Could Alumasc shares be worth your time?

2nd March 2018 17:08

by Richard Beddard from interactive investor

Share on

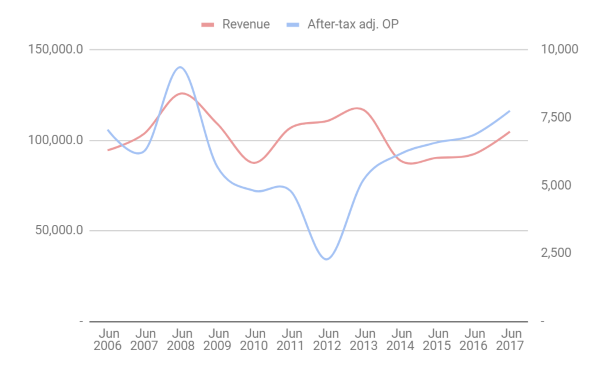

If you look at revenue and profit over the last decade or so, you'll probably be nonplussed. Alumasc doesn't look like a growing business and candidate for long-term investment.

First impressions are misleading. The business is better than it looks:

Source: interactive investor

Undeniably, the revenue curve is alarmingly flat, and the profit line is punctuated by a worrisome decline in 2012.

The years 2009-2012 were years of recession in the construction industry, which Alumasc primarily supplied. Today the focus has intensified, Alumasc only supplies the construction industry. It designs and supplies premium building products.

By shedding two businesses in a different industry, engineering, Alumasc may have exposed itself to bigger swings of revenue and profit in the future because it's un-diversified, so to speak, but I don't think so. I think Alumasc's un-diworseified, its undone a diversification that was holding it back.

Undoing bad diversification

The first chart I'll show you strips out the revenue of Alumasc Precision Components and Dyson Diecasting. Alumasc disposed of them in 2015 and 2016. They were vestigial, relics of a conglomerate of industrial, engineering, and building products firms spun out of Consolidated Goldfields in 1984 by the current Chairman, John McCall.

Manufacturers, the customers of Alumasc's engineering and industrial companies, had relocated to Asia, while architects, consultants, contractors and builders, of course, remained here, where Alumasc's customers are still building.

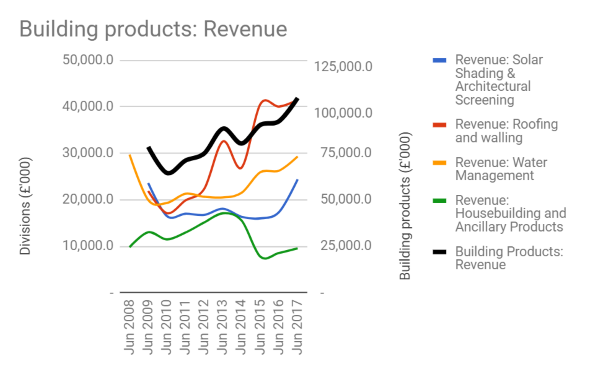

Alumasc, chose to focus on builders not manufacturers, so we'll get a better idea of the characteristics of the business now if we ignore those it no longer owns:

Source: interactive investor, Alumasc Annual Report

The data for this chart is taken from the segmental report buried in the notes of the company's annual reports. The thick black line shows revenue (on the right hand scale) for all Alumasc's building products divisions, but it excludes APC and Dyson, the engineering businesses, which obviously added to revenue before they were sold.

Albeit with the help of two relatively modest acquisitions, building products revenue grew 35% from £78 million to £105 million.

