Why this is as good as it gets for equity markets

10th May 2018 12:41

by Jim Levi from interactive investor

Share on

The global economy has hit a sweet spot. Growth is healthy and widespread across many regions - it's expected to reach 3.9% for this year. Perhaps only a dozen countries around the world are actually in recession. Moreover, they are mostly tragic cases such as Venezuela, Haiti, Syria, Yemen and Somalia.

In economic terms, the planet does not really get much better than this. It is the Goldilocks scenario - not too hot and not too cold - where there is healthy growth with inflation under control.

The US has led the expansion and is on track for the longest period of economic growth in its history if it can keep edging higher for another year. Keith Wade, chief economist at Schroders, thinks the US will make it comfortably and break the 10-year expansion record last achieved between 1991 and 2001.

Wade says: "Barring external shocks such as a trade war, the most likely time for the expansion to end would be when the economy feels the full impact of rising interest rates and the impulse from tax cuts fades. That is unlikely before 2020."

Perversely, financial markets seem incapable of lying back and enjoying these good times while they last. The explanation for this paradox is that markets are, as always, busy extrapolating - in other words worrying about the future.

Of course, there is plenty to worry about. Our five asset allocators can quickly produce a sizeable list of reasons to be less than cheerful. Trade wars, new 'cold wars', rising interest rates and perhaps an unhappy ending to the great loose money experiment carried out by central bankers are all part of the fretful mix.

Last time we surveyed our asset allocators' opinions (in the February 2018 issue), many leading equity indices were close to all-time highs. The mood has since changed dramatically. Several key equity indices have swung from peak to trough in the space of a few weeks. Thus, the index had fallen by more than 10% by early April, while Wall Street's S&P 500 has been down as much as 7.5%.

To be fair to our panel, they had been more cautious about the prospects for global equities in their previous review without actually turning bearish.

F&C's Rob Burdett, for example, had been anticipating this correction for more than a year, while Wade started the New Year with the inclination to "take some risk off the table after such a good 2017".

He also warned how difficult it was for equities to make progress when US and UK interest rates were forecast soon to be on the rise. Richard Dunbar at Standard Life Aberdeen suggested: "Expectations for 2018 have to be reined in."

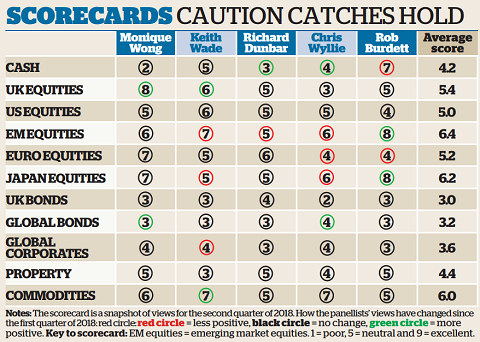

Our previous scorecard showed a mixed picture, however. Average scores for European and emerging markets equities were trimmed a little. Those for the US and the UK were slightly higher, while Japan was unchanged.

In their current update, our five panel members are, as usual, not exactly singing in unison, though it is possible to detect some clear trends to guide the non-professional investor.

Our May scorecard shows that average scores for three equity sectors - emerging markets, Europe and Japan - are lower. Corporate bonds have also been downgraded again, for the second quarter in a row. Chris Wyllie of Connor Broadley notes that high-yield corporate bonds in the US have lately been weaker. "Often in the past, this has been an early warning sign of trouble ahead," he says.

Growing anxiety

The US is, of course, the key market driving all markets. This time around none of the panel is altering their score for US equities, and the average score remains a neutral five. Healthy earnings growth prospects are offset by high valuations, concerns about the future direction of the dollar and new anxieties over the outlook for technology stocks in the wake of the row over data protection.

Wyllie says: "We are in the twilight zone for equities - the zone between day and night. Investors are pretty comfortable with the earnings growth expectations, but they are not comfortable with the markets. Like everyone else, we are wrestling with the problem of how bearish you want to be when the economic runes are so good."

The odd one out in the equities mix is the UK. Since November the average score has risen from 4.2 to 5.4.

Its economy has a projected growth rate for this year of just 1.7%, less than half the global growth forecast. Moreover, with the UK set to leave the EU in a year's time, Brexit uncertainty remains rife.

