Why Howdens is on this 'buy list'

13th April 2017 14:26

by Richard Beddard from interactive investor

Share on

Richard, I need to talk to you about . I've wanted to buy shares in the company for years and I think I'm about to cave...

Howdens? What about Judges Scientific? You left us on a bit of a cliff-hanger with that one*?

Later. You know how I like to mull things over. I also like to have options, and Howdens is one.

There's money in kitchens?

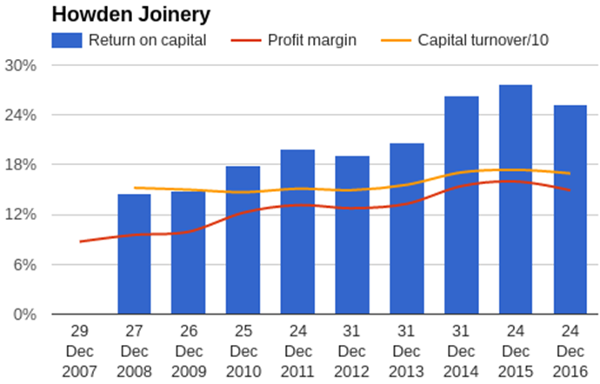

You betcha. We're talking fitted kitchens: carcasses and doors in many colours and styles, supplied with or without knick-knacks, appliances and flooring sourced from third parties. It also makes bathroom cabinets. Take a look at this:

That's what consistently high returns on capital look like, returns that, by-and-large, have improved over the years.

My rear-view vision is occluded before 2008 because then Howdens was part of MFI, a furniture chain that was a big customer until it went into administration, leaving Howdens to pay for store leases it no longer needed and with a large defined benefit pension scheme to service.

Ooooh. Onerous leases, pension deficit. Getting the nasties out of the way early are you?

Well, the pension fund may be a concern. The deficit, the unfunded part, is more than half annual profit and the total obligation is more than five times annual profit.

But since Howdens has sorted out the legacy of MFI, and the onerous leases, it has churned out enough cash to fund its expansion plans, payments into the pension plan, and fund a substantial share buyback without endangering its policy on debt, which is to avoid it throughout the financial year. I think Howdens is in good shape financially.

I hear you, but there was a dip in that chart. 2016 wasn't such a good year was it?

It depends on how you look at it. Revenue increased but adjusted profit was flat. The company says it experienced less demand in the second half of the financial year, which ended in December, and that has continued into the new financial year. Also, the fall in the value of the pound increased the cost of imported kitchen components.

It would be naive to expect profitability to be uniform from year to year, homeowners and landlords defer costly modernisations if money's tight, and, although Howdens is passing on higher import costs in higher kitchen prices, the economic climate is more challenging.

Howdens is sanguine about its long-term prospects, but another indicator the company's expectations are lower in the current financial year can be found buried in the remuneration report.

Howdens is lowering bonus targets for executive directors. What may have been stretching targets before have now, apparently, become inconceivable.

Those thieving...

Yes, I know how you feel about executives and their disproportionate pay packets, but we may have to hold our nose. Matthew Ingle, who founded Howdens in 1995, and his long standing finance director, now also deputy chief executive, Mark Robson, are very well paid.

Even if Ingle misses all his targets, he'll earn nearly £1 million a year. Bonuses can, and have, earned him many times that much.

This puts me in a bit of a dilemma, because there's little doubt the two executives have done an excellent job, and the company's performance suggests the annual bonus culture, which extends down to depot staff, isn't damaging the business. It may even enhance it – something you don't often hear me say.

Even so, I believe the inflation of executive pay generally is contributing to increasing and damaging inequality, and I urge the good companies I invest in to set a better example.

OK, so we hold our nose because it's a special business, you say. Is that based on the numbers, or is there more to it?

Just read the annual reports. They're like sandwiches dripping with honey. The company explains exactly what it does differently. It sells only to local builders, and it does everything it can to keep them happy.

There are obvious things, like supplying a good quality product at a price that enables the builder to make a good profit. And there are less obvious things, like confidential pricing, which allows the builder to decide his own mark-up and depot managers to favour their best customers.

Howdens provides enough credit for the builder to receive payment for the fitted kitchen before paying Howdens for it, and Howdens keeps almost 100% of the products it sells in stock at one of its 650-odd depots.

