Considering commercial property

8th September 2017 13:13

by Emil Ahmad from interactive investor

Share on

From Trumponomics to geopolitical risk, the last 12 months have been a case in point for the way the political landscape can shape market direction. Closer to home, there is the generation-defining event that we have become tired of hearing about: Brexit.

If there is one asset class which characterised the adverse effects of the Brexit vote, it's commercial property.

Amid fears over falling UK asset values, outflows from commercial property funds forced a number of investment vehicles to suspend trading. Open-ended funds representing over £18 billion in managed assets were put on hold with investors unable to liquidate their holdings for weeks.

In fact, it took almost six months for the last of the affected funds to begin trading again. As the associated Financial Conduct Authority (FCA) review raises more questions about the challenges of real estate valuation and liquidity monitoring, now is an opportune time to assess the sector's health.

Business as usual?

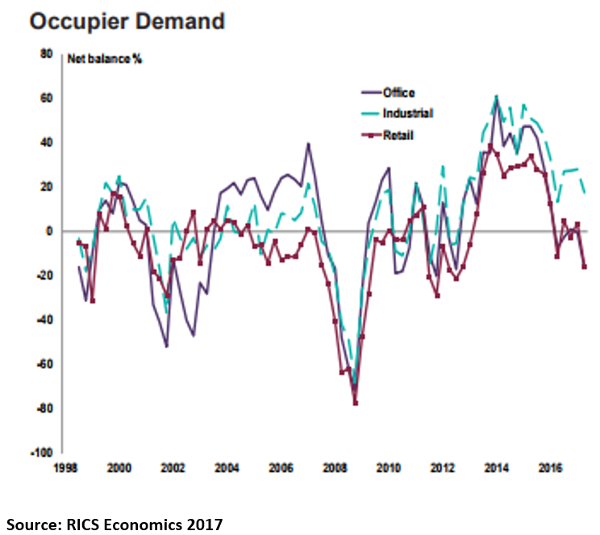

Despite uncertainty in the UK, the commercial property market has been relatively resilient. However, it is not all good news. A survey by the Royal Institution of Chartered Surveyors (RICS) noted that demand to rent commercial property hit five-year lows over the last quarter. Net demand for commercial rental space was in negative territory at -2%.

Although the figures may not be hugely significant, it could be indicative of a softening market. As online shopping continues to cripple the bricks-and-mortar retailer, demand within the retail sector could fall further.

Conversely, this ongoing move towards an all-encompassing online shopping experience is benefiting the industrial segment. Growth is healthy with surveyors noting that rental space in this area is subject to a supply squeeze. Demand for office space is also expected to hold firm.

Brexit naturally grabs headlines. Some 17% of respondents indicated they had seen evidence of planned business relocation abroad over the next two years.

Simon Rubinsohn, chief economist at RICS, said: "The commercial property market has enjoyed a good run and it's hardly surprising that we are now seeing a flatter trend emerge in the responses to the survey which chimes both with recent economic newsflow and the political environment."

However, he is cautiously optimistic about medium-term prospects, adding "...the underlying picture remains fairly resilient which is highlighted by the fact that medium-term rent expectations are still holding up particularly for prime space".

The China syndrome

It could be a tighter regulatory regime implemented 5,000 miles away which creates the biggest immediate headwind for the UK market. China's concern about capital outflows and leverage has led to government disapproval focused around a "negative list" of foreign investments.

This has huge ramifications for their foreign direct investment (FDI) in property. According to Morgan Stanley, China withdrew 84% of this FDI in the first six months of 2017. In financial terms, the numbers make for sobering reading. This investment in foreign global property stood at $10.6 billion (£8 billion) in 2016. It's now just $1.7 billion. Morgan Stanley expects this lack of investment to persist in 2018.

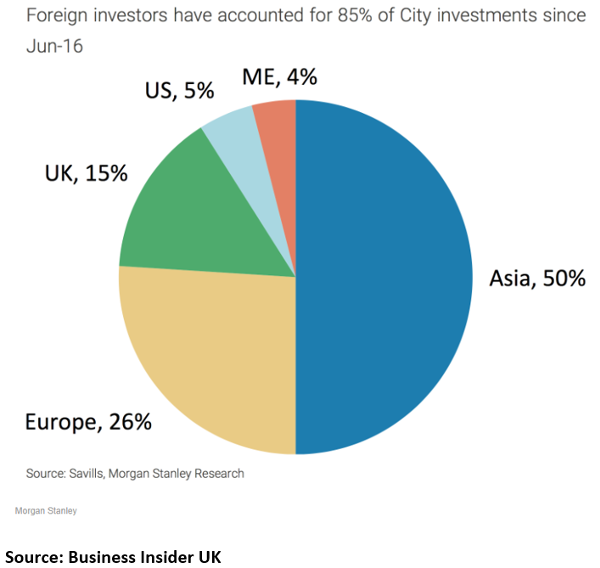

From a UK perspective, the effects are most pronounced in London. The analysts indicate that a quarter of central London commercial property purchases in 2016 could be attributed to the Chinese. In 2006, Chinese money represented a negligible 1% of total inflows, reflective of the huge growth in this FDI.

Outflows in 2017 have undoubtedly contributed to a recent softness in the London market, to the extent that even the residential sector is suffering from lower prices. And Morgan Stanley again emphasises the impact of Far Eastern money, noting "...over half the investment in the City over the past year has come from Asian investors". With the UK subject to such political and economic uncertainty, the equivalent level of domestic investment is an unsurprisingly low 15%.

Small is beautiful

This restriction on high-profile overseas deals may create opportunities for smaller Chinese companies. The Royal Albert Dock project is a case in point, with Chinese investment accounting for a significant proportion of the 60% of total office space already secured. This £1.7 billion regeneration project in East London is focusing on attracting Chinese and Asian money.

Chinese development firm ABP is overseeing this project and Sam Crispin, CEO of the Hong Kong sales division, is not overly concerned about Beijing's clampdown. Crispin said recently that existing and potential buyers of the project are less leveraged, smaller firms. This means they make "smaller investments that are below the radar" of the Chinese authorities.

Evidence suggests that countries could form an orderly queue to pick up the slack from a slowdown in Chinese investment. For example, recent data from JLL confirms the surge in growth from Hong Kong investment. Q1 inflows into British real estate reached almost $3 billion, a 256% year-on-year increase.

Crispin is confident that this is the case, with his project having also attracted investment from Taiwan, Hong Kong and India. His positive rhetoric extends to suggesting that Brexit is "...nothing more than a speed bump on the road" to Asia's ongoing spending spree on British commercial real estate.

Property funds rebound

In terms of UK open-ended funds under the Investment Association (IA) property sector, only a couple of funds have failed to deliver a positive return over the last 12 months. The sector as a whole has returned 5.2% over the corresponding period.

Despite this recovery from the immediate Brexit aftermath, this renaissance should be viewed with a degree of reservation. Property funds are currently not immune to another case of collective suspension should another event trigger mass outflows.

While FCA reforms are expected to address 'gating' sagas of this nature, the extent of such a regulatory overhaul is still unknown. Cash buffers are presently excessive due to concerns over liquidity. This averages between 20-25% across the sector and an inability to put this money to work is inhibiting fund performance.

Commercial property faces a number of headwinds, but has proven steadfast as the UK's political and economic future becomes increasingly convoluted. Foreign investment is clearly playing a key role in its performance. This may be brought into sharp focus in a post-Brexit world when an independent UK forges new international business relations.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.