Three funds to play the UK

25th October 2017 09:44

by Dzmitry Lipski from interactive investor

Share on

Third-quarter GDP data has done nothing to dampen expectations that UK interest rates will rise next week. Despite political uncertainty post June's snap general election and tortuous Brexit negotiations, the UK economy has continued to grow and unemployment has fallen to 4.3%, the lowest since 1975. But there are serious concerns.

Growth has slowed to just 0.2% in Q1 this year and then 0.3% in the three months to June. Inflation is rising at an annual rate of around 3%, yet wages are increasing by only 2.1%, meaning that many households are worse off.

On top, the Bank of England may increase borrowing costs to control inflation. Investors are concerned that as inflation continues to rise and rates increase, real disposable incomes will come under pressure, despite a resilient jobs market.

Against such a challenging backdrop, UK equities still made strong gains and reached record highs this year. Due to its international nature, the UK equities markets benefited from weaker sterling, supportive monetary policy from central banks and improving global economic backdrop.

UK equities offer a dividend yield of around 4% which is very attractive relative to other developed equity markets and relative to government bonds that pay only 1.3%.

While UK equities appear neither cheap nor expensive relative to their historic valuations, they still offer good value relative to US stocks. And, if earnings improve, those valuations might become even more attractive for investors.

It's widely believed that UK earnings have plenty of room for recovery after their poor performance in recent years. As commodity prices have recovered from their lows, earnings expectations have improved. UK equities also stand to benefit more than most other developed markets from any further improvement in commodity prices.

Choosing the right exposure

The , tracks the biggest companies listed in the UK, including such global names as , , , and . The index generates almost 70% of its revenues from overseas. The mid-cap has a larger exposure to the domestic UK economy and includes companies such as , Poundland, and .

A fall in the pound should favour internationally exposed large-cap equities, whereas a rise in the pound should favour smaller, more domestically-focused stocks. For example, last year when sterling collapsed on the back of Brexit vote, the FTSE 100 outperformed FTSE 250 by almost three times.

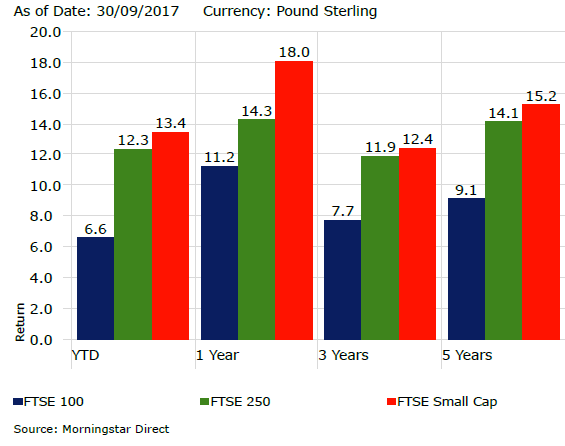

Mid and small-cap equities have strongly outperformed large-cap equities since the financial crisis, but could be more at risk if the UK economy slows further as Brexit negotiations drag on. This outperformance is mainly attributed to the fact that smaller equities are typically under-researched, underinvested, and less efficient than the market for large caps and, therefore, could yield superior returns over the longer term.

In contrast, the FTSE 100 - the largest and most liquid index - tends to be less volatile than smaller UK indices. The index performance has been dragged by its heavy weighting in oil and gas, mining and resources companies that have struggled over the recent years against a backdrop of falling commodity prices and slowing growth in China.

The index of larger companies tends to perform better during deteriorating economic conditions, periods of fear, and times of rising risk aversion such as Brexit last year.

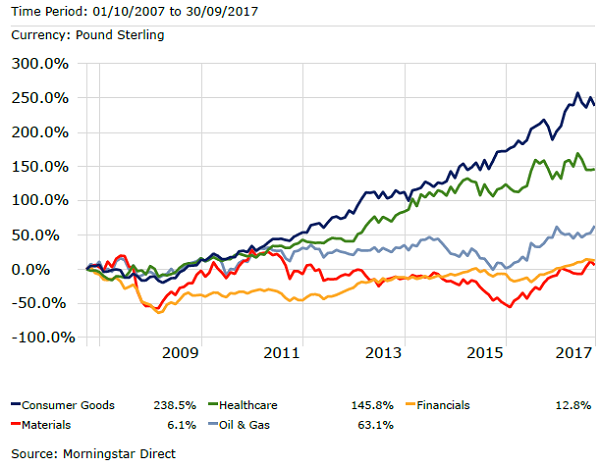

The performance of the headline UK indices fail to tell the full story; the performance of the sectors reveal far more. The search for yield and safety in the low interest rate and volatile market environment has led to increased demand for high-yielding defensive growth equities, with consumer goods and healthcare perceived as a safe bet.

As a result, valuations in these sectors are looking stretched, which makes them vulnerable to any potential interest rate raises creating 'bond proxy paradox'. In contrast, sectors such as financials, energy and materials have been out of favour since the financial crisis, but are expected to benefit from a recovery in commodity prices and higher interest rates.

Money Observer Rated Funds for UK equity exposure

invests in a portfolio of UK equities and aims to add value over the investment cycle through a concentrated, high-conviction portfolio invested primarily in large-cap companies.

Slater Growth fund invests in a concentrated portfolio of UK companies which the manager believes to be attractively priced and exhibit superior, sustainable growth potential. The fund is invested primarily in small and mid-cap companies.

Liontrust UK Smaller Companies fund invests in a portfolio of UK smaller companies with intellectual property that will enable them to deliver sustained above average profitability.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.