Stockwatch: This blue-chip's a 'choice pick'

30th September 2016 11:49

by Edmond Jackson from interactive investor

Share on

Consider this irony of a housebuilder. Despite a non-executive director buying 25,000 shares at 197p a fortnight before, traded at just 182p at the start of 2016 on analysts' forecasts of £606/£696 million normalised pre-tax profit for 2016/17.

These have now been upgraded by 16.3% and 10.8% to £705 million and £771 million respectively, and yet the stock has fallen 18% to about 150p, testing 115p after the Eurropean Union referendum.

On a 12-month forward basis the price/earnings (PE) multiple is about 8 times with a dividend yield of 8%, with the analysts' consensus 'hold/buy'.

It's as if the market regards such numbers more like a cyclical warning that builders' profits are exposed. Committing to an intrinsic 5% yield and special dividends as profits allow doesn't even seem to be convincing the market. Are the fears rational or jaundiced?

Housebuilders in no man's land

In principle they should take encouragement from a positive macro framework in which central government is encouraging home ownership and exerting pressure on local authorities to give planning consent.

Brexit will bring economic disruption, but without other shocks a hard recession is unlikelyMortgage interest rates look set to remain low for a while longer, and employment/wages are firm.

The Bank of England's renewal of quantitative easing is likely to support asset prices in the medium-term, notwithstanding the eventual dilemma central banks are creating to exit their bond-buying. Brexit will involve some economic disruption in the next three years, but unless other shocks materialise a hard recession is unlikely.

Bears caution that Taylor Wimpey's sales may be 40% reliant on the Help to Buy mortgage subsidy, although the scheme runs to 2021. The Bank of England also recently cited healthy mortgage demand in August, even with Help to Buy participation reducing.

It's also unlikely cost increases will seriously check against margins as bears proclaim likely: Taylor Wimpey targets a modest 3-4% rise in build costs for 2016. The first-half year operating profit margin was flat at 19.2% after a rising annual trend (see table, foot of page), which may represent a peak if house prices consolidate.

So, there are reasons for caution after housebuilders' excellent run since Help to Buy's introduction in 2013 - if insufficient negatives.

Autumn Statement a likely arbiter for sentiment

It's nearly two months away, yet could be most significant. New chancellor Philip Hammond has indicated that he will use the Autumn Statement to reset Britain's economic policy amid calls for more spending initiatives.

The government has already announced it will commission thousands of new affordable homes, an approach not seen since the 1980s Docklands regeneration.

Wimpey's board has bolstered dividend payouts to support shareholder valueThe number of new homes annually built in England and Wales fell to 112,000 in 2010, its lowest level since the 1960s, but this increased to 149,000 in 2015. The chancellor will need to balance interventionism with reassurances in the form of planning consents, otherwise there is the potential for a net negative for the top eight firms that currently provide about half of new homes.

In January, David Cameron said: "The direct commissioning approach will support smaller builders and new entrants who are ready to build but lack the resources and access to land." If this intensifies, then it will affirm a sense of cyclical maturity among the bigger firms.

Attracting income investors

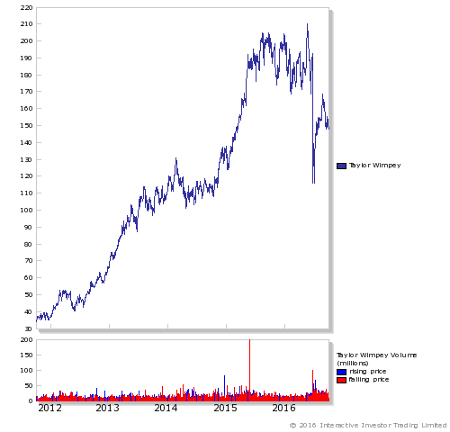

Amid many risks for companies that have grown from Mid-250 to FTSE 100 status, the Taylor Wimpey board in particular has bolstered its dividend payouts to support shareholder value; although the five-year chart implies 2015-16 volatility has brought prices back to trend-line after two years' exuberance (see chart below).

