Here's what's behind Carillion surge

24th October 2017 11:58

by Graeme Evans from interactive investor

Share on

Fixing won't be easy - possibly taking as long as five years - but at least the bombed-out construction and outsourcing group has made a start.

The company, whose recovery prospects have divided investors in recent months, has just announced two new lending facilities worth £140 million, plus the sale of some healthcare contracts and the deferral of certain pension contributions.

Given recent standards in this beaten-up sector, an update devoid of further bad news was rightly welcomed as shares jumped as much as 20% at the open to its highest this month.

Interim chief executive and former boss at highly-regarded engineer Weir, Keith Cochrane, said there had been "progress on a number of fronts" and that customers and creditors were still supportive.

But having recently recorded a £1.2 billion loss on the back of construction deals gone bad, no-one is questioning his view that "there remains much to be done". Priorities, we're told, include further disposals, major cost savings and more detailed discussions with lenders on shoring up the company's balance sheet.

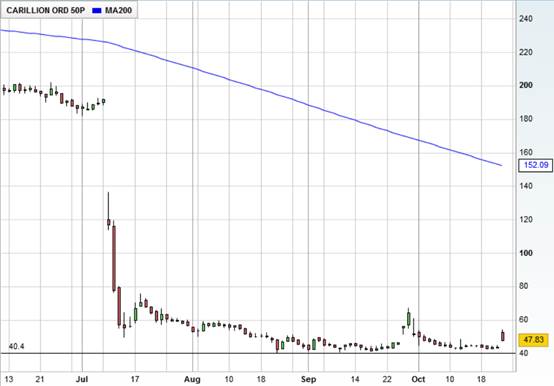

With this in mind, the early morning rally to 54.5p was scant consolation for shareholders, having seen the stock dive from 190p in early July to just 40p in August. The price has bounced along sideways ever since and its market cap is little more than £200 million.

Net debt is expected to be in the region of £850 million in this financial year, we hear, prompting the need to raise £300 million from asset disposals and to address the company's pension obligations. A rights issue is another potential option.

In a recent note, Investec Securities analyst Chris Moore warned that "risk still outweighs reward" with Carillion.

He said: "At a minimum, Carillion needs to execute on its £300 million disposal plan and raise around £450 million of equity to repair the balance sheet, in our view.

"However, this will be challenging given the current market cap, and the risk of further write-downs, with gross receivables and payables c.40% above the sector average".

One of the biggest positives in today's trading update comes from the fact that Carillion continues to win new contracts, including a £105 million joint venture deal to build premium residential apartments at Dubai Creek Harbour.

These operations in the Middle East have raised hopes in some quarters that a bidder from the region might be waiting in the wings.

Carillion, which is still underpinned by an order book worth £2.6 billion, confirmed today it intends to sell the remaining contracts in its UK healthcare facilities management portfolio during 2018.

This comes after signing a deal worth £50.1 million with rival for certain operations. It is also continuing to pursue the disposal of its Canadian businesses.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.