A better business

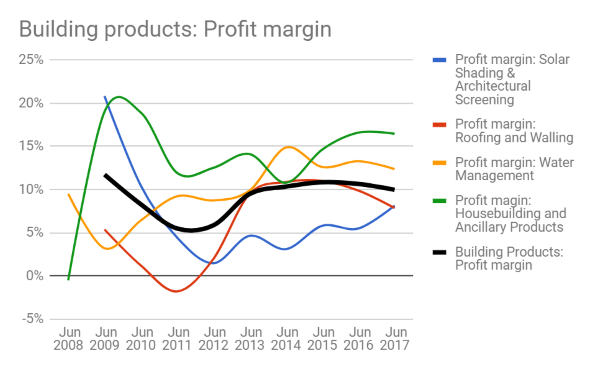

The question is though, did selling APC and Dyson make Alumasc more or less prone to the dramatic loss in profits it experienced in 2012, when its profit margin fell to 2%? That year APC made a loss of £1.8 million compared to a profit £1.6 million the previous year. If we take APC and Dyson out of the picture, this is what we see:

Source: interactive investor

Again, the thick black line is for all the building products divisions. The profit margin never fell below 5%, and in normal circumstances it's about 10%.

Profit margins measure the difference between revenue and profit, so for every pound of revenue Alumasc earns, it makes about 10p in profit (before tax) in normal times. In the extreme circumstances following the financial crisis, Alumasc made 5p profit for every pound. That may not sound impressive, but many businesses supplying the construction industry lose money when times are hard and don't make particularly good margins when they're good.

The evidence bears out Alumasc's assertion that it makes premium building products (Described in this article), that customers are prepared to pay premium prices for even when there is little demand and competition is most intense.

Good diversification

The charts demonstrate another facet of Alumasc's business model. The company owns a range of brands in demand at different points in the construction cycle. The most extreme, perhaps, is Levolux, which Alumasc says is market leader in the UK. It supplies solar shading, often giant structures on the exteriors of large buildings like office blocks, hospitals and car parks.

As well as improving the appearance of buildings, solar shading helps control the temperature inside and reduce energy costs. Because it's an external structure, customers buy it at the end of a building project, once the building it will attach to is built, and so Levolux is most in demand as the building cycle peaks in intensity and large numbers of buildings are approaching completion. It contrasts with Timloc, another Alumasc business, that produces components, vents for example, that are inserted in houses as they go up.

We can see this in the charts. Revenue and profit from solar shading (blue lines) were high at the beginning of the period, when buildings conceived of before the financial crash were still going up and still needing shading. Since then, revenues and profits have been subdued, but both rose sharply in 2017.

Unsurprisingly, Alumasc is ploughing resources into Levolux at the moment, because it sees lots of buildings going up. In the US, which is almost virgin territory, it's increased the sales force by 50%, and this underpins expectations that the company will still grow in 2018 even though some of its other business may not do so well. Meanwhile those other businesses have done the running in recent years.

Ironically, it was the non-building products business, APC, that added to Alumasc's instability in 2012, and the the fact that demand for Alumasc's building products peaks and troughs at different times makes the company more stable.

The Apple of building products

Perhaps the biggest surprise though, given the stable profit margin, is how much profitability has improved. In the last three years, return on capital has risen to new heights, above 20%. Return on capital is the product of profit margin and capital turnover, and it's capital turnover that has improved strikingly. Alumasc is using much less capital to generate similar levels of revenue.

Alumasc used to have capital tied up in the factories and machinery used by its engineering businesses, but brands like Levolux are nowhere near as capital intensive. Most of the fabrication is done by manufacturing partners and most of the installation is done by third party installers. Levolux, predominantly, designs and sells , and the same is true of the majority of Alumasc's brands. In this sense Alumasc is a bit like iPhone manufacturer Apple.

Good business, bad pension

Regrettably, despite confirmation Alumasc is a business I could hold through thick and thin, and despite the enterprise trading on a multiple of only about 12 times adjusted profit, Alumasc has two large pension funds, which reduce my confidence in the investment. Pension fund analysis is a subjective and imprecise set of skills I don't possess, so I'm still treating Alumasc with caution.

I know there are investors who think differently. They think the reasons pension liabilities have ballooned over many years, principally falling interest rates, must go into reverse thereby shrinking the liability. If you are one of them, I think Alumasc might be worth your time. Speculative buy.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Alumasc

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.