How this asset manager's preparing for larger correction

21st February 2018 10:29

by Holly Black from interactive investor

Share on

Asset manager Mike Deverell tells Holly Black how he plans to preserve gains ahead of a larger stockmarket correction.

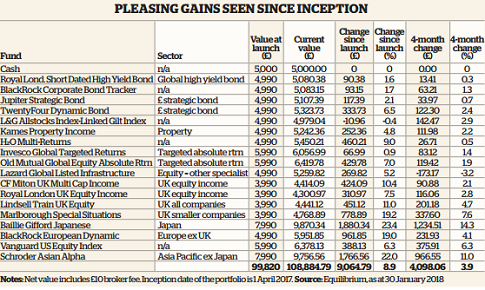

Ten months after inception, our long-term growth portfolio is up almost 9% (to end January). Mike Deverell of Equilibrium Asset Management has positioned the portfolio more cautiously than he usually would to conform with a growth remit, but a stellar run for global stockmarkets has driven strong gains.

He says: "It has been a phenomenal time for investing. But it does feel a bit too good to continue; you can't expect this momentum to keep up after such a strong run."

has been the standout performer since our previous update in November, up 14.3% over the past four months alone and up 23.4% since the portfolio launched in April. Close behind it is the , which has gained 11% over the past four months and 22% since inception.

"Asian and Japanese economies have been doing fantastically well, and the bonus of investing when we did is that these markets were cheaper than, say, the US," says Deverell. He thinks that as the US stockmarket continued to rise, investors were taking profits and looking for alternative markets in which to deploy the resulting cash, which helped drive Asian markets higher.

The Baillie Gifford Japanese fund was already the largest holding in the portfolio, but it now accounts for almost 10% of assets, so Deverell may take some profit from the fund at the next update. For now, though, he thinks Japan funds have further to go.

Indeed, it's the UK that is his main concern for the coming months. Rising inflation, problematic Brexit negotiations and expensive share valuations mean he is not positive about companies. "I'm usually a fan of mixing active funds with trackers in a portfolio, but I did not include a FTSE tracker this time because I'm concerned that a lot of the stocks are at high valuations," he says.

The decision to back smaller-cap companies instead seems to have paid off, with and up 19.2% and 10.4% respectively since the portfolio's inception. However, he may reconsider this approach at the next update.

Deverell says: "I also want to reduce exposure to the US from around 6% of assets to 4%, as the stockmarket there has been doing very well for a very long time. I will reshape this portfolio in line with the way the investment environment is changing." He may channel assets into an India fund to try to capture some of the growth potential of the country's burgeoning economy.

The only fund in the red since the last update is , an alternative income play that he says initially did "better than we ever expected" but has now faltered. Deverell thinks the fund has been hit by investors taking profits. It's also possible that the collapse of Carillion and subsequent profit warning from have spooked infrastructure sector investors.

Infrastructure investments may have further to fall, he warns. With inflation and interest rate hikes making a bond sell-off more likely, Deverell believes income-paying 'bond proxy' investments could get caught up in the fallout.

That said, he thinks having alternative assets in a portfolio is the key to withstanding a stockmarket correction, so the Lazard fund will be retained for now. He adds: "You've got to remember this is supposed to be a defensive position, but it gained 9% in just six months, so even if it has fallen back since, it has still done pretty well."

Other alternative investments such as , and are also being retained. Deverell thinks exposure to assets with lower correlations to equities will be beneficial as central banks wind up their monetary stimulus programmes. He says: "It's a hard time to be an investor. The traditional asset mix of equities and bonds just isn't going to work at the moment. Both are expensive and interlinked, and that's why you need lots of alternatives in your portfolio."

Growth remit

Deverell has fulfilled his remit also to capture long-term growth opportunities: has delivered a 19% gain since the launch of the portfolio in April. A strong rally in continental Europe was due, he says, after years of Europe being out of favour with investors. The BlackRock fund's assets are spread across French, German and Swiss companies. Top holdings include life sciences group Lonza, chemical company Sika and luxury brands firm .

Just one fund has strayed into the red since inception: the . It will only come into its own if UK inflation starts climbing. When the stockmarket soars, as it has, gilts tend to lag.

Some 5% of the portfolio is still sitting in cash, but Deverell is willing to wait for the right time to put this capital to work. The stockmarket suffered a small setback at the end of January, but he is looking for a larger correction before he uses the cash to top up holdings or buy new ones.

For now, his priority is finding the right balance between capturing gains and building in protection in the event of a fall, and between taking advantage of rising equity markets and diversifying into alternative assets. He says: "We have tried to dial down risk in this portfolio, so to have still achieved a 9% gain since launch is great. But I'm worried about equities and bonds. The market has to turn at some point, and hopefully that will be when some of our holdings come into their own."

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.