Are you overexposed to markets about to pop?

13th October 2017 13:05

by Kyle Caldwell from interactive investor

Share on

On only two occasions - in 1929 and 1999 - have US stockmarket valuations been more expensive than they are currently on the cyclically adjusted price-to-earnings (Cape) ratio valuation measure, and we all know what happened next on both those occasions.

High US valuations present a conundrum for investors, as the chances are that a US stockmarket correction would spark a so-called domino effect, sending share prices lower across the globe.

Investors might assume that investing in global funds will insulate them pretty well from such an event, given that global managers can go wherever they see fit geographically and are not constrained to one particular market.

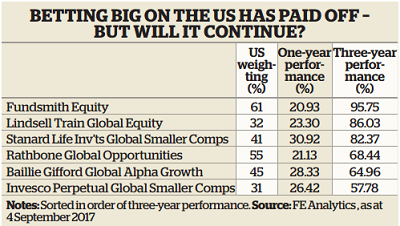

However, a look 'under the bonnets' of global funds reveals that they have meaty weightings to US shares.

Number-crunching by Morningstar for Money Observer found that funds that sit in the Investment Association's global sector have on average 47% of their assets in US shares - more or less in line with the MSCI World Index (53% in the US), a benchmark many funds in the sector pitch themselves against.

According to Neil Jones, an investment manager at wealth manager Hargreave Hale, there's some definite "benchmark awareness" at play, with fund managers knowing that if they bet against the US and lose, they are likely to slip down the performance league tables.

"It's important to know what you are buying before investing in a global fund," says Jones. "There's also an issue of concentration risk for investors who pick a couple of global funds that have half of their portfolios in the US."

Global reach

Against this, fund managers - including James Thomson, manager of the Money Observer Rated Fund Rathbone Global Opportunities (which we feature in our fund focus below) - often make the point that buying US-listed businesses is also an indirect way to gain exposure to strong growth areas in emerging markets, because US businesses frequently operate on a global scale.

Terry Smith, manager of Fundsmith Equity, and Nick Train, another Money Observer Rated Fund manager, share this perspective.

However, when investors seek emerging market exposure in this way, they pay a premium, says Andrew Johnston, a senior investment analyst at fund research house Square Mile.

He adds: "The valuation of the US stockmarket is one of the highest ever, and this is one of our biggest concerns at the moment."

Investors are aware of the risks of putting money into the market when the US stockmarket is trading at a record high.

According to Karel Jacobs, co-managing director at Canter Holland, a financial adviser, it is inevitable that markets will fall out of form at some point.

He says: "I always tell clients to invest for a minimum of three to five years. But today, given how high valuations are, I have been stressing that five years is now the minimum, as I expect a correction to materialise at some point."

Correction caution

Johnston and Jacobs are quick to point out that this does not mean a sell-off is around the corner in the next couple of months or even the next year or two.

Nonetheless, while this is true - stockmarkets can stay overvalued for years and become even more expensive - when valuations are extremely high, risk increases.

Johnston says: "If a company misses a profits target and is on an expensive valuation, it will be severely punished. In addition, given that the US market as a whole is expensive, it is vulnerable if there's a policy error - if interest rates rise too quickly, for example."

There are other concerns. Most worryingly, geopolitical tensions have jumped a couple of points up the risk Richter scale, on the back of North Korea's nuclear weapon threat.

Elsewhere, the so-called reflation trade seems to have stalled, given that US president Donald Trump's infrastructure spending spree - a key reason why US markets rallied after Trump's election win - has not yet materialised.

Not everyone agrees with the consensus view that a correction is on the cards. Alan Steel, who has been a financial adviser for more than 30 years, thinks fear of a correction is an overreaction.

According to Steel, comparing the present valuation of the US stockmarket with past valuations is flawed.

He says: "It's a herd belief that US stocks are expensive and ripe for a fall. But expensive compared with what?

Looking at historical valuations, you are not comparing like with like. For example, it was not until the 1970s that financials were added to the S&P 500. Up until that point, the index was dominated by industrials and utilities. Today the S&P 500 is home to various tech and media stocks, so the index's composition is completely different."

Investors running overweight positions to the US - including Thomson, who has 55% of assets in the country - sit on the same side of the fence. According to Thomson, parts of the US stockmarket do carry sky-high valuations, but he is happy to "pay up for quality growth" in other parts of the market.

He says: "The US market is home to companies that have unique products and services, so it is not unusual for these companies to trade at a premium. However, I think it's wrong to say the whole market is expensive. Growth stocks that have reliable qualities are reasonably priced."

Truly global

Investors looking for a global fund that, geographically speaking, invests more globally than rivals should not make the mistake of completely dismissing a fund that has been a poor performer over the past couple of years.

Jason Hollands at adviser Tilney Bestinvest says: "The chances are that those that have underperformed are not going to have big weightings to the US (an overweight position). In fact, they may be more diversified in terms of countries."

Johnston tips the , because it has a higher weighting than most - currently 21% of assets - to the fast-growing emerging market regions.

He also likes Standard Life Investments Global Smaller Companies, which he describes as a "lower-risk way to gain exposure to the higher risks that come with investing in smaller companies".

Steel, a fan of smaller companies, names Invesco Perpetual Global Smaller Companies as another option. Hollands' choice is Lindsell Train Global Equity, which only has 32% of its assets in the US. The fund focuses on "quality growth companies".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.