2018 ISA fund tips: Three ways to profit from emerging markets

17th January 2018 10:23

by Marina Gerner from interactive investor

Share on

The 'emerging markets' moniker may be considered too broad for the set of disparate and complex countries it covers.

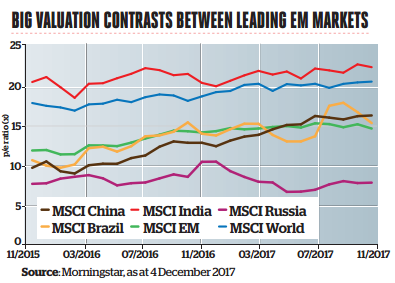

However, Dan Kemp, chief investment officer at Morningstar Investment Management EMEA, points out that, viewed through a country focused lens, the lower returns that can be expected at the global emerging market level are primarily the result of relatively high equity prices in countries such as China.

In contrast, he adds: "Russian equities appear attractively priced, with an implied real return approximately five times higher than China."

Healthy climate

"The global economy, bolstered by continued non-inflationary US and European recoveries, looks set to continue growing into next year," says Gary Greenberg, head of emerging markets at Hermes.

This means the environment for emerging markets is healthy at present. "In emerging markets themselves, current accounts, inflation and growth are generally supportive," he adds.

Greenberg points out that foreign indebtedness makes Turkey and South Africa particularly vulnerable, but most emerging markets have built strong defences against foreign rate rises and investor panics.

Will Landers, manager of , says that for people looking for interesting options beyond Asia in emerging markets, Brazil stands out. "Brazil is coming out of recession, and the government is making the reforms necessary for growth."

Bryony Deuchars, an emerging markets fund manager at Aviva Investors, says the rise of Chinese internet companies this year "has been stellar, to say the least, with the likes of and seeing their stock prices rise by more than 100 %".

She adds: "Their combined market capitalisation is now more than $1 trillion [£745 billion)." But she cautions that repeating this performance will not be easy. "Against the back drop of slower Chinese growth and lofty valuations in certain segments of the market, there is considerable uncertainty around the outlook for emerging markets."

Greenberg also remains cautious. He says that although the current situation "is about as calm as emerging markets get, a shock from the developed world would be felt in emerging markets as well".

Risks include rising US rates and the possibility of military conflicts in the Korean peninsula and Taiwan. "The ability of markets to shrug off politics will be tested, especially given the unpredictability in Washington," he adds.

This is why he looks at 2018 under a variety of scenarios, some of which could see current bullishness reverse.

"But as a base case, mild interest rate hikes by the US Federal Reserve and the gradual unwinding of its balance sheet does no more than put clouds on the horizon in an otherwise sunny landscape. It will be important to test the wind frequently."

The improving global economic outlook is also encouraging for emerging bond markets. According to Claudia Calich, manager of the , as emerging market credit ratings actions tend to correlate with growth rates. "Typically, severe recessions lead to downgrading by the credit rating agencies, while strengthening economic activity tends to stabilise these ratings actions," she says.

Note of caution

But Calich, too, cautions that potential risks, including higher US interest rates, need to be monitored closely.

However, she adds: "For a number of emerging market economies, the higher US interest rate environment is less challenging than it would have been a few years ago."

Kemp concludes that investing in emerging markets can result in high volatility and long periods of underperformance.

He says: "The greatest challenge when investing in emerging markets is therefore not doing the analysis required to find the most attractive parts of the universe, but deploying the discipline to implement your results."

Emerging market trust and fund tips

(adventurous growth)

TR 1 year 36.2%, 3 years 57.7%, yield 0.6%

This fund was tipped last year, and buyers have been rewarded as it has returned 36% on a one-year view, comfortably ahead of the average emerging market fund return of 22%. Brian Dennehy thinks there’s more to come in 2018. But with a third of the fund’s money in China, bearish investors may be wary of this fund .

(adventurous growth)

TR 1 year17.1%, 3 years 28.9%, yield 1.7%

The fund is described by Broomer as "an attractive option for investors who are seeking a well-run fund with a sensible approach to investing in the region". James Donald and his team seek to invest in financially productive businesses or companies where financial profitability is improving.

(core growth)

SPTR 1 year 37.1%, 3 years 38.9%, discount -9.9%, yield 1.1%

TEMIT has picked up impressively since Carlos Hardenberg moved up to lead manager in October 2015. Peter Hewitt says he is making good use of Templeton's considerable research facilities, and the portfolio now has a broader global spread and a more attractive sectoral mix.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.