Our top 10 fund tips from 2017

11th December 2017 12:40

by Holly Black from interactive investor

Share on

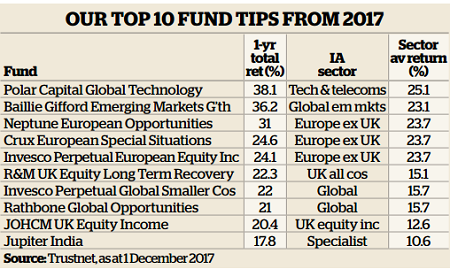

Our fund experts were faced with a tough challenge in January 2017: picking out funds that would outperform in a year of great uncertainty.

Against a backdrop of Brexit negotiations still in their infancy and a new US president in place, we tasked the professionals with finding investments that would prosper.

Let's look at how their favourite funds fared.

was tipped for its concentrated approach and ability to pick out undervalued companies.The fund was up 21.5% in 2017 (to 29 November), compared with the Investment Association (IA) global sector average of 13.1%.

The fund's performance benefited from manager James Thomson's preference for US markets, where 55% of the portfolio is invested. Big-name US tech firms, such as and , saw their share prices soar as the stockmarket hit repeated record highs over the year.

Thomson largely steered clear of emerging markets. Chinese internet giant was the fund's only holding in Asia Pacific.

Sweet spots

The strongest performer among our experts' tips was , which delivered a return of 42.6% in 2017, compared with the IA sector average of 26.2%. Polar Capital says strong fundamentals and ongoing disruption of their industries by technology companies continued to drive outperformance.

While cyclical sectors such as technology can be volatile, Polar Capital's impressive run has seen it outperform its peers for several years.

The infrastructure sector has been a favourite of income-seeking investors in recent years, with a government spending splurge contributing to the steady yields these assets produce.

Hard on its heels, was tipped for its consistent track record, despite a performance blip in 2016.The fund returned to form in 2017 to produce a chunky return of 41.4% over the year, compared with the IA sector average of 23.7%.

Richard Sneller, manager of the fund, says the diversity of the portfolio - which includes ecommerce in China, banking in Brazil and tech in Taiwan - contributed to outperformance.

In contrast, a value investment style helped the deliver a 19.7% return in 2017, compared with the IA Europe ex UK sector average of 17.5%.

Our experts predicted the fund would perform if the cyclical industries it favours recovered, and that's what happened.

Neptune says contrarian investments in the consumer discretionary, financials and materials sectors helped boost performance.Holdings in car exporters , , and also improved, as the strength of the euro eased off.

An underweight position in underperforming US small-caps helped deliver top-quartile performance in 2017. The fund returned 17.1%, thanks to strong stock selection. Fund manager Nick Mustoe says investments in Europe, Japan and Asia boosted returns.

Defensive lapse

As always, there were underperformers scattered among the tips, in some cases reflecting the nature of an asset class or fund philosophy.

, another constituent of the IA global sector, had been a leader in its field, but in 2017 its return of 8.7% lagged its global sector peers.

The fund invests in firms that own or operate assets such as toll roads, airports and railways. It still yields a reasonable 3.2%, but Peter Meany, head of global infrastructure securities at the firm, says such defensive assets tend to lag in sharply rising markets.

In the IA flexible investment sector, returned just 3.7%. The fund was tipped for its ability to deliver capital appreciation with low volatility and good track record in falling markets.But as global stockmarkets continuing to climb in 2017, the fund struggled. The management team says performance was held back by the portfolio's high liquidity.

Meanwhile, currency decisions led to a loss of 1.8% for the , compared with the average return of 4% among its peers.

Manager Jim Leaviss reduced his exposure to the dollar at the end of 2016 after strong gains, but the greenback continued to appreciate against sterling into 2017.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.