Are investors wise to ignore US tariff tensions?

7th June 2018 10:33

by Rebecca O'Keeffe from interactive investor

Share on

Despite threats and recriminations from China and other global leaders, investors are actively choosing to ignore the trade tariff tensions, with global equity markets rising.

The G7 meeting next weekend is now expected to be the main showdown for the issue, with investors hoping that the US administration will backtrack on their current stance - but they might be disappointed.

The two main benchmarks President Trump appears to use to gauge the success of his policies are his grassroot supporters and the US equity market.

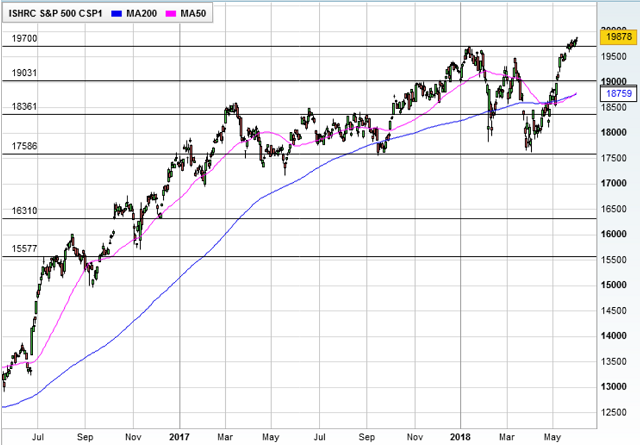

iShares Core S&P 500 ETF USD AcciShares Core S&P 500 ETF USD Acc GBP

Source: interactive investor Past performance is not a guide to future performance

His blue-collar followers are hugely supportive of tariffs, and with equity markets currently also choosing to dismiss the problem and in positive territory, this is reinforcing President Trump's view that he is doing the right thing, making it less likely that he will back away from his current stance.

This chicken and egg position, where markets don't believe that tariffs are a credible threat, combined with President Trump's position that markets are not worried about the issue could lead to an unpleasant reality for both sides eventually.

However, for the moment, investors are benefitting from positive sentiment.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.