10 top shares with the magic formula

8th November 2017 13:44

by Ben Hobson from Stockopedia

Share on

Every so often we talk in this column about an investment strategy developed a few years ago by an American fund manager called Joel Greenblatt. It's called the 'Magic Formula' and it's an intriguing strategy for a few reasons, not least because it's a useful barometer of the market mood.

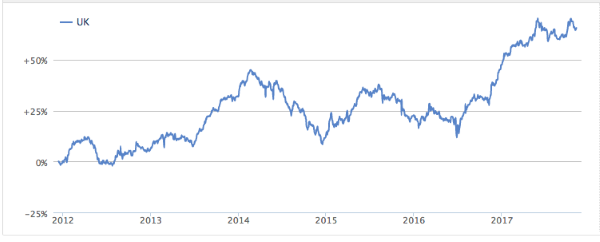

The ups and downs of the Magic Formula are often a good reflection of how well 'value investing' is working in the market at any time. A look back over the past few years shows that high ranking Magic Formula portfolios performed very well through 2012 and 2013, but did badly in 2014. Then 2015 got off to a strong start before the strategy fell out of favour again.

This is very much what Greenblatt said would happen to the strategy when he wrote about it in "The Little Book That Beats the Market". In essence, it looks for good quality, cheaply priced shares. But there are times when cheap value shares just aren't popular in the market - no matter how good they are.

So how has the strategy performed more recently? Well, after hitting a low shortly after the EU referendum in June 2016, it has been absolutely flying. A version of Greenblatt's approach tracked by Stockopedia has seen a 28.3% return over the past year. That's well ahead of the 20% gain seen on the FTSE SmallCap index over the same period.

This is a very encouraging sign for investors seeking good stocks that are attractively priced. It shows that even in bullish markets when growth stocks are the main focus of many, you can still get a value strategy to work well, especially when you combine it with 'quality'.

A primer on the Magic Formula

Greenblatt's strategy uses just two simple ratios: the earnings yield as a measure of 'cheapness' and return on capital as a measure of 'quality'.

Earnings yield tells you how much profit a company is making in relation to its underlying value. To take account of varying levels of cash and debt in companies, a widely used way of working it out is to divide what the company earns in operating profit by its total valuation (known as the enterprise value). You can then apply this earnings yield to every company in the market to see which are offering the best value – the higher the yield, the cheaper the company.

Next, the return on capital focuses on how good a company is at generating a profit from the investment it makes in itself. Good quality companies are very efficient at delivering high percentage returns from the cash they reinvest to grow. It might be opening new stores, expanding product lines or buying new plant and equipment. The return on capital is the percentage improvement in profits relative to that investment. That makes it a leading indicator of good quality companies that can grow profitably.

The strategy scores every company on each ratio and then adds the scores together to get a Magic Formula for each one. The beauty of this approach is that you can rank the market for companies with the best blend of cheapness and quality and always find results.

Ranking the market

To get an idea of the kinds of companies with high Magic Formula scores right now, we've reproduced the current list. The table includes Greenblatt's Magic Formula expressed as a more understandable percentile ranking where zero is worst and 100 is best.

| Name | Mkt Cap £m | Magic Formula Rank % | Return on Capital % (Greenblatt) | Earnings Yield % | Sector |

|---|---|---|---|---|---|

| STM | 31.4 | 99.2 | 387.9 | 34.5 | Industrials |

| Sportech | 194 | 99.2 | 203.6 | 58.6 | Cyclicals |

| LSL Property Services | 246.1 | 99.0 | 213.8 | 25.3 | Financials |

| System1 | 51.4 | 98.3 | 125.7 | 15.2 | Cyclicals |

| Character | 86.8 | 98.3 | 94.1 | 16.3 | Cyclicals |

| Wincanton | 327 | 98.2 | 91.8 | 15.9 | Industrials |

| SCS | 70.4 | 98.1 | 50.2 | 32.6 | Cyclicals |

| PayPoint | 619 | 98.0 | 246.8 | 12.0 | Industrials |

| Hogg Robinson | 258.2 | 98.0 | 78.4 | 16.3 | Industrials |

| Indivior | 2,747 | 97.9 | 272.7 | 11.5 | Healthcare |

Striking a balance between quality and value

This approach gravitates towards smaller stocks, with companies like financial services firm , marketing consultancy , toy group and furniture retailer all with market-caps well below £100 million. But larger companies, such as the drugs group , can also rank well against Greenblatt's metrics.

It's essential to bear in mind that Magic Formula stocks have sometimes encountered problems. They may have hit temporary setbacks and unsettled the market, or they may be facing more structural challenges. The idea is that their quality can often help them recover from these issues.

It's very much this balancing act that means the Magic Formula has periods of success punctuated by spells of underperformance. The recent strong run is a reminder why this strategy is so popular and why a combination of quality and value can be a very powerful way of achieving outperformance in the stockmarket.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

Interactive Investor readers can enjoy a completely FREE 14-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.