This, however, does not deter two of our panellists from raising their scores. Monique Wong, who steps in to replace Alan Higgins at Coutts, edges up from 7 to 8, while Wade raises his score from 4 to 6. The only panel member underweight in the UK now is Wyllie.

He sticks firmly to a 3. "I cannot see the catalyst to get the UK market performing," he says.

Wade can. He thinks a deal on Brexit could be that catalyst. "The prospects for a soft Brexit deal have now increased," he says. "UK shares looks pretty cheap on a long-term basis. They are already discounting a lot of bad news."

In the Coutts camp, they have been positive on UK equities for some time.

Wong says: "We can make the case that everyone has got too negative. The UK is a value play with a 4.5% dividend yield. If we get a Brexit deal and the animal spirits in the business community revive, you could see a scenario where there is a bear squeeze on UK equities."

Richard Dunbar, who raised his UK score to 5 in February, simply cites the currency as an indicator that the UK market may be too cheap.

"Sterling is up almost 20% against the dollar since we last spoke," he points out.

"You can see our currency as if it were the share price of the country. So maybe it is telling us that people are more sanguine about Brexit."

Of all our five panel members, Wyllie is probably the least bullish about equities generally. He has taken the precaution in the present climate of lowering his equity scores for emerging markets, Japan and Europe, and rebalancing his portfolio by raising his global bonds score from 2 to 4, while at the same also raising his cash score from 2 to 4.

"We are moving in a defensive direction for the first time in three years," he says. "I would be surprised if the equity markets make new highs over the next six months."

Connor Broadley takes four factors into account in determining its market strategy: market sentiment, valuations, momentum and earnings growth prospects. "The only indicator showing the green light now is growth, and we are hanging onto that," says Wyllie.

Global growth false dawn

What worries him most is that even the growth signal may be giving a false reading.

"It is the consensus view, and I have to be wary of that. Remember, nobody believed in global growth only a year or so ago. Now everyone is saying we are at least a year or maybe 18 months away from the next recession. We don't really know. Suppose the consensus view is wrong again?"

He points to signs that inventory levels in US business are increasing, a possible pointer to growth levelling off later this year.

At the other end of the spectrum is Monique Wong, who seems the most upbeat member of the panel. Leaving aside her score of 5 for the US, she keeps overweight positions in all other equity sectors.

"In the wake of the market volatility in February, we increased our overall equity weightings," she says.

"Europe, emerging markets and Japan are all leveraged to global growth and they should all outperform."

She has raised her score for global bonds, though, in recognition that rising interest rates could make bond yields more attractive. All eyes are on the yield of the US 10-year Treasury note going above the 3% level, making the so-called 'risk free' asset more competitive with other risk asset categories (equities, property, commodities and corporate bonds).

Backing Japan

Rob Burdett is perhaps the panel member who emerged best placed ahead of the recent market correction in equities. In the previous survey he kept his cash score high at 8, but lowered his scores for both European and Japanese equities.

However, he did prematurely place more chips on the UK market. Now he thinks it is time to go back into Japan and further increase his exposure to emerging markets. He scores 8 on both. He balances that by going underweight in Europe and reducing his cash position from 8 to 7.

Two views now emerge on Japan. Burdett reiterates the bull case he has long argued: attractive valuations, rising corporate earnings, political stability, increasing reforms in corporate governance to the benefit of shareholders, and a still-relaxed approach to monetary stimulus by the central bank.

He now makes two further points for good measure. His first point is that in volatile periods such as these, UK investors get some protection from the Japanese yen's reputation as a safe-haven currency.

He explains: "When Wall Street tumbles, Japan falls as well, but the yen tends to go up, softening the blow for UK investors."

Burdett's second point is that although we think of Japan as an export-led economy, its stockmarket is much less so.

"Exports now represent less than a quarter of Japan's stockmarket earnings by value. The market is much more driven by the domestic economy," he says.

Tempted to take profits

Profit taking has been a feature in emerging markets. There are few negative noises here from the panel, but three members have chosen to take profits and trim their scores. Only Burdett raises his score to 8. He says: "The sector has demonstrated its qualities."

There is gradually rising support for commodities, partly because global growth may eventually lead to supply shortages. Keith Wade raises his score from 5 to match Chris Wyllie's score on 7.

He predicts: "If there is a trade war, there will be a scramble for commodities." Wyllie believes demand and supply in the crucial oil market are now coming into balance.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.