Best opportunities in emerging market bonds

31st August 2017 13:23

by Dzmitry Lipski from interactive investor

Share on

Current low interest rates and uncertainty over the prospects for bonds in the developed world have made it difficult for many investors to find a good yield. But it's not impossible.

Approximately $6 trillion (£4.7 trillion) of government bonds in developed markets now trade at negative yields at maturities out to 10-years, and more than 50% of all government debt yields less than 1%.

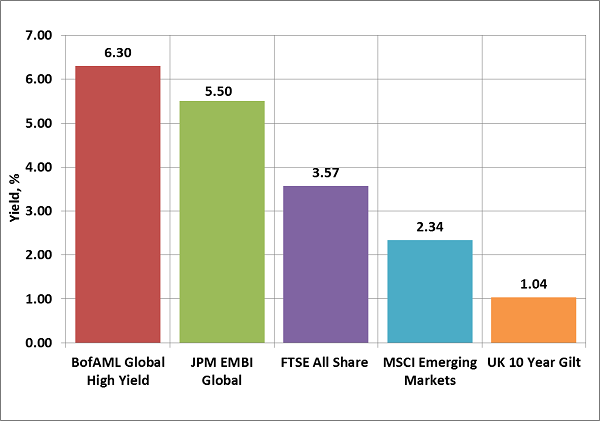

In contrast, emerging market bonds offer very attractive yields of around 6%, which is higher than on equities and government bonds, making it an option worth considering for income investors.

Source: Interactive Investor as at 31st August 2017. All yields in local currency.

Emerging countries have undergone a radical transformation over the last decade to achieve increasing growth & economic stability. Debt levels are also low compared to developed market nations, with debt-to-GDP of around 40-50% versus 100% respectively.

Emerging market countries' fundamentals have also improved so that they can provide better protection for investors from global risks such as tighter monetary policy by the US Federal Reserve.

Rising demand has allowed emerging countries to increase the range of bonds available, offering a wide choice of good opportunities. Emerging market debt has grown to a $14.8 trillion asset class with over 1000 corporate and sovereign issuers based in 80 countries. Additionally, 66% of issues are now rated as investment grade.

Investors who are searching for higher quality yields within emerging markets will not only benefit from this positive economic story, but also from the fact that emerging market bonds are now less expensive relative to many other fixed income asset classes.

Bonds vs equities

Investors should be aware that emerging market debt and equity have many similarities, but also differ in their exposure to countries and risks.

The MSCI Emerging Markets Index contains 24 countries, with the five largest accounting for 70% of market value. Three countries China, South Korea and Taiwan comprise more than 50% of the index. Compared to equities, the emerging market bonds universe is more diverse.

The JP Morgan EMBI Global Index, which includes dollar-denominated debt issued by emerging market countries, contains 66 countries. The largest five countries account for only 40% of market value, and the top three for 28%. Of the 66 countries in the emerging market fixed income benchmark, only 19 countries overlap with the equity universe.

In contrast to equities, emerging markets debt benchmark contains an insignificant exposure to China of approximately 4%.

Emerging market bonds performance

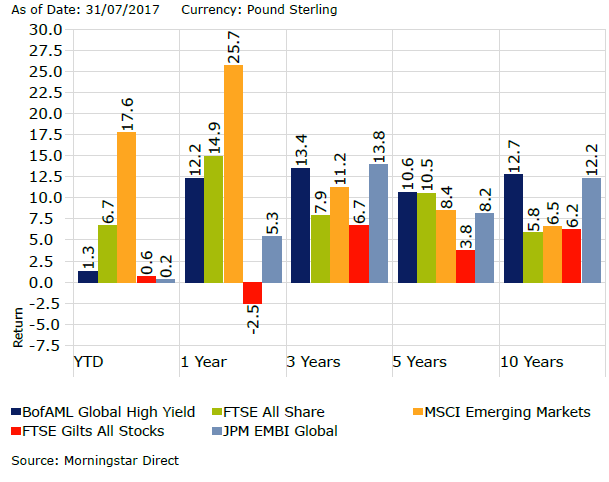

While the environment for emerging market bonds has improved and yields look attractive, investors remain wary about the asset class. It has suffered following Trump's US election win, with prices falling and yields rising, but the overall performance of the asset class has been relatively resilient.

It had a difficult time until a year ago, but has turned the corner and we're now seeing some of the best performance to date. Since the financial crisis in 2008, emerging market bonds have delivered positive returns every year except in 2013 during the 'taper tantrum'.

How to add emerging market bonds to your portfolio

With yields at extremely low levels, investors should think about diversifying across different asset classes and regions to achieve required income.

Emerging market bonds can help generate an attractive yield, but capital returns in the fixed income market may be significantly affected by rising rates. Government bonds would likely suffer most, while the higher yields of emerging market bonds should compensate investors for capital losses incurred, making the overall return effects positive in most cases.

Additionally, the relatively low correlation of emerging market bonds to other asset classes should offer good diversification benefits to investor portfolios.

The investable universe of emerging market debt has grown significantly in recent years, making active management key to seeking out the most attractive opportunities and avoiding those that represent the highest risk.

Investors have two options when it comes to investing in emerging market bond funds: hard currency (usually US dollar or the euro), or local-currency emerging market bonds, or include both options (blended approach) in a portfolio.

Due to currency stability and high liquidity, hard currency bond funds, such as Pictet Global Emerging Debt or *, may be a good options in times of uncertainty for new investors in the asset class, or for more cautious investors.

But some investors suggest that recent US dollar appreciation is peaking and setting the stage for more stable and appreciating EM currencies.

In this case a local currency bond funds such as GAM Multibond Local Emerging Bond may be a better option. The potential benefit of local currency funds is that they allow investors to diversify their holdings away from the US dollar, but local currency exposure adds more risk.

Alternatively, investors may consider funds such as *, that adopt a blended approach and move between hard and local currency-denominated bonds, depending on prevailing market conditions.

*Money Observer Rated Fund

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.