The best and worst FTSE 100 shares to own this tax year

29th March 2018 19:04

by Graeme Evans from interactive investor

Share on

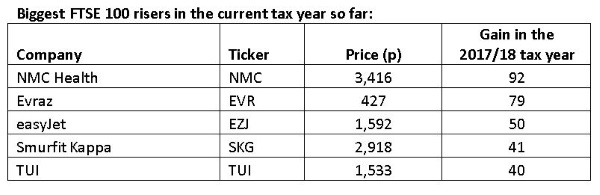

In these final days of the tax year, it appears that investors who spotted potential in Middle East healthcare and Russian steel will be sitting pretty today.

In contrast to the resounding success of and , with gains so far of 92% and 79% respectively, those 2017/18 ISA portfolios built around familiar stocks closer to home are likely to have suffered.

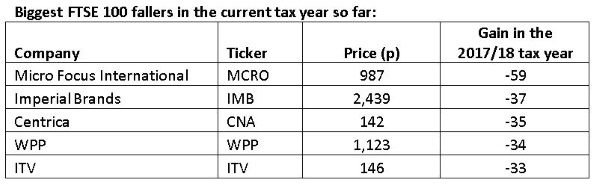

, , and are all down by around third in the FTSE 100 Index since April — falls only exceeded by with a slide of 59%.

Overall, the FTSE 100 Index is down 3% across the tax year to date, although at one point in January it had been 6% higher. It's been a challenging first quarter of 2018 with traders increasingly fearful of rising inflation and higher interest rates, as well as concerned by the prospect of a global trade war.

Source: interactive investor Prices as at close of play on 28 March 2018

None of this has hurt NMC Health, which has continued its meteoric rise since listing on the London Stock Exchange in 2012 and securing promotion to the FTSE 100 Index in September. It is currently valued at more than £7 billion.

NMC is the UAE's largest private healthcare provider, having started out from a one room clinic in Abu Dhabi to become a global healthcare enterprise in the space of 40 years. It has two main branches, NMC Healthcare and NMC Trading, which is a leading distributor of pharmaceutical products.

Chief executive Prasanth Manghat recently said the company had gone from success to success in recent years, adding that there was no reason why this should change. A few days ago, Berenberg supported his view by reiterating its buy investment rating and raising its price target to 4,600p from 4,000p.

Evraz has been on a similar path, having seen its shares jump from 64p in February 2016 in a boost to Russian billionaire and Chelsea FC owner Roman Abramovich, who holds a near-31% stake in the company.

Coal and steel prices have remained strong and account for much of the doubling in underlying earnings in August. Buoyed by strong cash flows, the company has just resumed dividend payments after not making any award in 2016.

President Trump's plans to impose a 25% tariff on steel imports represent a threat to progress at Evraz, although analysts think the impact will be felt more keenly in the European Union and China.

Despite uncertain consumer confidence, travel stocks have also fared well during the tax year after FTSE 100 Index pair and rose 50% and 40% respectively.

At the low-cost airline, there have been plenty of factors working in the favour of new chief executive Johan Lundgren, who took over from Carolyn McCall in December.

For example, the collapses of Monarch, Air Berlin and Alitalia, as well as the impact of Ryanair's winter flight cancellations, have combined to take capacity out of the market and enable easyJet to increase passenger numbers.

Shares are close to their highest level since early 2016, but brokers including Credit Suisse and Kepler Cheuvreux said recently that they think a price above 1,800p is achievable.

Tailwinds have also been supporting the TUI share price as families in Europe show no sign of cutting back on their traditional summer break. Sales trends are positive and the firm has seen a strong pick-up in demand for holidays in Turkey.

Making up the top five FTSE 100 Index stocks for 2017/18 is corrugated packaging firm , which is up 41% as a result of takeover interest from US firm International Paper.

The bottom five are led by Micro Focus, which has lost more than half its value after the troubled integration of assets it acquired from Hewlett-Packard Enterprise in a transformational £6.6 billion deal. Sales are falling faster than expected and the company recently announced the departure of CEO Chris Hsu.

Dividend worries have been driving Centrica shares lower after CEO Iain Conn admitted to a "very poor" performance by the British Gas owner in 2017.

Speculation about the future of the 12p a share pay-out intensified after a huge profits warning in November. For now, Conn says the level of award will be maintained as long as net debt stays below £3.25 billion and the company keeps operating cash flow within its target of a £2.1 billion-£2.3 billion range.

This may still be a big ask, though, if headwinds remain as fierce as they have been in recent months. Shares are down 35% and the stock's projected dividend currently yields 8.5% — one of the highest in the FTSE 100 Index.

Imperial Brands' long-term dividend growth has attracted investors for many years, with fans including fund manager Neil Woodford. Recent market conditions, however, have been challenging and left Imperial trading on a forward PE of 9.1 with a projected dividend yield of 7.8%.

Woodford wrote recently: "With the share price revisiting valuation territory that we haven't seen in many years, Imperial Brands simply looks like it is trading at the wrong price."

The fund manager is also a backer of ITV, having opened a position in the broadcaster in October. His team wrote at the time that ITV's valuation was looking increasingly attractive as the market has focused too much on the perceived structural threat posed by digital media and new entrants.

That was before new boss Carolyn McCall pulled the plug on ITV's five-year record of paying a special dividend. Among her reasons for doing this, McCall pointed to the return of a "more normal" ordinary dividend after the total 2017 pay-out increased 8% to 7.8p.

The dividend yield, which today stood at 5.5%, has been supported by strong cash flows over the years but there are persistent concerns about the impact of the changing media landscape. Shares are down 33% in the tax year.

Similar fears are impacting WPP, with shares now at their lowest level in more than four years amid worries that the likes of Google and Facebook are radically changing the advertising market.

Positives were hard to find in WPP's recent results, with even CEO Sir Martin Sorrell admitting it had "not been a pretty year".

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation, and is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.