achieved this year, though.

And…

And?

There's one thing the company doesn't control - the share price. It's almost quadrupled. It values the enterprise at £565 million, or about 17 times the bumper profit in 2017.

That takes some of the sheen off the investment. It's one of a kind, though, and, even though it annoys a lot of people, it makes a lot more happy.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.