Why bitcoin and cryptos are surging again

15th February 2018 12:24

by Gary McFarlane from interactive investor

Share on

After stalling at around $8,500 and having difficulty breaching resistance at $9,000, bitcoin (BTC) has now surmounted that test to trade sharply higher at $9,700, up 15% in the past week, according to US exchange Coinbase.

Fears about the impact of a looming clampdown by regulators around the world on the cryptocurrency sector are clearly dissipating.

As was seen in previous regulatory tightening phases, the fears, first greeted by selling, come to be reinterpreted as positive developments for a maturing marketplace that needs to broaden its base of investors, as it seeks to attract mainstream retail investors and institutional buyers.

With bitcoin now poised to break through the $10,000 mark, it should be noted that the price move is on relatively low volumes, and there may be resistance forming ahead. On 15 February, global trading volume was 52,509 BTC, according to research site cryptocompare.com. That compares with 495,883 and 271,450 on the 6th and 7th February, respectively.

Cryptocurrencies are trading higher across the board, with total market capitalisation standing at $464 billion. Bitcoin dominance (the proportion of the total capitalisation its value represents) has crept up slightly in recent days to 35.2%, according to coinmarketcap.com.

Litecoin on a roll

Bitcoin aside, it is Litecoin that is leaving other coins in the shade. It is up 52% over the past week, with most of that price gain taking place over the past two days, reaching a high of $235, although it is currently priced at $220 on popular altcoin exchange Binance.

Several factors seem to be behind the surge - payments solution LitePay getting nearer to coming out of beta, a looming fork called Litecoin Cash and the coin's growing popularity on the dark web.

The Litecoin Cash fork is controversial. Litecoin, in itself a fork from bitcoin, differs from bitcoin in its use of a hashing algorithm called scrypt as opposed to SHA-256. Suffice to say, scrypt is easier to mine and the reasons or benefits from this fork changing to SHA-256 are not clear, although the Litecoin Cash website claims its intention is to bring old legacy bitcoin mining gear back on stream. The new coin will also have a supply of 840 million which is 10 times that of Litecoin.

The other factor supporting Litecoin may be its increased popularity with criminals operating on the dark web. The dark web refers to websites that can only be accessed by using the Tor software that anonymises web browsing. A report by cyber threat intelligence and analysis group Recorded Future details the findings of research conducted since 2016, showing an ongoing shift away from bitcoin to other crypto, notably Litecoin, but also Dash and Monero.

The transaction times on the congested bitcoin blockchain partly explain the trend, as does the stronger privacy features of coins such as Monero. The cost of transactions is also a possible concern for those involved in illicit activities, but more so for illegal marketplaces and not so much for money launderers transacting with large sums.

In other coin and token news, Ripple inked a deal with UAE-based remittance and payments company UAE Exchange and, separately, money transfer behemoth Western Union revealed it's currently trialling Ripple's blockchain-based solutions.

Ripple is also working with the Saudi Arabia central bank on blockchain solutions for cross-border payments between the regional banks. The UAE news earlier this week had helped to push the price of Ripple's XRP token back above a dollar to currently trade at $1.12, despite the fact that the deals don't necessarily involve the companies concerned using the token to fuel transactions.

Ethereum Classic has seen a bump this week and, again, the reasons for that rise are not readily apparent. Trading above $34, a 30% leap from $21 on 11 February, Ethereum Classic has been receiving vocal support from Barry Siebert, the entrepreneur behind the Grayscale Bitcoin Investment Trust and the Digital Currency Group which owns CoinDesk and has a stake in Coinbase.

Ethereum Classic is sometimes called the "original Ethereum" because its codebase is the version of Ethereum that existed before the hack of The DAO in May 2016, one of the first projects to raise money through a token offering on the platform. Ethereum's software has to be tweaked in order to recover the lost ether. Those nodes that refused to update stayed on the original codebase.

ECB's Draghi says won't regulate

As we previously reported, US Congressional hearings turned out to be fairly positive for crypto, and that has probably helped sentiment.

The European Central Bank (ECB) is the latest institution to pass judgement on crypto, and market participants will have been pleased with what they heard, although president Mario Draghi dismissed the notion that bitcoin was a currency, citing its lack of a backer, no protection for users and volatility.

However, crypto followers will be somewhat blasé about those criticisms and were likely more interested in any suggestions that the ECB might intervene to regulate cryptocurrencies. On that score Draghi was markedly hands off.

Asked whether the ECB was going to regulate bitcoin, the central bank president left no room for misinterpretation. "Many of you posted questions about whether the ECB is going to ban bitcoins or it's going to regulate bitcoins," said Draghi. "I have to say it's not the ECB's responsibility to do that."

Following from reports of informal discussions at the World Economic Forum in Davos, central bankers are expected to openly address the question of how to deal with the new asset class when they gather in Buenos Aires for the G20 meeting of political and financial representatives of the major economic powers in March.

