IQE rockets ahead of iPhone 8 launch

5th September 2017 17:56

by David Brenchley from interactive investor

Share on

The long-awaited iPhone 8 will likely be released next week, although there is speculation around the exact date. There's lots of rumour surrounding new features, too, among them talk that users will be able to unlock their handsets using facial recognition. To do that the phone could use laser diodes called vertical-cavity surface-emitting lasers (VCSEL).

One UK company at the forefront of this technology is AIM-listed . Apple suppliers are under strict orders not to use the "A" word in any marketing or conversations with external parties, but it's thought big contracts have been signed with Apple.

IQE is the leader in the VCSEL market and, in interim results for the first half of 2017 published Tuesday, the company said it had seen a strong ramp up in sales of VCSEL wafers, marking "the start of a new wave of growth, with a pipeline of new mass-market technologies".

Revenue for the six months to 30 June were £70.4 million, up 12% year-on-year, with revenue from the VCSEL wafers up 17% to £69.4 million. Chief executive Dr Drew Nelson confirmed the Welsh firm is well on track to deliver its current full-year expectations, only recently upgraded.

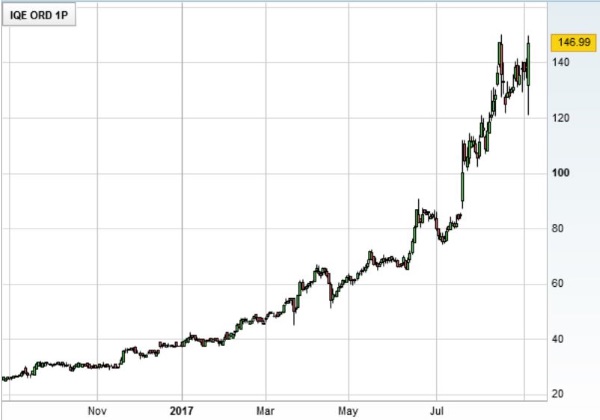

It's why the shares surged as much as 8% to touch 149.75p Tuesday. That's a whisker away from the all-time high 150.25p hit three weeks ago.

IQE has ramped up its capital investment, more than doubling to £15.4 million, as it strives for further capacity to enable it to meet higher levels of wafer demand in the second half of the year. It's why adjusted pre-tax profit fell 5% year-on-year to £9.6 million.

Sales in its three primary markets were up, with Photonics (+48%) leading the way; Infrared (+19%) and Wireless (+9%) duly followed.

"IQE's outlook has never looked better," said Dr Nelson. "The broad range of customer engagements across multiple technologies and multiple end markets, provide a clear path to increase revenue diversity and accelerate growth over the coming months and years ahead."

Our resident stockpicker Edmond Jackson has long been a fan of the company, tipping it first at 23p in July last year before dubbing it as the "successor to ARM Holdings" three months later at 40p. His last comment late last month is worth a read.

IQE share are up 242% year-to-date and 622% since 19 July 2016 , but it still has enthusiastic cheerleaders in the City. Both N+1 Singer and Peel Hunt have just reiterated 'buy' ratings and believe the shares remain attractive.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.