Lloyds Bank receives dividend boost from regulator

26th September 2017 13:50

by Lee Wild from interactive investor

Share on

shares had been in a downward trend since the end of May, bottoming out at a five-month low early September. However, they've rallied since, outperforming both the UK banking sector and wider market, which are both nursing losses. And this week, there's renewed confidence in the lender's ability to deliver both share price upside and a dividend surprise.

Higher interest rates are clearly a boon for Lloyds' profit margins, so a more hawkish Bank of England has created demand for the shares. It's quite possible that UK borrowing costs will rise sooner than expected, possibly as early as November, according to some.

Yesterday, in its latest consumer credit report, the central bank's risk regulator, the Financial Policy Committee (FPC), warned that UK banks needed a further £10 billion of rainy day money in case of losses on personal loans and credit cards.

In a downturn, losses could reach £30 billion, about 50% more than the 2016 stress test. But, remember, Lloyds was the second-best performing bank in that test.

Lloyds shares have come off a bit since the review, but analysts at Barclays believe the outcome is "relatively benign", with any impact on CET1 ratios absorbed by current capital targets which already provide sufficient buffer.

Importantly, there is no crackdown on products and services like 0% balance transfer credit cards and personal contract purchase (PCP) car finance loans.

And there was a further unexpected positive in that IFRS 9 accounting changes, which bring forward recognition of impairment provision even when the chance of a loss is low, will "not result in a de facto increase in capital requirements".

"While market concerns on the UK macro outlook are likely to persist, this review supports our 'overweight' ratings on Lloyds (77p price target) and (360p price target) where UK consumer credit is 20% of the business," says Barclays.

That IFRS 9 news, which Lloyds chief Antonio Horta Osorio had previously flagged a key uncertainty for the bank, also supports the broker's view that "Lloyds has the potential to deliver a significant step up in capital distribution with FY17 results in February".

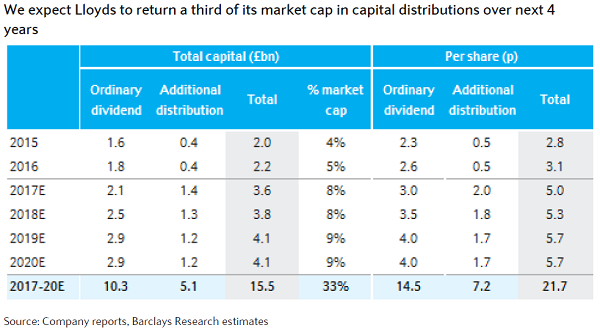

"We expect continued strong underlying returns helped by a sustainable net interest margin, and ongoing cost control," writes Barclays. "This should offset rising provisions and result in underlying return on tangible equity being maintained at c15%, generating sufficient capital to return one third of its current market cap to shareholders over the next three years.

"At 8.4x underlying 2018e earnings, 1.2x tangible book value (P/TBV) and an 8-11% dividend yield we continue to see the shares as attractive and reiterate our 'overweight' rating."

If we get a better-than-feared outcome on economic uncertainty in the UK, higher capital returns could drive Lloyds shares as high as 107p, believe Barclays analysts.

Elsewhere, they keep as 'equal-weight' with 260p price target. A price/earnings (PE) ratio of 10 is a 10% discount to the sector and 0.9x P/TBV a 26% discount. Downside risk to the share price appears "fairly limited," argues Barclays.

At 269p, Virgin Money currently trades at a 33% discount to Barclays' price target of 360p, but the broker believes concerns about the UK economy and consumer credit are "are significantly over-discounted by the market".

"We do not think [growth prospects] are reflected in the current 6.1x 2018e earnings multiple or the 0.8x tangible multiple."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.