Will a US bear market stuff the European recovery?

15th September 2017 13:38

by David Brenchley from interactive investor

Share on

In what is often described as a "benign" economic environment, there is still plenty to worry investors, not least North Korean nuclear posturing, President Trump, central bank monetary policy, and Brexit negotiations.

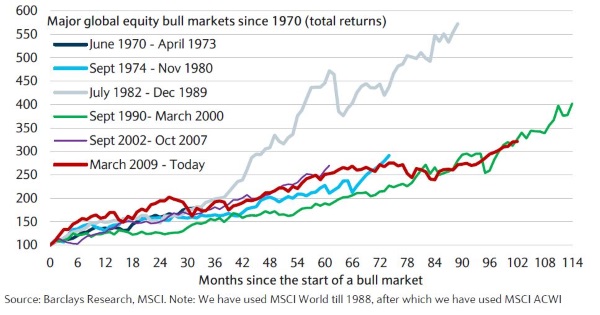

Chief of these, though, is stockmarket valuations. We're now eight years into a US-led bull market and, according to Bank of America Merrill Lynch's (BAML) September survey of European fund managers, investors increasingly see valuations as stretched.

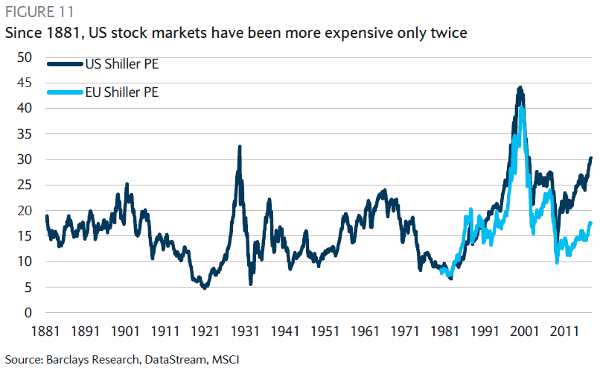

On a Shiller price/earnings (PE) ratio of 30 times currently, the US market has only been more expensive twice before in history - prior to 1929's Great Depression and 2000's tech bubble. By comparison, European stocks, trading at 17 times, look cheap.

Analysts at broker Barclays have long been bullish on Europe, but the prospect of a bear market in the US makes them "uncomfortable". However, it's a scenario they see as unlikely in the short term, noting that the Shiller PE went from 30 times in 1997 to 42 times in 2000 before entering a bear market during the tech boom and bust.

Despite this, a downwards correction is inevitable. So, when the US does enter a bear market, what will be the impact on markets around the world?

According to Barclays' analysts, "a 10% decline in the S&P 500 has mostly seen the [German] DAX also decline by a significant margin". While that doesn't invite confidence, there is no historical precedent resembling today's situation as, on a price/book ratio, Europe has never been this cheap relative to the US prior to the States entering a bear market.

During the tech bust, however, there was one asset class that was cheap compared to the US - emerging market (EM) equities. This did not, though, safeguard them from wrath of the tech bubble and EM equities fell by 26% in dollar terms and 15% in local currency terms.

"While valuation gaps can help generate relative outperformance even during bear markets, it can do little to shield the region from significantly negative absolute returns," the analysts conclude. "Therefore, if the US were to endure a valuation-driven bear market, it appears unlikely that Europe will hold up."

A bear market in the States is not Barclays' base case, though. In fact, more likely, we're told, is that other regions, particularly Europe, catch up with the US in valuation terms. That's because the factors driving US valuations - low and stable inflation, stable GDP growth, easy monetary policy and high profitability - are unlikely to change near-term.

"The relatively low valuation of European stocks versus the US appears primarily driven by the lower returns on equity (ROE) generated by European companies relative to the US," says Barclays. "However, the ROE gap between European and US companies has started to close. In fact, most other regions are now starting to catch up with the US on profitability."

Stephen Dover, head of equities at Franklin Templeton agrees. While markets currently look unprepared for a shock, "as long as companies have earnings growth, the market should be able to keep moving higher".

While an equity bear market is certainly not off the table - the BAML survey indicated a net 12% of respondents said this scenario would not be a surprise in the next six months - it does seem unlikely.

The bull case for Europe is still intact, according to Barclays. A re-rating on the continent could be imminent and there is "potential for strong returns from European equities in the near-term".

The view on European banks

One sector proving popular are banks. According the BAML, European fund managers are overweight banks and consider the sector the most undervalued, although the percentage of managers overweight the sector has declined since August from 44% to 26%.

Dover adds that European banks are doing better than many thought they would. "Financials in general still haven't completely recovered from the global financial crisis, providing additional upside potential," he explains.

In a separate note to clients Friday, Barclays said, at its global financials conference in New York this week, "investors say they are less underweight European financials than a year ago and expect them to outperform in 2018".

"The revenue outlook is now more positive for many banks and consensus expectations for 2-3% growth look consistent with the commentary from individual banks," Barclays' European Banks team said.

They add that Southern European banks have the potential for the greatest upside, while Scandinavian and UK banks remain out of favour. Despite the latter statement, it reported "positive messages" for popular high-street lender , alongside Sabadell and Danske. "We also remain constructive on Santander, BBVA and Intesa."

For investors looking for exposure to European banks, Bill McQuaker, manager of the Fidelity Multi Asset Open Fund Range, likes as it offers a focused play on both banks and oil. Financials account for almost a third of manager Jeffrey Taylor's portfolio.

also has banks as a "key overweight", with 37% of the portfolio in financials. "Interest rates have hit a floor in Europe and tapering is on the agenda," explains manager Rob Burnett. "Rising rates benefit some companies. Banks, in particular, can increase earnings as rates rise," he explains.

Intesa is held by both aforementioned funds - it's the largest holding in the Neptune offering. Its next two largest holdings are also banks - Unicredit and Commerzbank.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.