What higher interest rates mean for Lloyds and UK bank shares

28th September 2017 17:24

by Lee Wild from interactive investor

Share on

We keep writing that higher interest rates are good for UK bank sector margins, and more hawkish comments from the Bank of England in reaction to rising inflation makes an increase quite likely. But how much of an impact will rising borrowing costs have on a lenders' bottom line?

Analysts at UBS recently shifted the house view to two 25 basis-point rate increases – in November and then May next year. It is very probable that a stronger pound and forecasts of lower future inflation, mean a more gradual tightening of monetary policy. But rates will very likely rise soon.

"All else equal, higher UK policy rates are clearly supportive of interest margins," writes UBS. It adds: "We see HSBC as best positioned of the banks overall given its $120 billion European deposit surplus; we think Royal Bank of Scotland is best-placed of the domestic banks given its excess deposit holdings and low-cost funding".

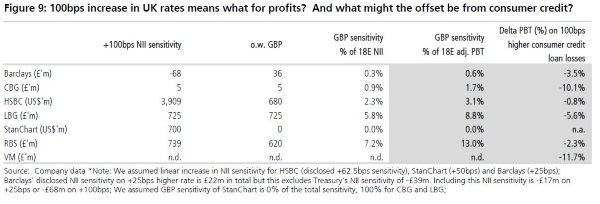

A 100 basis-point increase in sterling rates would generate an extra 13% of adjusted pre-tax for Royal Bank of Scotland in 2018 and 9% for Lloyds Banking Group.

That gearing is almost entirely down to the UK domestic banks' enormous variable rate mortgage book. "A rate hike – which would automatically raise returns over a one-two month period on the UK's £587 billion in floating rate mortgages – should be margin additive even if it leaves borrower households with lower disposable income," believes the broker.

UBS also raises the Financial Conduct Authority's (FCA) comment in its recent consumer credit report, which implies banks need not worry about upcoming accounting change IFRS9, something we talked about earlier this week.

"Whatever the board decides, this should come as good news for a high payout ratio firm like LBG," writes the broker, although there is no change to UBS's earnings per share (EPS) and dividend forecasts for now.

UBS is not minded to upgrade forecasts for net interest income yet, either, given the forecast risks around rate changes and the industry's reaction to potential rate hikes.

"Against our forecast of a sharp slowdown in UK economic growth, roll-over in inflation, rising unemployment, sluggish wage growth, falling consumer sentiment and low savings rate, and our strong view that debt of all kinds will be harder to get and more expensive in 2018, we find it difficult to see a cycle of hikes."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.