Why oil price could halve again

10th February 2015 11:41

by Lee Wild from interactive investor

Share on

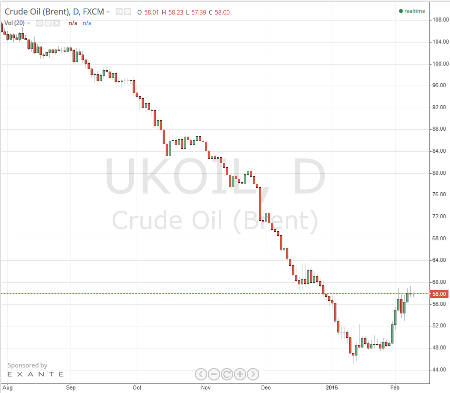

Oil prices have surged by 20% since the end of January. The bounce has led some to call an end to the eight-month long rout during which the cost of a barrel of both Brent crude and West Texas Intermediate (WTI) has more than halved. Not everyone, however, is so confident.

This rally has been driven by a drop in US rig count, massive cuts in upstream capital expenditure, the reading of technical charts, and investor short position-covering.

“Chartists...are strutting their stuff at the moment as their support levels are being held and upward resistance being tested,” says industry expert Malcolm Graham-Wood. “For Brent, support is seen as being at $53.99 and $52.40 while resistance is at $59.15 and after that at $69.23. Brent’s intra-day high yesterday was $59.61 and whilst we are well off that at the moment if it should close above that level then they are in Nirvana.”

But the team at Citi reckon this is "more like a head-fake than a sustainable turning point".

They believe that short-term market factors are more bearish, implying more price pressure for the next couple of months and beyond. "Not only is the market oversupplied, but the consequent inventory build looks likely to continue toward storage tank tops," says Citi. "As on-land storage fills and covers the carry of the monthly spreads at ~$0.75/bbl, the forward curve has to steepen to accommodate a monthly carry closer to $1.20, putting downward pressure on prompt prices. As floating storage reaches its limits, there should be downward price pressure to shut in production."

Citi reckons prices should bottom "sometime between the end of Q1 and beginning of Q2 at a significantly lower price level in the $40 range." Only after that will markets start to balance, beginning with an end to inventory builds and then a period of sustained inventory draws.

Source: TradingView

"It's impossible to call a bottom point, which could, as a result of oversupply and the economics of storage, fall well below $40 a barrel for WTI, perhaps as low as the $20 range for a while," adds Citi.

So, what's the shape of the oil price recovery likely to be? Well, it's unlikely to be L-shaped, according to Citi; prices are already too low to be sustainable. A U-shaped recovery looks "superficially more plausible," with Brent falling to $45 and WTI to $35 where they could linger before recovering.

"In short, it looks as though there should be a sharp recovery in prices by winter 2015/16, and as a result of that, there should be an enhanced stimulus for US shale production growth going forward. This could well overwhelm demand growth and bring prices down again, in a 'W' shape."

"Of course, all other things may not be equal - 'W' could also stand for 'wildcards', with potential problems for supply out of Iraq, Libya, Iran, Venezuela or elsewhere. But these would take place in a world with shale."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.