Although Howdens sees scope for 800 UK depots, it's got the country pretty well covered now, which means the builders don't have far to go to pick up supplies whenever they need them, even to make an exchange when a customer changes his mind.

The products are supplied part-assembled so they can be fitted quickly, and, as an example of builder-focused innovation, last year Howdens introduced a quick-fit internal door that can be adjusted in size without trimming.

I'm underwhelmed, it's customer-focused. Surely it's not the only customer-focused kitchen supplier?

It depends what you mean by customer. Howdens is focused on trade customers. Other kitchen suppliers, Magnet for example, supply small builders too, but they also supply big construction companies and retail customers, so they have more than one kind of customer to think about.

I'm picking on Magnet because it helps to have a competitor in mind when you think about a company. Oh, and because Ingle was Magnet Trade's managing director before he started Howdens.

I'm not an expert in kitchen supply, you understand, so I'm casting around a bit here, but it probably makes things a bit more difficult for small builders if a customer can pop into a Magnet retail showroom and get a quote for the same, or a very similar, kitchen.

I don't think Magnet's trade arm has 100% stock availability either; its website boasts of 20,000 products available at trade prices but “hundreds of best-selling... products in stock at all times”.

If bits aren't in stock, it will complicate builders' already crazy schedules and annoy their customers. Although it's much older, Magnet has only 180 trade counters, so it's probably less convenient.

Howdens is a specialist and, although that reduces the size of its market, it seems reasonable to suppose it's more competitive than generalists in that particular market.

Great, I see what's in it for small builders. What's in it for Howdens? How's it more competitive?

Howdens can focus on doing one thing well, which makes it very efficient. The depots need to be convenient for small builders, not retail customers, so they are situated in cheap, unfashionable locations away from busy town centres.

Small builders market the kitchens to homeowners and landlords, so it doesn't have to commission expensive TV advertisements or build retail showrooms.

Most of a typical depot is dedicated to housing stock, the availability of which is a competitive advantage, and most of Howdens' attention goes on developing the products, sourcing the stock from its own factories and third parties, and incentivising depot managers with profit-related bonuses that the company describes as, on occasion, “life changing”.

It doesn't even have to deliver. The builders do that.

Wait. You said Howdens doesn't have showrooms. You mean people don't need to see the kitchens before they buy?

Howdens sends a designer to the customer's house, who conjures a 3D plan, probably in their shabby old kitchen.

Is this a good time to admit we've only bought a fitted kitchen once? And that was so long ago I can't remember much about it except MFI was still in business. That's where we bought it.

In mitigation, it was our first house, and it might have been one of Howdens' first kitchens as the year was 1996, I think.

Companies like Howdens and Magnet have 50 or more kitchen styles, in countless colours, and myriad options. No showroom is going to contain your kitchen, is it? Bit of an odd concept really.

I love a company that explains itself well, and it sounds like Howdens is right up there with the best of them. I'm almost sold on it, but you said something that unnerved me earlier. That target of 800 depots. It already has nearly 650. How's it going to grow once it reaches the target?

The problem with a target is it summons visions of a kind of cliff-edge. If Howdens keeps opening depots at the current rate, it will go over the edge in about five years' time, which is unnerving. Does revenue growth stall then? Does profit growth? I don't think so.

First of all, Howdens has had lower targets before and raised them, so 800 depots may not be the end point, though there has to be one.

Secondly, it takes about seven years for a depot to reach its full potential, so Howdens should keep growing for a while even once it has saturated the market (as long as it hasn't oversaturated it).

Thirdly, Howdens is experimenting in Europe, principally France, where it has been operating for 11 years and now has 20 depots.

French stores may well be less profitable than British ones because, for example, French workers have more rights. Nevertheless, Howdens is a very profitable business, so there surely remains scope to profit abroad.

No Armageddon, then. But Howdens would suffer in an economic slowdown, and it may have to work harder in future to grow. Is now a good time to buy?

Don't ask me that! The future is unknowable.

I'll sleep on it, as usual. But I can tell you, I'm tempted to buy. It's right up there with Judges Scientific on my "hit list".

While £3 billion, or about 16 times adjusted profit, might not seem cheap for an enterprise with iffy immediate prospects, it's an excellent business, and I reckon it will remain so.

*See Judges Scientific: A miniaturised Berkshire Hathaway

Contact Richard Beddard by email (richard@beddard.net) or on Twitter.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.