Predicting the retail apocalypse

13th October 2017 10:25

by Emil Ahmad from interactive investor

Share on

There is little doubt that the US retail sector is undergoing unprecedented evolution as it tries to find ways to respond to the threat of e-commerce. Of course, by online retailer we really mean , but reports that the US retail sector is about to enter its death throes is pure hyperbole.

The sector is certainly large enough to weather the storm. By virtue of its size alone, it certainly should have time to respond and re-establish its competitive credentials. While it may re-emerge on the other side as a leaner and meaner beast, proponents of retail Darwinism may consider this a good thing.

In simplistic terms, US retail reached saturation point some time ago and e-commerce is arguably accelerating a process that was inevitable. Pessimists will point towards the growing rate of retail company bankruptcies as malls lie half-empty across the country.

However, the US has many times the retail space per capita of other developed nations, created with a different customer in mind; the pre-financial crisis consumer whose spending sprees were fuelled by borrowing against rising house prices.

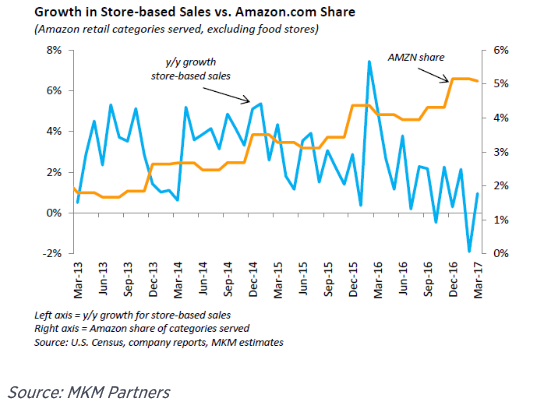

According to recent data from the US Census Bureau, Amazon only accounts for 5% of total retail sales (excluding food). Furthermore, statistics from US Department of Commerce confirm that over 90% of retail sales still take place in traditional 'bricks-and-mortar' stores today.

The challenge for the traditional retailer is arguably how to best leverage this dominant market share and embrace the rise of e-commerce. This process will also involve reassessing archaic business models in order to meet the needs of the modern consumer.

Despite the bears predicting the retail apocalypse, the fundamentals for consumer spending are sound. As this form of consumption accounts for over two-thirds of US economic activity, it is vital to GDP growth. Recent data from the Commerce Department indicates that consumer spending grew at a 3.3% annualised rate in Q2, driving GDP growth to a 3% rate over this three-month period.

The stockmarket has hit record highs in recent weeks and house prices have maintained their upwards trajectory, enhancing household wealth. Admittedly, a greater pick-up in wage growth might be anticipated as the labour market approaches full employment, but these figures and favourable macro backdrop support a retail sector and economy in relatively robust health.

Hurricane Harvey made August a challenging month for the retail sector. The Commerce Department confirmed that in September, overall retail sales fell by 0.2% against an expected 0.1% increase. This 'force majeure' undoubtedly impacted sales of motor vehicles which fell by 1.6% over August, the biggest drop since January.

Conversely, this retail sub-sector is likely to receive a corresponding boost from the replacement of flood-damaged vehicles. Sales of building materials also stand to benefit, as the clean-up process begins in earnest following Harvey and Hurricane Irma.

A question of inflation

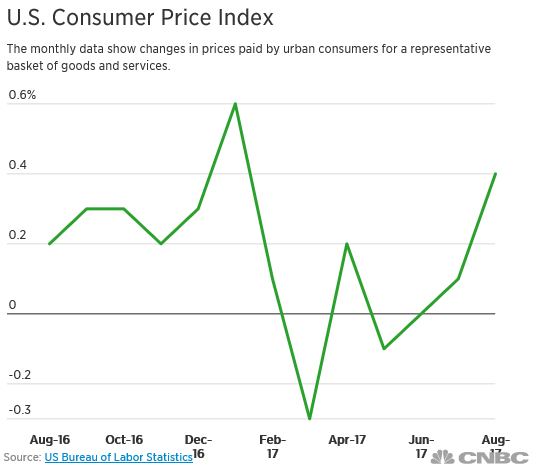

Primarily boosted by rising gasoline prices and rents, the US Consumer Price Index (CPI) rose by 0.4% in August, the largest gain in seven months. The Labor Department confirmed this lifted the CPI to 1.9% in August year-on-year, an increase from July's 1.7% figure. With the Fed tightening monetary, these signs of firming inflation provides further impetus for another rate rise this year.

As a driver of global monetary policy, the rest of the world will be watching closely. As UK inflation nudges 3%, the Bank of England has also become more hawkish of late, with the market pricing in a potential November rate rise.

At the September MPC meeting, Governor Carney noted the Bank was "beginning to shift" on when to raise rates. If the Fed leads the way once again, this shifting opinion could rapidly gain more traction.

Such is Amazon's influence, it would seem that the internet giant's grasp on the economy is all-pervasive. Never mind its unrelenting influence on the retail sector, it has also been responsible for stagnant inflation too. At least, that's the belief of Goldman Sachs' chief economist Jan Hatzius.

And the mystery of persistently low US inflation - below the Fed's 2% target even 10 years after the financial crisis - has puzzled many an economist in recent years.

Hatzius suggests that the "Amazon effect" is the prime culprit, forcing traditional retailers to cut prices rather than raise them as part of "…a desperate bid to stay alive". He further contends that this could equate to a 0.25% drag on core US inflation. Cheap US imports and structural forces in the services sector are also blamed for delaying a return to the Fed's inflation target.

Black Friday and the seasonal surge

As the US retail sector again looks to Black Friday for a catalyst for a festive spending frenzy, the preliminary forecasts are encouraging. Estimates suggest Americans will spend $680 billion over the holiday season, a year-on-year increase of around 4%.

While Black Friday remains the most important single shopping day on the retail calendar, there is evidence that the tide is turning. Seasonal discounts have become more spread out rather than focusing on one flagship day.

Research from PwC reflects this changing consumer dynamic, with only 35% of Thanksgiving week consumers planning to shop solely on Black Friday. This figure has dropped from 51% in 2016, a further decrease on 2015's 59% equivalent. Steven J. Barr, consumer markets leader for PwC, believes that Black Friday has become less important.

"Retailers have conditioned the consumer to believe everything's on sale every day, which means the deals on Black Friday are not significantly different from any other time," noted Barr.

There is also evidence that the novelty of this US import may be wearing thin closer to home. While it has yet to translate to weaker sales, Mintel's Consumer Confidence Tracker points to a degree of UK Black Friday fatigue.

According to their research, 28% of consumers felt the available discounts were not genuine, while 49% spent less on Black Friday than they originally anticipated. Buyers' remorse is hardly a new concept, but a further 34% bought items they subsequently regretted.

Despite the Amazon effect, physical retail's sheer scale will ensure its longevity as a key player in US consumption and economic activity for years. So, the US retail sector will continue to evolve as it responds to the rising challenge of e-commerce. This 'natural selection' will leave a less bloated and more efficient operator in its place.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.