Saltydog ventures back into the markets

17th November 2014 09:54

by Richard Webb from ii contributor

Share on

The worst trading conditions for momentum investors are periods when markets are relatively flat, but rising and falling in short cycles within a very narrow band.

Unfortunately that's exactly what we've seen all year. Up until a few weeks ago the FTSE 100 (UKX) index had been trading between 6450 and 6900, with most of the time spent above 6600.

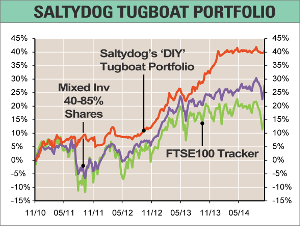

Under these circumstances our Tugboat portfolio has reduced its exposure to the equity markets, while we wait for stronger trends to emerge, and at the same time we have been looking for funds that give slow, but steady, returns.

During the summer we were invested in various bond funds which we hoped would give us safe, but modest returns. These have now been replaced by property funds.

Commercial Property Exposure

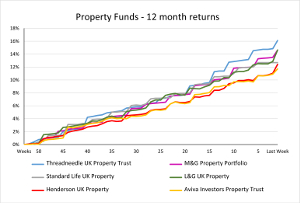

These were highlighted by some analysis that we did looking specifically for funds that have given positive returns over the last 12 months, without suffering any significant losses.

Over the last 12 months these funds have not only made healthy returns, but have also been much less volatile than the equity markets.

They aren't without risk and if property prices were suddenly to fall we would expect to see them go down. Another potential problem is liquidity.

If investors suddenly want to withdraw a significant amount from the fund, then the manager may need to sell some property to generate sufficient cash.

This is an expensive process and the costs could be passed on to the exiting investors in the form of a dilution levy.

| Total return | 40.2% |

| Annualised return | 9.8% |

| 12-month return | 14.6% |

The worst case scenario is that investors would be locked into the fund until the properties are sold.

We are looking to reduce the risk of this happening by limiting the amount invested in one fund, keeping a close eye on the levels of cash that they are holding, and only gradually increasing or decreasing our holdings.

Snakes and Ladders

This portfolio aims to be relatively cautious, and avoiding falls in the markets is as important as making gains when they are going up - keeping off the investment snakes and going up the ladders.

As conditions have started to improve we have ventured back into the markets and will increase our exposure if this trend continues.

We are currently holding from the global sector, from the global equity income' sector, and the

Funds investing in India have performed well for most of this year, and we were invested in them up until the recent downturn. We are hoping they will return to their previous good form.

| Saltydog Group | Date purchased | Fund name | Gain/Loss (%) | % of portfolio |

| Safe Haven | Cash | 56.4 | ||

| Steady | 30/10/2014 | Fidelity Global Dividend | 2.1 | 5.4 |

| Steady | 30/10/2014 | Fundsmith Equity | 1.6 | 5.4 |

| Developed | 07/08/2014 | M&G Property Portfolio Feeder | 2.6 | 24.6 |

| Developed | 23/10/2014 | SWIP Property Trust | 1.2 | 5.4 |

| Specialist | 30/10/2014 | Neptune India | 1.7 | 2.7 |

Richard Webb is managing director of Saltydog Investor.

To find out more about the Saltydog service, and a two month free trial that is offered to all new members, go to saltydoginvestor.com.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.