How to screen for winners in the bargain bucket with Piotroski

3rd December 2014 11:59

by Edward Page Croft from Stockopedia

Share on

This is the fourth article in my series on classic stock screening techniques. In the last few weeks we've discussed a range of ideas: How to profit from the payoffs to value, quality and momentum in the stockmarket; how Benjamin Graham single handedly invented Bargain Investing; and how he increasingly improved his profits by filtering for the higher quality shares in the bargain bucket.

In the next few articles we'll be developing this last idea further with the help of a few brilliant academics as sidekicks. Let's get started by learning about the ultimate ivory-tower-born checklist for finding high probability turnarounds: The F-Score.

Introducing Professor Joseph Piotroski

In the 1990s Joseph Piotroski, Stanford finance professor, was puzzled. In the bargain bucket of the stockmarket there is a huge variability of returns. Surely there was a way to separate the wheat from the chaff?

"In that mix of bargain companies, you have some that are just stellar. Their performance turns around. People become optimistic about the stock, and it really takes off. However half of the firms languish; continue to perform poorly and eventually delist or enter bankruptcy."

His solution was published in a seminal Year 2000 paper titled Value Investing: The use of historical financial statement information to separate winners from losers. In it he theorised that most investors focus on the wrong things - the 'story' or analyst forecasts - while ignoring the financial clues in a company's accounts. So he detailed a simple but astonishingly effective nine-point checklist - like a financial obstacle course - that only shares with the best fundamentals could survive.

Piotroski's nine-point checklist

The nine checks look for improvement in company accounts - where profits and cash flow are growing and canny management teams aren't pulling any accounting tricks. They also look for signs that a company is making more money from its assets, cutting debt and not having to issue new shares. In plain English, his tests are as follows:

● Is the company making a profit?

● Is it generating cash?

● Is it making more cash than it's reporting as profit?

● Is it more profitable than it was last year?

● Is the company's long-term debt reducing or stable?

● Is it increasing its ability to pay short-term debts?

● Is the company trading without having to raise funds from shareholders?

● Is pricing power improving and/or costs reducing?

● Is it more productive than last year?

Each check scores one point for a pass, none for a fail and the closer a stock gets to scoring a full nine points, the more faith an investor can have that its financial strength and track record are improving. The final result of applying this checklist to shares is known as the "F-Score" (Fundamental Score).

Piotroski found that weak stocks, scoring two points or fewer, were five times more likely to either go bankrupt or delist due to financial problems. As a result his recommended strategy was to buy shares in the cheapest 20% of the stockmarket that also scored eight or nine on his F-Score checklist - in essence, he'd filtered the market to a set of high probability turnaround stocks.

Piotroski's strategy performance

At the time most investors hadn't even heard of Piotroski let alone begun to act on his advice, but over a decade later the proof that his is a consistently market-beating strategy is mounting.

Piotroski's own back-tests over 20 years showed that his formula could improve the returns from typical value investing strategies by at least 7.5% annually. In addition, buying the top stocks in the market and shorting those that scored poorly on his checklist resulted in 23% annualised gains.

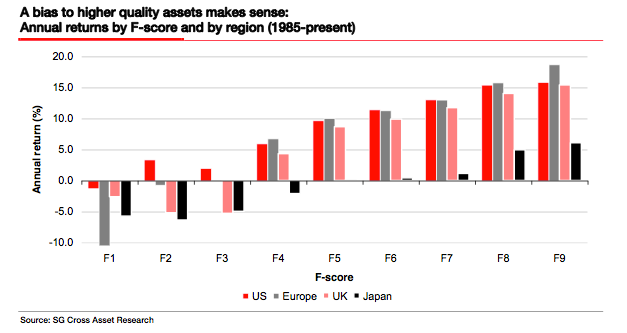

More recent research by blue-chip investment bank Societe Generale has shown that large-cap stocks scoring nine out of nine on Piotroski's checklist returned over 15% annualised since 1985 and beat the market in four out of every five years!

Applying the F-Score to UK stocks

At Stockopedia.com we've been publishing F-Scores for all the shares in the UK stockmarkets for the last three years, as well as checklist breakdowns for bottom-up F-Score analysis on shares. Our tracking of the classic Piotroski strategy detailed above has not been without volatility, but has shown strong, market-beating performance of 45% over the last three years (14% annualised).

Similarly to Graham's bargain strategies there can be a lot of micro caps qualifying for the classic Piotroski strategy - but some of the standout names on the current list include troubled betting firm , , oil and gas oldies and , and the . You can find the other eight qualifying shares and two other related Piotroski strategies on the Stockopedia.com website.

Piotroski's F-Score is the classic metric for stock picking value investors, especially who hunt amongst small caps. Piotroski said: "The benefits to financial statement analysis are concentrated in small and medium-sized firms, companies with low share turnover, and firms with no analyst following."

As discussed in my first article - it's only by venturing where others fear to tread that one can generate standout value investing returns. Piotroski lights the way.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ed Page Croft of Stockopedia.com, the rules-based stockmarket investing website. You can click here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a 2 week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

● To learn more about Ben Graham and his deep value investing strategies, you can download the free Stockopedia book, How to Make Money in Value Stocks.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

About the author

Edward Page Croft is the CEO and founder of Stockopedia.com. His background is in wealth management and engineering, having worked as a private client broker at Goldman Sachs before founding Stockopedia.

He graduated from Oxford University with first class honours and is a Zend Certified PHP Engineer. Edward writes regularly for This is Money, Business Insider and the London Stock Exchange's Private Investor Magazine. He is the author of several ebooks including "How to Make Money in Value Stocks".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.