The interim results cited an interim "maintenance dividend" of 0.53p per share to be paid on 7 October, bringing 2016 total dividends up to £356 million or 10.91p per share.

Going forward, an annual payout policy of 5% of net assets (at least £150 million through the cycle) is to be enhanced by a £300 million special dividend of 9.2p in July 2017, hence the expectation for a total distribution of about 13.8p for 2017.

It's underpinned by rising cash flow, helped by balance sheet discipline as well as profits growth: net cash rose from £87.6 million to £116.7 million over the year to end-June despite paying £304.0 million in dividends.

This extent of payout (versus the share price) therefore gives Taylor Wimpey a marginal advantage versus other major house-building stocks - e.g. offering 6% and 5% - and ought to be supportive so long as the wider story remains resilient.

It also mitigates concern that housebuilders now trade at sizeable premiums to net asset values, a classic late-cycle feature. Mid-year, Taylor Wimpey had asset backing of 79.4p per share with negligible intangibles and no goodwill involved.

Land bank adds value

Taylor Wimpey's near-term land-bank has some 78,000 plots, meaning 5.8 years' supply at current completion levels. Buying 3,110 plots in the first half, management continued to buy high-quality land at an investment operating profit margin of about 20%.

The bear case needs a recession and/or asset inflation by central banks, causing a financial crisisFor the long term, Taylor Wimpey has the largest strategic land-bank in the sector with about 104,000 potential plots. The planning process with local authorities is said to be improving with full benefits yet to flow, so the land-bank is encouraging for capital and income investors alike.

Ultimately, Taylor Wimpey shares will track fortunes of the sector generally, where the perennial risk for builders is a retreat in house-prices.

The bear case requires a recession and/or asset inflation by the central banks, culminating in a financial crisis, although sub-1% of Taylor Wimpey stock on loan shows scant few traders daring to bet on such a scenario.

Meanwhile if the board can deliver on the dividend expectations then the stock should trade higher - an 8%+ yield prices in plenty risk - i.e. Taylor Wimpey looks a choice pick among the larger builders.

| Taylor Wimpey - financial summary | Consensus estimate | ||||||

|---|---|---|---|---|---|---|---|

| year ended 31 Dec | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Turnover (£ million) | 1808 | 2019 | 2296 | 2686 | 3140 | ||

| IFRS3 pre-tax profit (£m) | 78.6 | 204 | 306 | 469 | 603 | ||

| Normalised pre-tax profit (£m) | 93.3 | 205 | 314 | 471 | 603 | 705 | 771 |

| Operating margin (%) | 7.8 | 11.5 | 14.7 | 17.9 | 19.2 | ||

| IFRS3 earnings/share (p) | 1.7 | 7 | 7.3 | 11.5 | 14.9 | ||

| Normalised earnings/share (p) | 2.2 | 7 | 7.6 | 11.6 | 14.9 | 17.4 | 18.3 |

| Earnings per share growth (%) | -75.2 | 227 | 7.6 | 53.0 | 29.0 | 16.8 | 5.1 |

| Price/earnings multiple (x) | 10.4 | 8.9 | 8.5 | ||||

| Price/earnings-to-growth (x) | 0.4 | 0.5 | 1.7 | ||||

| Cash flow/share (p) | -0.6 | 2.5 | 3.1 | 6.1 | 12.6 | ||

| Capex/share (p) | 0.2 | 0.1 | 0.1 | 0.3 | 0.2 | ||

| Dividend per share (p) | 0.6 | 0.7 | 0.7 | 1.8 | 11.0 | 13.8 | |

| Yield (%) | 0.4 | 1.2 | 7.1 | 8.9 | |||

| Covered by earnings (x) | 12.6 | 11.9 | 5.2 | 8.3 | 1.6 | 1.3 | |

| Net tangible assets per share (p) | 57.1 | 61.4 | 69.4 | 77.8 | 83.5 | ||

| Source: Company REFS | |||||||

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.