How likely is FTSE 100 relief rally?

18th November 2015 12:00

by Lee Wild from interactive investor

Share on

Stocks closed Friday at a six-week low. They'd plunged over 5% in little more than a fortnight as investors found no good reason to buy equities amid a slew of big name third-quarter profit warnings, cooling growth prospects and valuation concerns. But events in Paris Friday night, rather than extend the sell-off Monday morning, did quite the opposite. There was talk that the Santa rally had started early. That's premature, but events about to unfold - and some star-gazing at the charts - add some clarity.

It's Fed time next month, and the likelihood of a first rise in US interest rates for almost a decade is currently put at about 66% - a 0.2% increase in the US consumer price index certainly adds fuel to the fire. And after a 9% risk-on rally here last month, investors switched from shares to cash ahead of what is a well-known risk event.

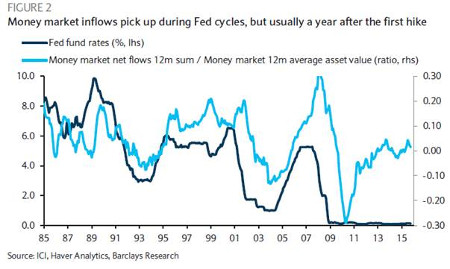

According to Barclays, money market inflows have been $164 billion (£108 billion) since July, more than the major sell events in 2011, 2012 and 2013. And that raises the prospect that this week's 150-point rally is a fake. "Fund flows do typically go to money markets during Fed cycles, but usually a year after the first hike," explains Barclays' asset allocation strategist Keith Parker (see chart below).

(click to enlarge)

The fake was something I talked about with our technical analyst John Burford on Monday, shortly after publishing his article examining the prospect that the FTSE 100 could eventually sink as low as 3,500. That was John's overall analysis for longer timescales. I was interested to understand the level of conviction underpinning John's forecast. "Pretty high," he says. "The global debt pile is what will kill stocks, but as ever timing is everything."

For day traders, however, the outlook was quite different, and John told me this latest spike would probably come to nothing (see hourly chart below from Monday). We'll see, but John still thinks the likelihood of a rally above 6,500 is "slim".

(click to enlarge)

A week earlier, fellow chartist, Alistair Strang at Trend and Targets, examined the circumstances under which the might hit 6,800, possibly by Christmas. You can read the full article here but, to summarise, Alistair wrote that "further weakness below 6,249 looks capable of 6,135 next". He was right.

Today, his software reveals a secondary target for the FTSE 100 just above 6,400. "This actively hits the ruling downtrend, so some stutters are expected at the 6,400 level. If it is bettered, it means Alistair's insane bounce from 6,030 to 6,800 prediction ticks its final box."

I've merged both John and Alistair's forecasts into the chart below.

(click to enlarge)

Clearly, what the money-men do will be a key driver for markets in the weeks leading up to the Fed's next meeting on 16 December. Fund managers have already scaled back risk exposure, particularly asset allocation funds and equity mutual funds, says Barclays.

But long/short equity hedge funds have increased net exposure over the past six weeks, and Fed concerns mixed with other risk factors like China and geopolitical events could convince them to sell again.

So, when will money return to equities?

"Cash could come back to markets if uncertainty around the Fed subsides, similar to other well-known risks (i.e., fiscal cliff)," reckons Parker. "With investors continuing to position defensively ahead of the December FOMC, we see scope building for a selective relief rally once uncertainty around Fed lift-off passes."

And the rotation to cash is likely nearing an end, near term, adds the Barclays man, with cross-asset investors most likely the biggest buyers, given 13% of assets under management are currently in cash. He adds:

"With rates expected to be hiked only gradually at a pace of 75bp [basis points] annually, we would not expect a significant rotation into cash. Importantly, we could likely see money return to markets as uncertainty subsides after the first hike.

"That said, the Fed typically hikes much earlier in the economic cycle, and later cycle risks in commodities and credit are a concern for investors. Overall, we would expect cash balances to continue to build ahead of the December FOMC, but partially reverse after."

(click to enlarge)

Too early to talk Christmas rallies, then. Yes, shares typically do better during the winter months, but this time plenty will depend on US economic data and the implications for US rates. And with uncertainty comes volatility - the VIX is currently ticking back up to the 20 level - so expect markets to move around a bit, too.

November payrolls due on 4 December will certainly be interesting, but minutes from the 27-28 October rate-setting meeting - tonight at 7pm UK time - come first. Watch this one like a hawk.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.