Why 7,900 is important for FTSE 100

6th November 2017 09:19

by Alistair Strang from Trends and Targets

Share on

Created 5/11/2017 at 22:35

FTSE this week & the BITCOIN Event (FTSE:UKX)

It's only fitting we should be writing this rant on 5th November, a date the UK sadly commemorates the failure of some bloke in bringing justice to politics. In the case of bitcoin, it feels like the fellow in North Korea needs have a word with whoever is mangling the rate between the pretend currency and the US dollar.

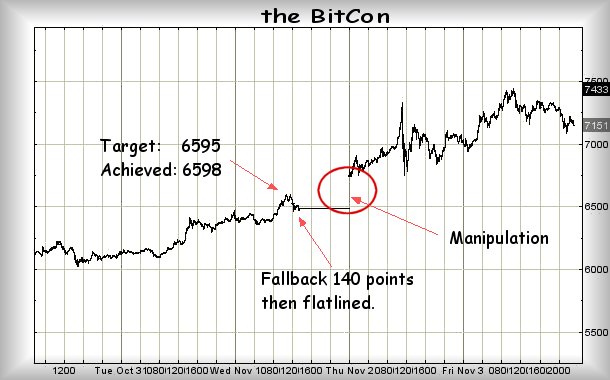

Our fury is due to our previous article which postulated bitcoin starting to behave like a "proper" currency, this due to us being able to calculate $6,595 as its high potential. We literally ran out of numbers beyond such a point.

In the event, on 1st November the BTC:USD pairing achieved $6,598 points, close enough to our maximum target level for a dislocated shoulder due to a self-congratulatory pat on the back.

What happened next shocked us, almost making trades against silver appear ethical.

The pairing retreated from our "maximum high" by around 140 points. This pretty effectively proved our calculations and Bitcoin was - finally - behaving logically. But the next day left us aghast.

As the chart below shows, the relationship with the USD was manipulated higher, once again launching the pretend currency into "bubble" territory where we cannot calculate highs, making the prospect of disaster increasingly likely.

Bitcoin is now on our naughty step. Our suspicion is it was manipulated upward, due to a very real terror of a fall without a parachute. This particular movement now makes such a scenario very possible.

Sour grapes? Us? Perhaps not. There's a reason some SB companies do not carry bitcoin and the lack of logic may be something to do with their decision.

The FTSE this week (FTSE:UKX)

The index has managed to close higher than ever before, forcing us to concede it's on an immediate path toward 7,635 points initially. Secondary, if bettered, is at 7,680 points. To cancel this prospect on the immediate growth cycle, the requires slither below 7,480 points currently - the red line on the chart.

It's also worth mentioning for those who recall our last Big Picture report we now regard the long-term influence on the FTSE as coming from 7,900 points.

We're aware the FTSE did not reach our 7,584 on Friday, topping out at 7,580. While this perhaps indicates weakness, visually it remains strong with us not inclined to panic unless the FTSE makes it below 7,480 as an initial 7,460 makes sense. Secondary, if broken, comes along around 7,420 points.

Of course, just 'cos something has achieved a new Higher High does not mean it will now go straight up. Rarely is this the case as generally some dramatics come first.

From a very near-term perspective, the threat is of below 7,540 bringing a drop to a useless 7,525 points. The danger obviously comes if 7,525 breaks as there's a danger of 7,507 making an appearance.

None of these numbers are particularly scary, only serving to give a sense of any weakness becoming apparent in the week ahead.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, Shareprice, or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.