How Carpetright shares could double

28th April 2015 11:20

by Lee Wild from interactive investor

Share on

announced bullish numbers last week. Less than a year after founder Lord Harris of Peckham handed over the reins, and just seven months after a dramatic share price plunge, the carpets and flooring specialist is in turnaround mode. New boss Wilf Walsh says the company made much more than expected in the year to April, which has drummed up support in the City. Now, analysts at Citigroup have joined the fan club and think the shares remain significantly undervalued.

Citi begins coverage of Carpetright with a gushing 44-page note in which it argues that management change should act as the catalyst to revive the company's trading performance.

"The recovery story highlights a refocused customer offer and property estate optimisation, boosted by a consumer spending tailwind," says the broker. "Early signs of improvement are encouraging (recent +10.5% UK LFL sales in 4Q15). Our bull case scenario targets more aggressive execution (quantum and timing), with a 'Red Carpet' 830p per share valuation."

It reckons there are two key aspects that drive the Carpetright investment case. To begin with, there's a "substantial" operating profit margin expansion opportunity, driven firstly by the operational leverage of an improving like-for-like (LFL) sales trend - especially in the UK where the firm recently introduced 0% finance - and active property portfolio management.

"Our base case assumes that these drivers sustain 80% compound EPS growth over the next three years, with dividends resumed in FY17. Consumer confidence has historically predicted LFL sales trends, with data in the UK now appearing especially supportive. Our Citi proprietary Household Available Cash forecasts (UK and Europe) also indicate more prospective upside."

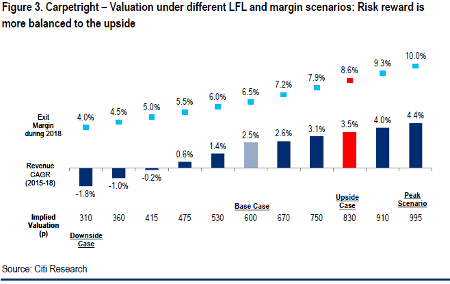

In terms of valuation, Citi runs through a number of potential scenarios, but even its base case implies a 600p target price using a discounted cash flow (DCF) model. That assumes only modest margin recovery to 6.5% by 2018.

A more optimistic margin recovery story - 8.6% by 2018, still way below peak margins of 14.7% in 2004 - implies 38% upside to operating profit and earnings for 2018. A valuation of 830p puts Carpetright on 7.9 times enterprise value-to-underlying operating profit and 9.1 times EPS estimates for 2018.

However, a "peak" scenario - 4.4% revenue compound annual growth rate (CAGR) for 2015-2018 and 10% operating margin - implies upside to 995p.

Clearly, there's much to be done, but Walsh has introduced lots of new initiatives which are already making a big difference. Profits are expected to grow deep into double-digits for the foreseeable future, and there's every chance of further upgrades, too.

Look for underlying pre-tax profit of £17 million in the year to April 2016, says Citi, up from £13 million this year, giving adjusted earnings per share of 19.2p from 14.5p. In 2017, Citi wants £24.1 million and 27.6p of earnings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.