Number of high-yield investment trusts up 50%!

26th April 2018 10:45

by Faith Glasgow from interactive investor

Share on

Stormy equity markets the past three months have impacted on the share prices of many investment trusts, pushing dividend yields upwards - and throwing out new opportunities for income-seekers.

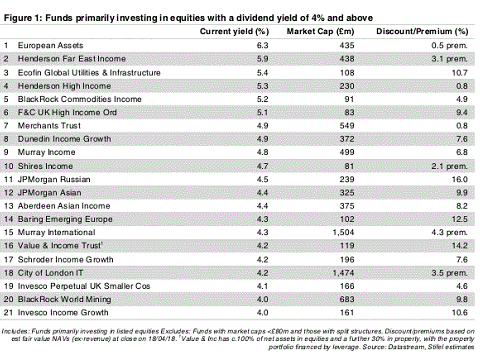

According to a new report from broker Stifel, there are now 21 equity-focused closed-ended funds with assets under management of £80 million plus that are yielding more than 4%- up from 13 six months ago in September and 11 in March 2017. Trust numbers have been further boosted by changes in policy for two trusts that have recently adopted a high-yield investment strategy and now feature in the table.

At the same time share price discounts to the underlying asset value have tended to widen over the period, offering an attractive opportunity for income investors to top up or expand their portfolios.

Increases in yield are evident across a broad swathe of sectors. Unsurprisingly, given the fact that domestic markets have fallen so heavily out of favour with international investors over recent months, more than half of the table are UK-oriented trusts.

They include newcomers (4.2% yield) and , which has recently adopted a more dividend-focused policy and now pays 4.1%. It has boosted its payouts by 22% over the past year and is prepared to supplement dividend takings with capital if need be. Several other trusts in the list have also adopted dividend-boosting policies, including (on a 4.3% yield) and .

Other UK-focused Rated Fund members worth noting on the list include (4.2% yield), which has grown its dividends for more than 50 consecutive years, and Shires Income, yielding 4.7%, though this latter sits on a 2% premium.

Asian funds are also in evidence, in the shape of , on a 3% premium but producing a meaty 5.9% yield. and JPMorgan Asian, meanwhile, are both on a 4.4% yield and offer better value in discount terms as they sit on high single-figure discounts.

The top-yielding equity trust, however, is interactive investor Rated Fund , paying 6.3% and sitting on a modest 0.5% premium. It pays its dividend primarily from capital and the board resets the dividend level each year. Stifel says that the forecast for 2018 amounts to a 6.3% payout.

Source: Datastream Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.