UK dividends lead the world in Q3

21st November 2017 12:46

by Tom Bailey from interactive investor

Share on

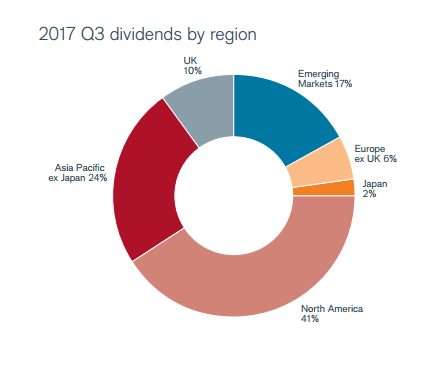

Global dividend payments surged by 14.5% to $328.1 billion in the third quarter of 2017, according to the latest global dividend update from Janus Henderson.

This was the fastest-growing headline figure in three years and a record for total dividend payments.

Headline dividend payout figures were boosted by several generous special dividend payouts, most notably from the company . With a special dividend payout of $8.4 billion, China Mobile delivered the largest single payout in the world in Q3 of this year.

However, underlying dividend growth (ignoring special dividends) was still high at 8.4%, the fastest growth in almost two years.

This continued underlying growth, Janus Henderson suggests, "testifies to the strength of the global economy and its impact on corporate profitability."

On the back of these figures, forecasts for 2017 dividends have been upgraded to a record $1.249 trillion, an increase of 7.4% in headline terms and 7.3% in underlying terms.

North America

Global dividends were once again dominated by North America, with the region accounting for $4 out of every $10 paid out globally. US dividends grew by 9.2% on a year-on-year basis, with underlying growth of 7.2%.

While every sector in the US increased payouts, aerospace and defence sector saw the fastest growth, in large part due to a special dividend from manufacturer Transdigm.

Banks also saw strong dividend growth, up 20% year-on-year, with the largest increases coming from Bank of America and . Transport, real estate and software also saw double-digit growth.

The UK and Europe

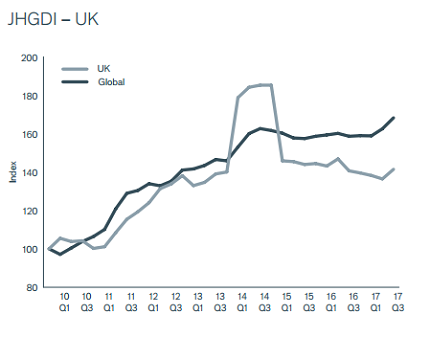

The UK saw the fastest underlying growth rate of dividends in the world in Q3, with a jump of 17.5%.

UK dividend growth had previously struggled, Janus Henderson notes, "owing to the devaluation of sterling following the Brexit vote, and to a wave of dividend cuts and cancellations from some of the UK's largest listed companies, particularly in the mining sector."

However, it continues: "with the anniversary of the pound's decline now behind us, it is no longer acting as a drag on headline growth in dollar terms."

At the same time, rising commodity prices have given a boost to mining firms: "Dividends from the sector surged as a result, and at a greater rate than investors anticipated."

, for instance, doubled its payout, while tripled its dividend on a year-on-year basis.

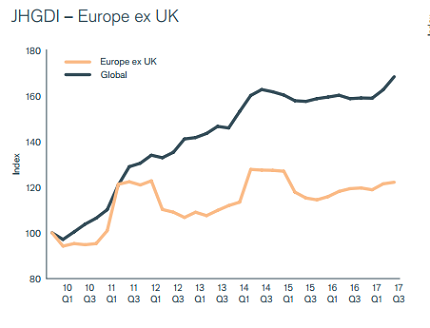

Continental Europe's dividend growth rate was smaller than the global average. However, Q3 is usually a quiet time for dividends in Europe, with most firms making a single annual payout between April and June.

The continent still saw respectable growth in the third quarter, with headline growth at 7.8% and underlying growth hitting 4.6%.

Spain, a country which sees less dividend seasonality than others on the continent, showed strong growth with an underlying rate of 13.3%, with and oil company Repsol issuing the largest increases.

French marketing and communications group also stood out, raising its payout by 15.6% in euro terms (translating even higher in dollars due to favourable exchange rate).

The Netherlands saw a 13.3% decline in its headline figure, but, notes Janus Henderson, "only because did not repeat the large special paid ahead of their merger last year.'

It adds: "All other Dutch companies in our index increased their distributions, extending the solid performance from the Netherlands in recent periods".

Asia Pacific

The third quarter is a usually a bumper time for Asian Pacific dividend growth. Q3 of 2017 was no different. Headline growth was 36.2%, while underlying growth was a solid 12.1%.

China Mobile accounted for almost half of the regions headline increases and three quarters of Hong Kong's due to its huge $8.4 billion special payout. This one-off payment, alongside a special dividend from Utility Power Assets, gave Hong Kong a headline growth rate of 82.7%. Underlying growth was more modest at 6.3%.

Australia saw its payouts jump to a record $22.8 billion, a headline growth figure of 17%. This was due to the strength of the Australian dollar, as well as to the payouts from utility company AGL and real estate firm Goodman, both strong performers.

Australia was also helped by the upswing in fortunes for mining companies as commodity prices continue to trend upward. When it comes to other sectors, Australia companies performed less well, with bank dividend growth particularly slow.

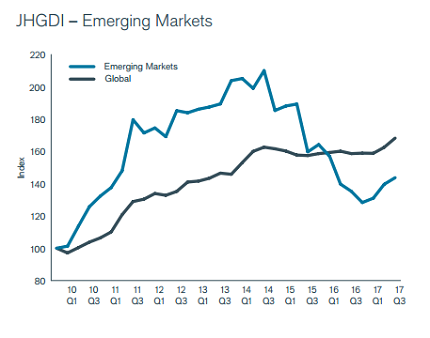

Emerging markets

China looks on track for a third consecutive year of dividend growth declines in 2017, after previous years of solid growth. Year-on-year, dividend payouts fell by 0.2% in Q3 of this year.

Bank dividends fell by 2.2%, with every bank except for China Merchants paying out less than in 2016. Oversupply in China's electricity market saw profits decline in sector and dividends following suit. Elsewhere, other sectors were flat.

China makes up half of all emerging market dividends in Q3, meaning its poor performance has acted as a general drag on EM dividend payouts. However, Russia and Brazil, of the back of commodity price rises, have seen strong dividend growth. Russian dividends rose by 11.9% and Brazil's by 9.9%. India's dividends rose by 9.4%.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.