Don't write off big-spending Treatt

26th January 2018 17:15

by Richard Beddard from interactive investor

Share on

Keeping staff happy trumps return on capital

Friday 26th January is Annual General meeting. Because of the warmth with which shareholders are received and the sharp citrus smell of its distillery, it's one of my favourite AGM's. Regrettably, I can't be there this year to hear about the latest developments in the flavourings business.

For a modest sized company, Treatt attracts large numbers of shareholders to meetings, which is perhaps why this year it's moved the AGM from its cramped HQ to a venue in the centre of Bury St Edmunds, Treatt's hometown. I hope, once Treatt has relocated to its new 21st century HQ, a few miles down the road from the current one, they relocate the AGM so we can admire the new facilities and see how the money was spent.

Today, most of my thoughts are about the huge injection of capital. I have already made my mind up about the business and its management. The business is being transformed by managers that have so far demonstrated all the right instincts.

I can't remember ever owning shares in a company that has invested such a large amount of money as Treatt plans to in capital expenditure over the next few years. I can't remember ever having invested in a company that has had to ask shareholders for money to move premises. Companies do, I'm sure, but I favour those that grow incrementally, rather than in great leaps. I'm scared by the amounts Treatt is committing, because I'm not used to it, and it could all go wrong (I suppose).

Treatt's investing £45 million, mostly in Bury St Edmunds, but also in its Florida subsidiary. To put that in perspective, in 2016, the year before Treatt bought the land for its new HQ, it required less than £50 million capital to operate. The new investment will cost many times more money than Treatt earns in profit. In the year to September 2017, it made a record £11 million in adjusted profit after tax, on revenue of £110 million.

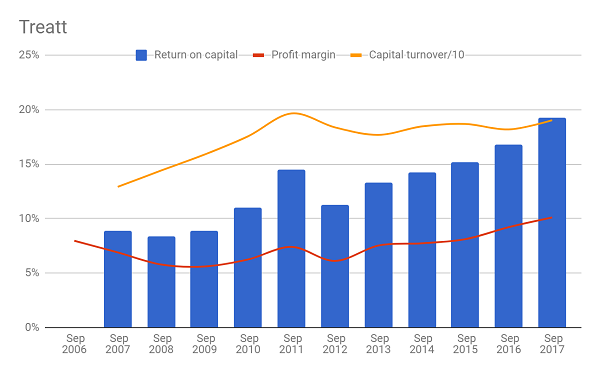

Capital, the amount invested in tangible assets like distilleries, laboratories, warehouses, vehicles and stock, is a slippery number. But since my enthusiasm for Treatt is partly justified by its record of increasing return on capital, and since Treatt is adding a great dollop of capital to the denominator of the return on capital calculation, it requires some scrutiny. Other things being equal, a large hike in capital means a commensurate fall in return on capital.

Other things aren't, of course, equal. The whole point of investing in new facilities is to increase the numerator, return, or profit over the long-term. Treatt's new headquarters will not just be able to process more citrus oil, it will be able to do it more efficiently. Today, forklifts navigate public roads to move product between five buildings. In a year or two there will only be one building.

New laboratories will allow Treatt's flavourists to collaborate with colleagues from beverage manufacturers, the likes of and , although Treatt won't name names, to produce innovative ingredients that enhance the flavour of their drinks. I'm not exaggerating when I say I've seen larger secondary school laboratories than Treatt's improvised laboratory in its current location.

These customers are relatively new, and they have sophisticated requirements. Technical ingredients, designed to capture the essence of freshly brewed tea, or remove the bitter aftertaste of sweetners, are more profitable than Treatt's staple business, selling processed citrus oils to flavour houses, intermediaries between processors like Treatt and beverage companies.

Since the corridors at Treatt's current HQ are not wide enough for two people to pass comfortably, it's not hard to brush shoulders with staff. Perhaps they will be the main beneficiaries of the new site, which will provide ample space to work together. As well as visiting Treatt for AGMs, a year ago I accompanied its chief executive to what was then the Suffolk Chamber of Commerce's best ever attended event. There he talked about employee engagement. "It's not going to cost you money," he said to the gathering of business people, "It's going to make you money."

His next words, I think will define where you stand on the huge investment the company is making. He said: "If you concentrate on the numbers in the business, nothing changes. Concentrate on the staff and everything changes".

This is me now, although I guess it could be him too: Employees are a company. They're the people that innovate. They're the people that treat customers well or badly. They're the people that help each other, or work in silos. It stands to reason that if you mobilise all employees around a strategy, it's more likely to succeed.

If I had not, sometimes literally, rubbed shoulders with Treatt staff, I might have dismissed Reeve's words as trite management guff and the company's ambition to build what will surely be the closest thing Bury St Edmunds will have to the Googleplex as a vanity project.

Treatt's annual report also puts staff front and centre. As usual, losing key staff is identified as a risk but, in mitigation, the company talks first about "securing an emotional attachment to the business" as well as appropriate pay. All staff receive free shares as a bonus and the company will give them a free share for every share they buy up to predetermined limits. Treatt's "cultural strategy" is integral to its corporate strategy, not a codicil in small print appended to the report. It emphasises training and development.

Glassdoor is a website where staff anonymously rate and review their employers. The number of staff who have left reviews of Treatt is not great, about 20, and most of the reviews have been posted in the last two months, so maybe they were orchestrated. Every staff member who has left a review recommends the company and its chief executive. The reviews mention good pay, benefits, and opportunities, a flexible and progressive culture, and social activities.

More interesting is the absence of employees with axes to grind. There's one, who has good things to say too, and still rates the company 4/5. In my experience, disgruntled employees and ex-employees frequently unburden themselves on Glassdoor.

Although the numbers in the accounts are not the means to improve the business, they show things are changing at Treatt. As Reeve said to those Suffolk businessmen: "Discretionary effort is making our returns". Here is the impact on return on capital:

My instincts about the company put me in a difficult position. If I were investing purely by the numbers, I might be a seller, despite increasing profitability and the acceleration of growth.

For a start, a small proportion of the growth in profitability has come from savings Treatt's made by not upgrading the aging equipment in its current site, pending the move. Also, enthusiasm has put a rocket under the share price. At 435p, it values the enterprise at £260 million or about 24 times adjusted profit, which is by no means cheap. While I expect revenue and profit to continue growing, I also expect return on capital to decline, for a few years at least, because Treatt won't grow fast enough to compensate for the sudden increase in capital. The company will be more indebted, because it's also borrowing to fund the investment plans.

But a new HQ is a long-term investment, and although the facts and impressions I've gathered aren't as definitive as the numbers in the accounts, they could be far more telling.

I believe Treatt is changing for the better, and this unprecedented injection of capital is, in terms of its dramatic size, a one-off. As the Treatt of the future generates more profit from high value flavourings, its reliance on processing a bulk commodity will be reduced, and so will its thirst for capital, which is not just tied up in machinery but also large stocks.

I'm not a seller. And these thoughts make me wonder about the other companies I'm shunning because the numbers, and particularly their valuations right now, don't look compelling.

If I knew them, like I think I know Treatt, perhaps they would be.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.