On the question of the blockchain - the distributed ledger technology that underlies bitcoin and other cryptocurrencies - Draghi said it was "quite promising", with potentially "many benefits".

The world's major central banks have all been testing blockchain technology. Draghi continued: "We're very interested in this technology but it's still not secure for central banking and therefore we need to look through it and investigate it more."

JPMorgan thinks crypto is here to stay but won't overthrow fiat

JPMorgan, the US investment bank whose chief executive Jamie Dimon famously described bitcoin as a fraud, has taken a positive line on crypto, in contract to its peers who are uniformly sceptical on whether crypto is anew asset class or a passing speculative fad.

The main takeaway from the 71-page in-depth report produced by JPMorgan analysts, is the observation that, far from the sector value collapsing to zero,crypto is here to stay:

"[cryptocurrencies] are unlikely to disappear completely and could easily survive in varying forms and shapes among players who desire greater decentralization, peer-to-peer networks and anonymity, even as the latter is under threat".

The bank's report balanced that conclusion with a more doubtful stance on the possibility of bitcoin or any other crypto contender challenging the monopoly of central bank money issuers, stating:

"It will be extremely hard for [cryptocurrencies] to displace and compete with government-issued currencies, as dollars to euros and yuan are virtual natural monopolies in their regions and will not easily give up their seigniorage profits [typically, derived from the difference between production cost and face value of fiat]."

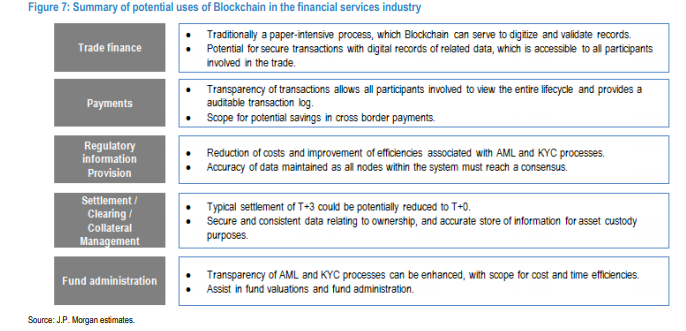

In common with others in the financial services sector, JPMorgan sees value in blockchain technology and produced a useful slide highlighting the benefits in cutting costs and increasing efficiency.

JPMorgan has its own blockchain platform called Quorum, and news emerged this month that the South African central bank will begin proof-of-concept trials on it in order to gain a deeper understanding of decentralised ledger technology.

Microsoft to use public blockchain for decentralised IDs

In a further sign of the interest in blockchain moving from prototypes to real products, tech giant Microsoft announced that it was looking to develop decentralised ID systems in its products and hopes to use public blockchains such as bitcoin, Litecoin and Ethereum's, to implement it. Microsoft engineers say in the blog, announcing the news that they would be using Layer 2 solutions to overcome scaling issues. Layer 2 solutions move many transactions off the chain and recording them to the chain less often, as the Lightning Network does for bitcoin.

On Lightning, CoinDesk reported this week there are now at least four other high-profile cryptocurrencies that are planning to implement Lightning or are trialling it. The four are Litecoin, Ethereum, Zcash and Ripple.

We haven't heard much about bitcoin futures recently, but US ratings agency Moody's said in a report on Wednesday that fears the instrument might destabilise the financial system were overdone. "So far Bitcoin futures volumes have been low, but CME and Cboe hope to tap into the investment community's interest in the underlying asset. Bitcoin prices have been highly volatile, but we don't expect this market risk to materially affect CME's or Cboe's creditworthiness given the small volumes involved and strong risk management at the central counterparty clearing houses (CCPs)," it stated in an 11-page analysis of the impact of bitcoin futures.

However, if futures trading volumes rise Moody's may wish to revisit that conclusion.

In related news, the US Commodity Futures Trading Commission, which oversees the futures markets, is setting up two sub-committees of its Technology Advisory Committee to assess issues surrounding cryptocurrencies and blockchain tech.

Wallet wars

A war seems to have broken out at popular web-based Ethereum wallet MyEtherWallet, which, among other things, is used for sending ether funds to initial coin offering contribution wallets, as well as to store Ethereum-compliant tokens.

Taylor Monahan, co-developer of MEW, as it is affectionately known in the community, has left to build an alternative product called MyCrypto. The new wallet will be going into public beta soon. The other MEW developer, known as Kvhnuke, remains in control of MEW's digital assets such as github repository and website, according to Monahan.

The surprise announcement from Monahan initially set off panic in the community until the situation became a little clearer, although there has been no official comment from Kvhnuke about what the developments may for the future of MEW.

The goings on at MEW will likely help to speed the adoption of hardware wallets such as Nano Ledger and Trezor, although the former had to admit earlier this month that there was a "theoretical" vulnerability in its code that meant users should always double-check wallet addresses.

Known as a "man-in-the-middle" exploit, the vulnerability and necessary countermeasures are detailed in a Nano Ledger blog. Nano Ledger has updated its software to force users to check the receive addresses shown by the device is correct.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.