The fatal flaw of 'buy and hold' investing

7th November 2017 11:07

by Douglas Chadwick from interactive investor

Share on

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At the end of the day, what fundamentally moves prices in the stockmarket is not news, or sentiment, or good or bad economic data, or even interest rates; it's money flow.

Prices rise when money flows into an asset class. They go down when money flows out. We believe the trick to being a successful investor is to be able to follow this movement in a timely fashion.

This is called 'trend investing', or 'momentum investing', and it is the opposite of what the financial services industry advocates for the private investor.

It would rather you were a low-maintenance investor using the 'buy and hold' approach. In other words, that you buy stocks or funds and hold onto them for years, irrespective of what the market does, trusting that you will come out on top over the long term.

But does that make sense? Here's a graph showing the up until the beginning of this year.

If you were looking for capital gains, and holding investments that generally followed the markets, then that is 17 years of going nowhere.

This is the one fatal flaw of the 'buy and hold' approach. You never know when the next big crash could wipe out years of hard-earned gains.

You will also miss out on some fantastic opportunities to make money. New companies and technologies come along, whilst old ones fade away. New sectors and regions come into favour, whilst established ones stagnate.

The finance services industry has three main objections to trend investing, and all of them are wrong.

Objection 1

It says that private investors cannot time the market. This is probably true if your decisions are based on hopes, fears and hunches.

However, if you are using up-to-date performance numbers and graphs, then trends become obvious and decisions are straightforward. Here are some examples from the last couple of years.

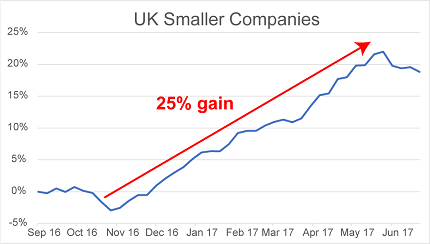

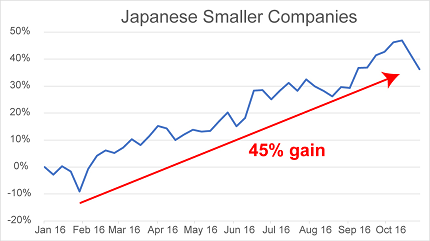

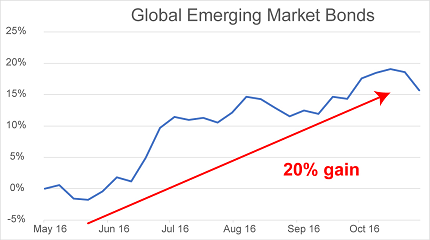

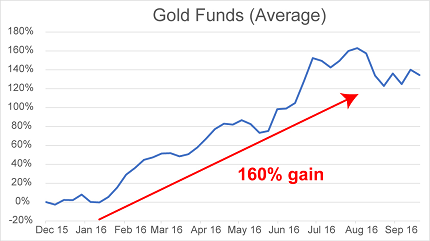

You can see from the graphs that the UK Smaller Companies sector went up 25% in seven months; Japanese Small Companies went up by 45% in eight months - Global Emerging Bonds went up by 20% in seven months - Gold funds went up 160 % in nine months.

It is not necessary to time the market exactly, but simply to re-act to the numbers. You will not actually achieve the percentages shown above because there is the delay in entering the sector on the up, and the delay in leaving on the way down, but you can see that significant gains were to be made as the sectors surged upwards.

Objection 2

It says that frequently changing funds to catch the latest trends is costly and your gains will be eaten up by trading fees. Again, this is simply not true. The arrival of fund supermarket platforms has reduced the cost of trading to close to zero and RDR has also reduced the management costs.

Objection 3

It says that trend Investing is too difficult and time-consuming for ordinary investors to follow successfully. Well, that dog is not going to hunt either. Certainly, if you do not want to give up any time at all, or if you prefer to have one meeting a year with an expensive financial adviser, then trend investing is not going to work for you.

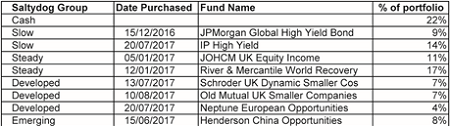

Conversely you could look at the Saltydog Investor system and use the weekly information that we produce on fund and sector performances. This only involves minimal work once a week, which could hardly be described as time-consuming.

There are also many financial publications and websites that provide the basic information on funds which would allow an individual to create their own system.

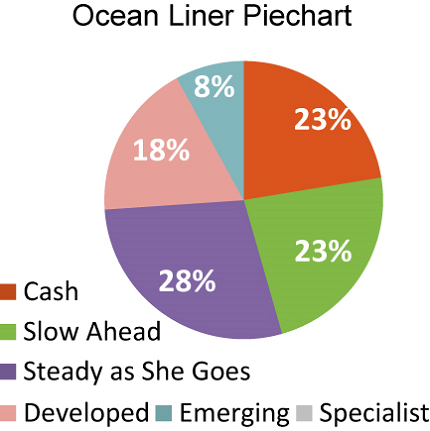

Using funds for trend Investing has a number of advantages. First, they provide exposure to all markets and all sectors across the globe, allowing you to take advantage of uptrends wherever they occur.

Secondly, they spread your risk across a range of different companies within one sector, meaning that your portfolio isn't dramatically affected if one particular company gets into trouble.

Finally, you get smart people with research teams doing the stock-picking for you, meaning that you don't have to be an expert in individual companies; this removes the time-consuming accusation.

Two other simple rules to follow

Don't use fund managers by reputation and hype. Use them when their investment style is working.

Don't fall in love with your funds. Stick to the facts and regularly review the funds you are invested in.

It was Voltaire who said: "Doubt is an uncomfortable position, but certainty is a ridiculous one." This is surely a good reflection on the difference between a proactive trend-follower and a "one shot takes all" buy and hold investor.

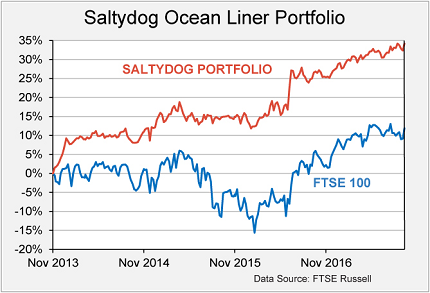

Since launching in November 2013 our demonstration portfolio, the Ocean Liner, has gone up by 34%, and it is up more than 16% in the last 18 months.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.