Where to look for income as global dividend index hits three-year high

21st August 2017 13:59

by David Brenchley from interactive investor

Share on

The UK was the sole region to see a year-on-year headline decline in dividends payments, according to a survey that shows global payouts hit a quarterly record in the second three months of 2017.

Companies around the world paid out $447.5 billion (£347 billion) in dividends in the second quarter of the year, a headline increase of 5.4% compared to the same period a year earlier. That's according to the Janus Henderson Global Dividend Index, which hit a three-year high level of 161.9.

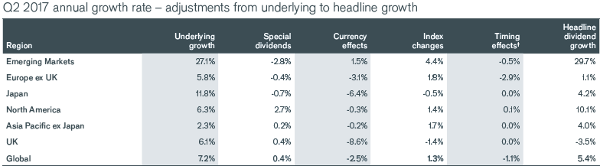

The UK was the worst-performing region on a headline basis, seeing dividend payments slide by 3.5%; both emerging markets and North America saw double-digit growth, at 29.7% and 10.1% respectively.

Globally, Janus Henderson has upgraded its forecast for total dividends paid in the full year to $1.2 trillion. That would be a headline year-on-year increase of 3.9% and an underlying increase of 5.5%.

"The global economy is very supportive for company profits and dividends at present," says Alex Crooke, head of global equity Income at Janus Henderson.

"Taking a global approach means a slowdown in any one part of the world has less impact on your overall income level, but investors will be pleased they are enjoying one of those periods when there is synchronised underlying dividend growth across all regions of the world."

Where to find UK dividend payers

Despite the UK's lacklustre headline performance, after stripping out four factors including exchange rate movements and special dividends, underlying dividend growth was a robust 6.1%, though still behind the global figure of 7.2%.

As the survey points out, sterling's devaluation since last June's Brexit vote "has masked solid progress in dividends paid by UK companies", though this should be the last quarter impacted.

The underlying growth was better than expected, according to Janus Henderson, with a significant improvement in the mining sector's payouts contributing most, with having restored its dividend in the quarter and making a bumper return to shareholders.

Eric Moore, manager of the , recently pinpointed mining as an "under-appreciated" sector for income investors. "These companies all cut their dividends in 2015-16, so there's still some scar tissue with investors. But this provides opportunity," he said.

Another area Moore favours for income is life assurance, which provides the combination of a good starting yield and good dividend growth.

He says: "People need to save more for their old age. The Retail Distribution Review has created an 'advice gap', and pension freedoms have pushed a lot of people into that gap. Therefore, there are great opportunities for the companies that can help people navigate these problems."

One firm Moore favours in this space is , which has grown its payout by more than 15% per annum for the last three years. It is the fund's sixth largest holding, accounting of 3.1% of the portfolio.

Europe ex-UK contributed two-fifths of the global amount of dividends paid in Q2 due in the main to most European companies making a single annual payment in the second quarter. The fastest increases on the continent came in Austria, Portugal, Belgium and Finland, while Switzerland, Belgium and the Netherlands reached new records. Spain and Italy, in contrast, disappointed.

Other countries that posted new quarterly records were the US, Japan, Indonesia and South Korea.

Dividends from North American companies counted for a third of the total in the quarter and its headline growth was boosted by higher one-off specials in the US as well as the addition of several Canadian firms to the index.

| The world's 10 biggest dividend payers in Q2 2017 | ||

|---|---|---|

| Rank | Company | Q2 2016 rank |

| 1 | Nestle | 1 |

| 2 | Zurich Insurance | New entrant |

| 3 | HSBC Holdings | 3 |

| 4 | Sanofi | 2 |

| 5 | Allianz | 5 |

| 6 | BNP Paribas | 10 |

| 7 | National Grid | New entrant |

| 8 | Anheuser-Busch InBev | 7 |

| 9 | Daimler | 4 |

| 10 | Commonwealth Bank of Australia | 6 |

Opportunities in US banks

$3.1 billion special dividend accounted for nearly a third of the US's 9.8% headline increase, while the banking sector contributed the most to the underlying figure of 5.9%. That's due to the US Federal Reserve giving banks across the pond the green light to make big returns to shareholders via share buybacks and dividend plans.

The top US lenders passed the second part of the central bank's annual stress test, leading to a bumper payday for investors like Warren Buffett that had kept the faith in the sector. According to RBC Capital Markets analyst Gerard Cassidy, the big six US banks will return almost $100 billion to shareholders over the next four quarters.

It's a reason Eric Lonergan, co-manager of M&G's multi-asset Episode funds, is still bullish on a sector he's "been able to make an awful lot of money" from since the great financial crisis. And he sees "a huge opportunity" to make even more gains.

"Capital ratios [are] up, liquidity ratios [are at] an all-time high… So you end up with a banking system that's culturally de-risked itself [and] a regulator who is actually your friend as an investor," he explains.

He points to the likes of and , which are priced to deliver a "phenomenal" real return of around 8-10%. "It would not surprise me if they go to higher price/earnings multiples than people are used to."

Stellar performance in South Korea

Branching out further, South Korean dividends also put in a stellar performance with a headline increase of 7.7% to a record $10.6 billion. Around 80% of Korean companies raised their dividends year-on-year, the reports states, with electronics behemoth Samsung the biggest contributor.

It is one market Liontrust's Asia team likes for income. The firm's recently increased its weighting to South Korean equities, which now account for almost 8% of the portfolio. Samsung is its second-largest holding.

Co-manager Mark Williams says it's becoming increasingly easy to find companies that return money to shareholders in Korea. Its biggest 10 firms have increased the absolute amount they are paying by 136% in the past five years, or 40% in the past two and Williams is hopeful this the election of Moon Jae-in as president will continue this process.

One company he likes is South-East Korean bank DGB Financial, which is currently both increasing its payout ratio and growing its earnings. "It avoids many of the risks of household exposure by having 70% exposure to corporate loans," he says.

"It is relatively conservative, with a high (and rising) core deposit rate of 38%, which gives it a lower cost of funding. Loan growth at the moment is hitting a normalised 8% for the year."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.