Saltydog: How I am preparing for a market correction

18th December 2017 13:55

by Douglas Chadwick from interactive investor

Share on

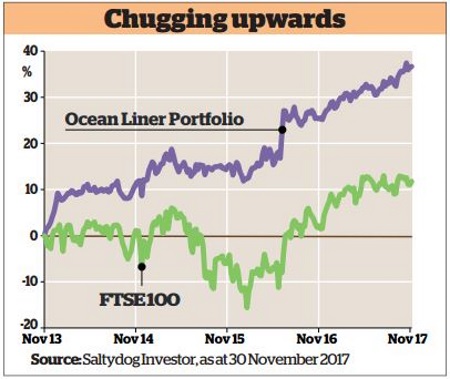

As I write this article, many stockmarkets from all over the world are at, or close to, recent all-time highs. The Saltydog Tugboat and Ocean Liner portfolios are in a similar wonderful position, as I am sure are many people's investments.

However, the financial press is in full destructive voice, warning of the imminent bursting of bond bubbles and a catastrophic political and banking-led collapse comparable with 2008.

So what do you do? If you are a passive investor, then when the storm strikes you will simply sit it out and wait for the weather to improve and hopefully let the future recover your losses.

Don't want to sit it out

If, like me, you are a more active investor, this approach is unacceptable. I do not want to lose substantial recent gains by sitting on my hands and doing nothing, but when to take action is the question. It is not wise to try and time the market.

No one can accurately predict the future and it is not sensible to listen to those who say they can.

For example, in the past three months, whilst the broadsheets have been preaching gloom, doom and apocalypse, the technology and emerging market sectors (in China in particular) have been making double-figure gains.

If you had been out of these particular markets, you would have lost out!

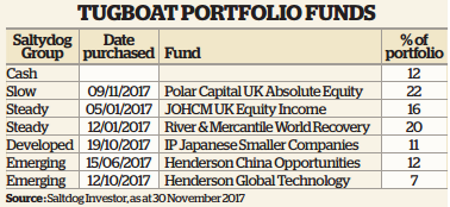

This is not to say that one should not make a partial exit. The Saltydog numbers are currently showing that the sterling high yield and other bond fund prices are starting to fall back.

Over the past few years these sectors have been attractive for growth, as yields have fallen from double figures to very low single figures.

This could now be due for a reversal. Interest rates are starting to rise, and high-risk bonds are finding it difficult to find a home. Whatever the cause, our numbers are saying watch out. With this in mind, we have started to take action and to exit these sectors.

Holding more cash, or at least rebalancing your portfolio, cannot hurt at the moment. Also, should there be a correction, do not forget the simple arithmetic of the before and after.

A third of your holding in cash today will become a half if the market subsequently halves.

Should this collapse happen, then that cash will be a useful cushion with which to buy back into the market after the panic is over.

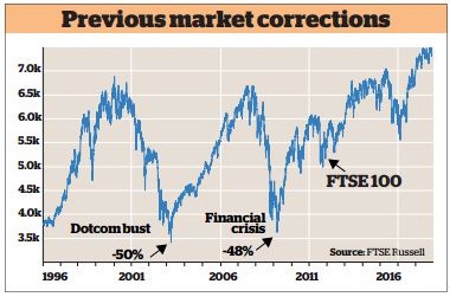

Looking at the graph above, it can be seen that sizeable market corrections occur at regular intervals, and therefore it is not unreasonable to expect another one soon. This is not rocket science; it is simply the way the mop flops.

Therefore, it becomes a question of how much notice we are going to get to avoid falling off this potential cliff.

It's worth noting that in the past these falls were not always precipitous, and in the case of the 2008 financial crisis they took place over many months.

Prior to the infamous crash, the reached a high in June 2007.

Three months later there was the run on the Northern Rock bank, and five months after that it was nationalised.

It was a year after the trouble at Northern Rock that Lehman Brothers filed for chapter 11 bankruptcy, and at that point the FTSE 100 index had dropped from over 6,730 to around 5,000. It was almost six months later that the market finally bottomed out at just over 3,500.

A collapse such as that should give those investors who are observant time to exit to a safe haven whilst the carnage takes place. I hope to be one of those investors sheltering my money as the storm passes over, ready to re-invest and hopefully produce the pot of gold at the end of the rainbow.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.