FTSE 100 rally's biggest winners named

17th February 2016 16:43

by Lee Wild from interactive investor

Share on

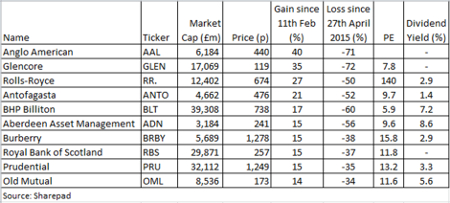

How times change. Only last Friday, just four trading sessions ago, global stockmarkets were on their knees. The fell below 5,500 briefly, its lowest since summer 2012, and the S&P 500 sank to a two-year low. Since then, the UK index is up over 500 points, or 9.3%. What's more incredible, however, is the rag-tag collection of companies leading the charge.

Anyone who doubted the virtues of contrarian investing will have been silenced by events of the past few days. Perversely, it's rising oil prices - up nearly 6% Wednesday to over $34 a barrel - that are lending a hand.

Miner had many wise heads wondering whether the shares would ever stop falling. After crashing 94% since 2011, they did. They've rocketed almost 40% this week already and have doubled in value over the past three weeks.

True, it's unlikely they'll ever see £35 again, but the market clearly appreciates that management is doing what it can to make things right. Plunging commodity prices mean it's struggling to generate enough profit to finance $12.9 billion (£9 billion) of net debt. Selling over half its assets - a "shrink-to-survive" strategy - makes perfect sense, then.

"The strategy outlined by Anglo American yesterday [full-year results on 16 February] amounts to putting the patient in intensive care," writes Investec Securities. "The news of further amputations in order to improve the chances of long term survival appears symptomatic of an environment that is rapidly changing the face of the mining industry globally."

"We are surprised that the company did not take the opportunity to feed the ducks while they were quacking." Well, they didn't, but at least they're acting now.

is second on the risers list. Like Anglo, the miner has crumbled in recent years, making a record low of 66.6p in September. But it, too, is tackling a horrendous debt problem by raising cash and selling assets. There have been a few fake rallies in the past, but this one has returned a mighty 35% to investors who piled in last Friday at 87p.

A day before the rally we wrote that Glencore appeared to be "racing to new lows", given it had fallen 18% in the first four days of last week. Trading update failed to excite investors, with production largely in line with expectations.

In the short term, at least, there's a chance Glencore could test a key level of technical resistance at around 125p. A weaker dollar, or surprise in the 1 March full-year results could keep the rally going.

, another dog of the past 10 months, is third in the list. Its shares have rocketed 25% since Friday, propelled higher by better-than-feared full-year results, and despite halving the dividend.

"The presentation itself was very well coordinated and the confident tones from Warren East and David Smith were obvious," said Barclays analyst Phil Buller. "What really matters is the rate at which costs can be driven out of the business and we're encouraged by what we see.

"Our question is whether the net effect on earnings and cash of the cost savings and the pricing of TotalCare [spares and maintenance contracts] justify this valuation."

Here's what our companies analyst Richard Beddard thinks.

At four comes South American copper miner , followed by posh handbags and fashion firm , another victim of the growth slowdown in China.

Financials make an appearance, too, recovering huge losses caused by fears of another banking crisis, sparked by problems at and . There was a real fear that central bank action is no longer enough to stabilise, let alone trigger heavy buying of risk assets, including equities. Wrong!

and insurers and make the top 10, up between 14% and 15% since Friday. , and are all top 20 risers, at least 12% higher over the past few days.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.