Little respite for supermarket slackers

29th September 2017 13:15

by Emil Ahmad from interactive investor

Share on

The new millennium ushered in a period of consolidation in the UK supermarket sector with familiar names such as Somerfield and Safeway consigned to high street history. Once the dust settled, the UK consumer was essentially left with a choice of four familiar names which still dominate today.

, , Asda and become known as the 'Big Four' and for a period, their market dominance was unassailable. Aggressive expansion embracing the rise of the hypermarket suggested a level of arrogance befitting of such supremacy. With complacency comes opportunity and when the Big Four were caught napping, a couple of German upstarts were ready to pounce.

The battle begins

Although Aldi and Lidl have had a UK presence since the 1990s, it was only the launch of the price wars in 2013 that really made Tesco et al stand up and pay attention. The Big Four had arguably lost sight of a changing consumer dynamic which was prioritising convenience over range. In more austere times following the Great Recession, the German discounters' business models were perfectly primed to deliver on the most important factor of all: value.

The supermarket price wars have permanently changed the business model which brought the main players such success. Operating in a lower margin environment is now the norm after price cutting across the sector lead to a period of groceries deflation in 2015 and 2016. Hypermarkets may become less relevant as factors such as convenience and value take precedence over the traditional weekly shop.

The main supermarkets continue to close less profitable stores to consolidate their balance sheets as the squeeze on margins gathers pace. Lidl and Aldi are perfectly positioned to carry on their meteoric rise, with their business models traditionally focusing on low prices, volume over brand and price over selection. As the market leaders adapt their strategy, unwinding parts of their less profitable property portfolios could give the discounters more room to expand.

A growing challenge

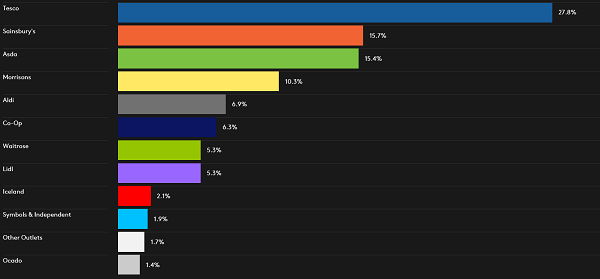

Even though Lidl and Aldi have started to snap at the heels of their more established rivals, it is important to put things into context. The latest figures from research company Kantar Worldpanel show that in the 12 weeks to September 11th, Tesco headed the table with a 27.8% market share. Add in the other three main supermarkets and the combined total is almost 70%.

Despite lagging behind the sector sales growth average of 3.6%, all four companies are firmly on an upwards trend. Tesco leads the quartet with a 2.7% gain, closely followed by Morrisons at 2.3%. Sainsbury's made gains of 2.1%, with Asda's volumes only increasing by 1.5%. This is notable progress when considering that growth has been negligible at best over the last couple of years.

Aldi has overtaken the Co-op to become the fifth biggest operator with a market share of 6.9% while Lidl is in joint seventh place with Waitrose (5.3%). Nevertheless, it may be the rate of sales expansion which is most concerning for the big supermarkets. Lidl and Aldi's sales grew by 19.2% and 15.6% respectively over the three-month period. If this trend continues over the next few years, the Big Four may have to begrudgingly welcome two new members.

UK Grocery Market Share (Source: Kantar Worldpanel, 12 weeks ending 11/09/17).

Kantar noted that the two German discounters now account for approximately £1 of every £8 spent in British supermarkets. This is in stark contrast to the £1 in every £25 figure from a decade ago, representing growth of around 300%. Brand awareness has clearly played a role in attracting more shoppers as revenue growth has justified increasingly visible marketing campaigns.

Over 63% of shoppers visited one of the two German supermarkets during the three-month period, a year-on-year increase of almost 5%. However, the fact that 98% of households still shopped at one of the Big Four puts this into perspective; organic growth and expansion may be ongoing but there is still a lot of ground to cover.

The sector as a whole is enjoying its longest growth run in four years. Kantar noted that there have now been six consecutive months where sales growth has exceeded 3%. Speaking to the Financial Times, Fraser McKevitt of Kantor noted that there has not been "…sustained market growth of this kind since May 2013." In considering this trend, McKevitt added, "A 1.5% increase in the volume of goods going through the tills has contributed to this growth while the remainder of the overall sales increase is down to higher prices."

The customer comes first?

While value may be fundamental to the challenger brands' business models, valuing the actual customer has possibly been less of a priority. Marketing agency ICLP would certainly concur with this point of view.

Jason De Winne, General Manager at ICLP, recognises the strides the disruptors have made but acknowledges that a more cultivated customer relationship is essential to future growth. De Winne noted that "…with challengers Aldi and Lidl, the focus has shifted from customer acquisition to retention. The UK's longer standing supermarkets are unlikely to benefit from engaging in a never-ending price war, and Aldi and Lidl have already built strong brand recognition for their deep discounts and no frills service. While their market share has reached impressive new heights, Aldi and Lidl lack a well-rounded relationship with their customers."

If the Big Four becomes the Big Six in the coming years, the market leaders will need to plot a path which embraces this challenge. Morrisons reported earlier this month and the signs were encouraging. The supermarket's 'Fix, rebuild and grow' strategy is starting to show results, with H1 2017 total sales up 4.8% and underlying profit gaining almost 13% year-on-year.

Morrisons' successful collaboration with has also been augmented by a new wholesale arrangement with . Tesco and Sainsbury's are both releasing interim figures in the next two months and the market will be looking for further evidence of a Big Four response.

Although this disruptive noise has yet to reach a crescendo, one thing is clear: Lidl and Aldi are not going away anytime soon. That's great news for the consumer; not so good for the grocers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.