Seven equity funds and trusts for your portfolio

9th December 2014 09:40

by Rebecca Jones from interactive investor

Share on

In our quarterly multi-manager series we reveal the funds and trusts selected by a panel of leading multi-managers.

Rather than build their portfolios by investing in individual stocks or bonds, these managers invest largely or exclusively in investment funds, leaving them well placed to identity future winners.

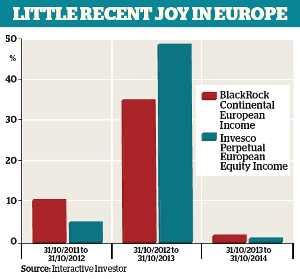

In terms of asset classes, equities are the standout winner this quarter. None of our managers have expressed positive views on fixed income and three are actively avoiding it. Within equities, Europe has come out on top, as recent sell-offs in the region have produced favourable valuations.

Other areas of positive interest for our panel this quarter were emerging markets and investment trusts, while they believe fixed income is best avoided.

John Ventre, portfolio manager, Old Mutual Spectrum fund range

He is most keen on smaller companies sensitive to economic movements, rather than more defensive large caps, as they are "better value for the risk". For this reason he highlights .

Ayesha Akbar Multi-asset portfolio manager, Fidelity

Like the majority of our managers this quarter, Akbar is most bullish on equities, as she believes they provide the best opportunities for investors in the current climate of "sustained economic recovery, loose monetary policy and muted inflation".

To access opportunities globally, Akbar recommends the . "It takes a robust approach, investing in companies with strong financials, low debt, high rates of wealth generation and the ability to sustain and grow profits.

Managed by Walter Scott & Partners, it uses a truly team-based approach to invest for the long haul," she says.

Regionally, Akbar prefers the US; she says the country "continues to lead the way to economic recovery", thanks to its strong growth policy and ongoing structural improvement. She adds that earnings revisions in the US have also been better than in other regions.

She highlights as an interesting option due to its focus on small and medium-sized companies, which she says are "often the key beneficiaries of a country's economic growth". In contrast, large-cap US firms are likely to be more influenced by global market conditions.

David Hambidge, head of multi-asset funds, Premier Asset Management

Premier's head of multi-asset funds David Hambidge has selected UK equity income as one of his preferred sectors this quarter, claiming that it is likely to remain a favoured hunting ground for income as "the baby boomer generation enter retirement".

He has chosen Money Observer Rated Fund , which he says pays an above-average dividend on a quarterly basis while being relatively cautious compared to the UK equity market as a whole.

Despite recent market woes, Hambidge is also keen on Europe. "Europe's equity market is getting interesting again, with many investors seemingly throwing in the towel at a time when the valuation relative to US equities is close to an all-time low,"he says. He favours , which like Fidelity's fund pays a "healthy, above average dividend" of more than 4%.

Ian Aylward, head of multi-manager research, Aviva Investors

Equities are also the winning asset class for Aviva's head of multi-manager research Ian Aylward, particularly those within "cheaper" developed markets that are "set to benefit from significant future monetary easing".

Japan, which recently increased its asset purchase programme to ¥80 trillion (£425.5 billion), is a favourite region for Aylward, and the is his pick. "We have been invested in GLG Japan for many years. We rate Stephen Harker and his team highly, as they have experience and great insight into the market while their large-cap value style has been proven over the years," he says.

Like Hambidge, Aylward likes Europe this quarter; he highlights the , managed by Stephanie Butcher, who Aylward says is "hugely enthusiastic and knowledgeable" on the asset class.

"As an income fund it is currently drawn towards more unloved areas of Europe, both geographically and sectorally - such as banks and Spain. Yet Butcher avoids stocks that are in her opinion cheap but structurally unsound, such as utilities," he observes.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.