Is bull market cheerleading just hot air?

13th December 2017 11:10

by Andrew Pitts from interactive investor

Share on

A government in chaos that lurches from one crisis to another, shedding cabinet ministers on the way; Brexit negotiations stalled and with it the growing prospect of a disorderly exit from the EU; and a resurgent and demonstrably anti-capitalist Labour party growing in confidence in parliament, and in popularity with the voting public too.

From an investor's perspective, what's not to dislike about it all? Yet the UK stockmarket soldiers on, inured to mounting pressures on the UK's corporate and economic prospects and the shambles that is the UK government today.

Five months on from the 8 June general election, the stocks that most represent the current and future health of quoted UK companies are actually doing rather well.

Forging ahead

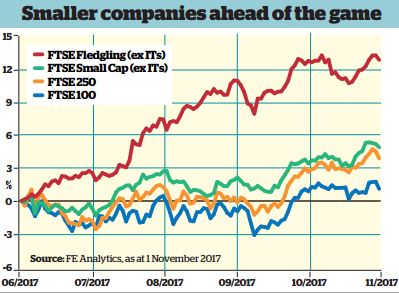

The of medium-sized companies has risen nearly 4%, trouncing the 1.1% gain from the globally focused .

Smaller companies have also continued their post-Brexit vote bounce. Since the June election, stocks in the FTSE Small Cap index have gained an aggregate 5%, while those in the FTSE Fledgling index have soared by nearly 13%.

The comparative weakness of the FTSE 100 can be largely explained by the strength of sterling throughout much of this year, particularly against the dollar and to a lesser extent the euro.

Whereas the post-EU referendum slide in sterling immediately buoyed the Footsie (because overseas earnings were immediately worth more when translated back into sterling), this year's reversal in sterling's fortunes has acted as a drag on the multinational Footsie, where two-thirds of revenues are derived from overseas.

Sterling's strength, driven by rampant consumer spending and high inflation (which currency traders correctly assumed would lead the Bank of England (BoE) to act by raising interest rates to 0.5% in early November), has not persisted.

It was a classic case of buy the rumour and sell the fact. The pound fell immediately after the rate rise was announced, for the bank's monetary policy committee made it clear that its gloomy Brexit prognosis meant the rise in no way heralded a more hawkish stance. Savers will be lucky to see just one further rate rise in 2018, and there currently seems to be no reason to expect rates to exceed 1% in 2019.

On the one hand, such an outcome will be some comfort to companies exposed to discretionary spending habits, because debt repayment burdens will not become overly onerous. But on the other, gathering thunderclouds are already starting to rain on this particular parade.

Retailing bellwethers such as and have recently reported weak revenue numbers, while October's car sales plummeted by 12% year on year, marking the seventh consecutive month of declines. The Society of Motor Manufacturers and Traders blamed declining business and consumer confidence for the slump in sales.

People are worried. Even the most ardent pro-Brexit investor would surely acknowledge that, politically and economically, the medium-term outlook looms pretty grim for UK plc.

In the microcosm of London the outlook is even worse than for the wider UK economy. Here the financial services industry has played a starring role in boosting the wealth of property-owners and developers, which trickles down to higher discretionary spending on luxury goods and pursuits.

But when Goldman Sachs boss Lloyd Blankfein uncharacteristically takes to Twitter to state he is looking forward to spending more time in Frankfurt, Londoners, in particular, should prick up their ears.

Whatever the outcome of the Brexit end-game, big global banks are already planning to move some operations and staff from London to the eurozone or elsewhere.

Banks, along with big global corporations with operations in the UK, are not going to place their post-Brexit business planning on hold indefinitely.

The BoE is assuming that a no-deal Brexit would result in 10,000 job losses in financial services, although deputy governor Sam Woods has acknowledged that a loss of 75,000 jobs cited in a recent report by consultancy Oliver Wyman is 'plausible'.

Daunting prospect

That 75,000 estimate looks even more plausible in a post-Brexit landscape that could also feature a new Labour government.

Global banks will be waving bye-bye to London if Labour makes good on its 2017 election manifesto pledge to raise close to £5 billion a year by expanding the stamp duty regime to derivatives and bond trading (it currently applies just to equities).

Some commentators reckon that a high degree of pessimism on the UK's prospects is already baked into share prices, particularly among domestically focused stocks.

Woodford Investment Management, which has commissioned a report on the economic consequences and impact of Brexit from the respected consultancy Capital Economics, is among this group.

The reassuring conclusions, which cover most potential outcomes for the post-Brexit landscape, were good fodder for the current investment strategy pursued by the funds Woodford runs. But it is interesting that nowhere does the report mention a prospective Labour government blowing many of its conclusions out of the water.

On a blog that accompanied the report, the Woodford team says: "It reinforces our confidence that the portfolios are positioned appropriately for the long-term outcomes that are forecast." It adds that the report indicates that "even in the event of no deal, the long-term prospects for the UK economy are nowhere near as bleak as many have predicted".

It is possible the report's findings will sway the opinions of Twitter followers of @woodfordfunds, nearly 42,000 of whom responded to a Brexit impact poll it conducted in early November. The question "What will Brexit mean for the UK economy in the long run?" yielded the following results:

45% – We're facing a cliff-edge

21% – Slightly worse off

13% – Slightly better off

21% – It's great news all round

The firm states: "This negative consensual view is reflected in the UK stockmarket, helping forge a compelling investment opportunity in domestically focused stocks, which the funds are positioned to exploit. The Capital Economics report, which explores the key debates in detail, provides considerable grounds for optimism that the long-term outcomes for the UK economy will be far better than the alarmed consensus would suggest."

I disagree. The performance of stocks this year suggests the 'negative consensual view' is not reflected in the stockmarket, which has been doing well. If anything, the market has been ignoring the negative consensus.

Misplaced certainty

No one can say with certainty that the negative consensus will prove wrong. The shambolic state of the government and its parlous Brexit negotiating position suggests the worried people are right. What's more, an opinion from a consultancy headed by Roger Bootle, an avowed pro-Brexiter, may have an element of confirmation bias baked in.

Investors in the Woodford funds, the recent performance of which has disappointed, should remember that they pay the firm to take a view on where to invest their money. They must hope that when it comes to post-EU Britain, and the government in charge of it, that this turns out to be the correct and, ultimately, profitable view.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.