How our Winter Portfolios keep beating the market

9th February 2018 16:36

by Lee Wild from interactive investor

Share on

There's a theme developing with our winter portfolios. Now in their fourth year, another tricky start to the period has been followed by a Santa Rally, and now gains have been topped up by a great start to the calendar year.

Clearly, both of our portfolios have not been immune from the impact of the recent stockmarket crash, but there is evidence in January's performance that suggests this year's constituents have what it takes to bounce back.

That, of course, is why they make it into the portfolios in the first place. Historic data proves that equity markets typically outperform over the six winter months from November to April. With help from Stock Market Almanac author and mathematician Stephen Eckett we identified the stocks with the best track record of returns over the past 10 winters.

Our so-called Consistent Winter Portfolio contains the five most reliable FTSE 350 companies of the past decade – each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Our reliable basket of shares has netted an average annual profit of 18% over the past 10 years versus just 3.5% for the FTSE 350 index. There's more risk in the aggressive portfolio, but average annual profit here has been 32%, almost 10 times the benchmark index.

A month of two halves

Events during December – US tax reform and a rare success in Brexit negotiations – teed markets up nicely for January. The FTSE 100 added almost 100 points during the first half of the month, making a record high at 7,792.

Unfortunately, the threat of inflation in the US, driven by higher-than-expected wages growth and the tax boost to company profits, caused markets to factor in a faster-than-predicted increase in US interest rates. The subsequent rise in bond yields triggered the rout in equity markets.

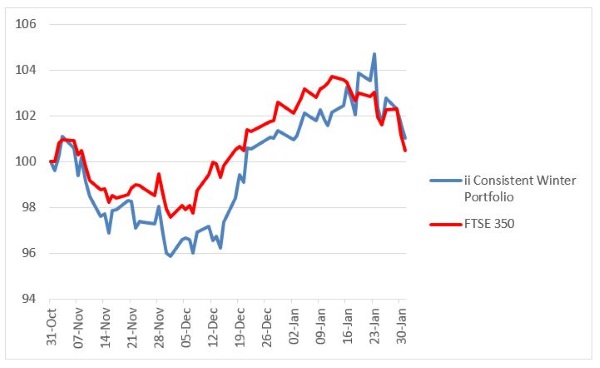

If you'd have stopped the clock on 23 January, our Consistent Winter portfolio would have shown a return for the period since end-October of 4.7% versus 3% for the FTSE 350 benchmark index. The Aggressive Winter Portfolio was up over 8%.

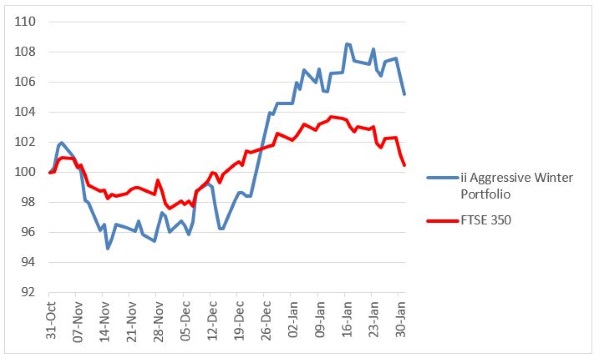

But the clock kept ticking, and so the consistent basket of shares fell 0.3% in January, while the aggressive basket made a 0.6% profit. The FTSE 350 fell 2.1%. Now, three months in to this six-month seasonal strategy, our portfolios are up 1% and 5.2% respectively versus the benchmark up just 0.5%.

Aggressive Winter Portfolio

After a period of steadily rising markets, volatility is back, clearly evidenced in January's performance by the five constituents of the Aggressive Winter Portfolio.

Best of the bunch this time was , up 8.9% in one month. We always get excited about the tracksuits-to-trainers chain's Christmas update, and this year did not disappoint.

As is typical for JD, business was great over Christmas, triggering a round of profit upgrades in the City. Analysts at Cantor Fitzgerald believe the forward valuation multiples does not "fully capture the earnings momentum or the global growth potential of the business". It's why the think the shares could be worth 525p.

Equipment rental giant did well, too, up 5.7% in January. Sunbelt, its US arm, makes most of the firm's profit, and it's expected Donald Trump's tax reform will provide a 5% boost to underlying earnings per share in 2018. In 2019, its first full year, it'll be 16%.

Workspace provider added more than 3% as discussions with Brookfield Asset Management and Onex Corporation about a possible bid for the UK firm were given the green light to extend in to February. Those talks have since been called off, but the subsequent drop in share price will only show up in February's stats.

and , both exposed to the UK building sector, struggled, down 7.7% and 6.8% respectively.

Hearing reports that UK house prices are falling, investors sitting on massive profits from the rebound since the EU referendum result, are selling housebuilders' shares. No extension to 'Help to Buy', rising costs and a wave of substantial share sales by directors have counted against the sector.

Consistent Winter Portfolio

This is the consistent portfolio, but performance during January was mixed. Tipping the basket of shares into negative territory was catering colossus following the death of chief executive Richard Cousins in a plane accident in Australia. Compass shares fell 7%.

Irish building materials firm felt the chill of a rising pound. The company, which does a chunk of its business in the US, benefits from a stronger dollar, so a surge of as much as 5% to $1.43 was bad news for overseas earners. Even our star performer – up 13% this portfolio - was flat in January.

On a brighter note, heat treatment specialist kept rising, up 6% last month after a 5% uptick in December. We're told Trump's tax cuts will add 5p to earnings per share in 2017, and that trading in the final quarter of 2017 was better than anticipated.

added 1.4%. It's our most reliable stock, having risen in each of the past 13 winters! Shares in the speciality chemicals company are now up over 7% since this year's portfolios began.

Stephen Eckett

Stephen Eckett started his career with Baring Securities and then later worked for Bankers Trust and SG Warburg, during which time he worked in London, Hong Kong and Tokyo. After settling in France, he co-founded Harriman House which has become a leading independent publisher of financial books in the UK. He also writes books on finance including, most recently, the Harriman Stock Market Almanac.

----------------------------------------------------------------------------------------------------------------

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.