Bitcoin futures trade at $20,000-plus

18th December 2017 13:58

by Gary McFarlane from interactive investor

Share on

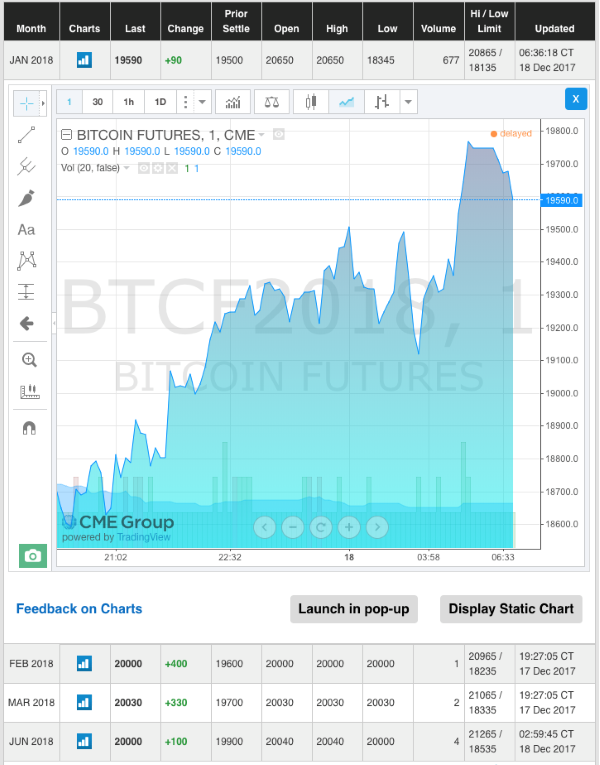

CME bitcoin futures began trading on Sunday and quickly straddled $20,000, although the price has rolled back from those highs to around $19,560 this morning. The CME price is currently $150 above that quoted by its cross-town Chicago rival CBOE. The CME is the largest derivatives exchange in the world, dwarfing the CBOE.

Depending where you look, the bitcoin spot price either breached $20,000, according to Coinmarketcap.com, or hovered just below $20,000 at $19,810 on the Coinbase exchange, in the hours before trading began on the CME.

Two things stand out in comparison with last week's CBOE launch. Firstly, the disparity in spot and futures price was about half that seen on the CBOE. Secondly, and perhaps most importantly, there was no 20% price rally. In fact, the price opened at $20,650 and then promptly fell almost 4%.

Other differences in the two products are apparent in where they get their price. The CBOE relies on just one exchange, Gemini. In contrast, CME Group uses several exchanges for its Bitcoin Reference Rate, including Kraken, Bitstamp, GDAX and itBit.

The introduction of futures trading is expected to hasten bitcoin's mainstream adoption because it means that financial institution can gain exposure because futures are regulated while the underlying asset, bitcoin, is not.

US retail broker TDAmeritrade said on Friday it would allow some of its clients to access the CBOE product. According to Bloomberg, another broker, ETrade, may also soon be offering bitcoin futures, according to its sources.

Trading firms and investment banks are taking a prudent approach to the futures products because of bitcoin's volatility. Interactive Brokers was insisting on margin deposits for short selling of 240% and Goldman Sachs was said to be requiring 100% collateral against the value of trades.

Interactive Brokers in a statement said it was responsible for just over half of all business in the CME bitcoin futures contracts on Sunday. Volumes on the January contract were relatively thin at 677 at the time of writing.

Swiss bank UBS has again warned of the dangers of investing in bitcoin, with chairman Axel Weber stating: "we do not assess it to be valuable or sustainable".

Smaller Swiss bank Swissquote is altogether more positive, looking to a near-term high for bitcoin of $25,000. "A correction is due at some point, but within the next few years it should easily reach $100,000," said Yann Quelenn, an analyst at the online bank.

Elsewhere, Sopnendu Mohanty from Singapore's Monetary authority was scathing about the cryptocurrency, if a little ignorant. "Bitcoin has no natural intrinsic value. Can you buy a house with it? Can you use it for daily interactions? It may be valued at $18,000 right now but what I want to know is how you convert it into fiat currency and realize that value. The risk comes at the moment of conversion,"

Mohanty is on stronger ground regarding valuation metrics, but investors can convert crypto holdings into fiat currency at any one of many exchanges. Perhaps something has been lost in translation and what he really meant to draw attention to was what happens when everybody tries to convert to fiat at the same time.

You can certainly buy property with bitcoin. For example, you can buy a property at 4 Stanley Gardens in west London on a bitcoin-only basis.

The property is being sold by London Wall Private Office. Co-founder Lev Loginov says his company has been contacted by around 20 potential buyers "and with a few of them we are in serious talks. Lawyers already instructed".

Although unable to reveal to interactive investor the identity of prospective buyers, Loginov observed: "I don't think that anyone who has contacted us is older than 30 and yet they have been able to make fortunes in cryptocurrency". And those fortunes "allow them to shop around for an £18 million holiday home in the UK", he continues.

Other bitcoin millionaires looking to realise their new-found wealth have turned to start-ups such as SALT, that allow investors sitting on large paper profits to access loans, using their crypto as collateral. SALT is the 42nd ranked coin by market capitalisation and is currently trading at an all-time high of $10.49.

Altcoins across the board continue to see record highs, with Neo, the Chinese blockchain platform, up 40% in the past 24 hours, to $80 and Qtum, which offers a way of speeding up transactions on the Ethereum blockchain, 81% higher at $52.

The overall market capitalisation of the cryptocurrency space is now valued at $598 billion, according to Coinmarktcap.com.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.